Exam 3: Product Costing and Cost Accumulation in a Batch Production Environment

Exam 1: The Changing Role of Managerial Accounting in a Dynamic Business Environment85 Questions

Exam 2: Basic Cost Management Concepts115 Questions

Exam 3: Product Costing and Cost Accumulation in a Batch Production Environment95 Questions

Exam 4: Process Costing and Hybrid Product-Costing Systems88 Questions

Exam 5: Activity-Based Costing and Management103 Questions

Exam 6: Activity Analysis, Cost Behavior, and Cost Estimation90 Questions

Exam 7: Cost-Volume-Profit Analysis109 Questions

Exam 8: Variable Costing and the Costs of Quality and Sustainability74 Questions

Exam 9: Financial Planning and Analysis: the Master Budget112 Questions

Exam 10: Standard Costing and Analysis of Direct Costs97 Questions

Exam 11: Flexible Budgeting and Analysis of Overhead Costs89 Questions

Exam 12: Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard89 Questions

Exam 13: Investment Centers and Transfer Pricing101 Questions

Exam 14: Decision Making: Relevant Costs and Benefits96 Questions

Exam 15: Target Costing and Cost Analysis for Pricing Decisions107 Questions

Exam 16: Capital Expenditure Decisions120 Questions

Exam 17: Allocation of Support Activity Costs and Joint Costs81 Questions

Exam 18: The Sarbanes-Oxley Act, Internal Controls, and Management Accounting20 Questions

Exam 19: Compound Interest and the Concept of Present Value27 Questions

Exam 20: Inventory Management20 Questions

Select questions type

In the two-stage cost allocation process, costs are assigned:

(Multiple Choice)

4.8/5  (39)

(39)

Job-order costing methods are used in a variety of service industry firms and nonprofit organizations.

(True/False)

4.9/5  (35)

(35)

As production takes place, all manufacturing costs are added to the:

(Multiple Choice)

4.9/5  (33)

(33)

The primary difference between normalized and actual costing methods lies in the determination of a job's:

(Multiple Choice)

4.8/5  (28)

(28)

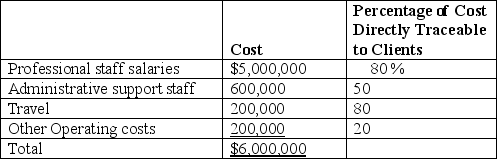

Bonanza Enterprises provides consulting services and uses a job-order system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by Bonanza , but not identifiable with specific clients, are charged to jobs by using a predetermined overhead application rate. Clients are billed for directly chargeable costs, overhead, and a markup.

Bonanza anticipates the following costs for the upcoming year:

Bonanza's partners desire to make a $480,000 profit for the firm and plan to add a percentage markup on total cost to achieve that figure.

On May 14, Bonanza completed work on a project for Laramie Manufacturing. The following costs were incurred: professional staff salaries, $68,000; administrative support staff, $8,900; travel, $10,500; and other operating costs, $2,600.

Required:

A. Determine Bonanza's total traceable costs for the upcoming year and the firm's total anticipated overhead.

B. Calculate the predetermined overhead rate. The rate is based on total costs traceable to client jobs.

C. What percentage of total cost will Bonanza add to each job to achieve its profit target?

D. Determine the total cost of the Laramie Manufacturing project. How much would Laramie be billed for services performed?

Bonanza's partners desire to make a $480,000 profit for the firm and plan to add a percentage markup on total cost to achieve that figure.

On May 14, Bonanza completed work on a project for Laramie Manufacturing. The following costs were incurred: professional staff salaries, $68,000; administrative support staff, $8,900; travel, $10,500; and other operating costs, $2,600.

Required:

A. Determine Bonanza's total traceable costs for the upcoming year and the firm's total anticipated overhead.

B. Calculate the predetermined overhead rate. The rate is based on total costs traceable to client jobs.

C. What percentage of total cost will Bonanza add to each job to achieve its profit target?

D. Determine the total cost of the Laramie Manufacturing project. How much would Laramie be billed for services performed?

(Essay)

5.0/5  (45)

(45)

Discuss the reason for (1) allocating overhead to the cost of production jobs, and (2) applying overhead using a predetermined rate instead of an actual overhead rate.

(Essay)

4.9/5  (35)

(35)

The estimates used to calculate the predetermined overhead rate will virtually always:

(Multiple Choice)

4.9/5  (40)

(40)

The left side of the Manufacturing Overhead account is used to accumulate:

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following statements about manufacturing cost flows is false?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following is not considered to be a service department?

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following statements about material requisitions is false?

(Multiple Choice)

4.9/5  (41)

(41)

The journal entry needed to record $5,000 of advertising for Oxner Manufacturing would include:

(Multiple Choice)

4.8/5  (38)

(38)

Templeton Corporation recently used $75,000 of direct materials and $9,000 of indirect materials in production activities. The journal entries reflecting these transactions would include:

(Multiple Choice)

4.8/5  (32)

(32)

Manufacturing overhead is applied to production.

A. Describe several situations that may give rise to underapplied overhead.

B. Assume that underapplied manufacturing overhead is treated as an adjustment to Cost of Goods Sold. Explain why an underapplication of overhead increases Cost of Goods Sold.

(Essay)

4.7/5  (32)

(32)

Which of the following would not likely be used by service providers to accumulate job costs?

(Multiple Choice)

4.9/5  (35)

(35)

Osgood Company, which applies overhead at the rate of 190% of direct material cost, began work on job no. 101 during June. The job was completed in July and sold during August, having accumulated direct material and labor charges of $27,000 and $15,000, respectively. On the basis of this information, the total overhead applied to job no. 101 amounted to:

(Multiple Choice)

4.7/5  (40)

(40)

A review of a company's Work-in-Process Inventory account found a debit for materials of $67,000. If all procedures were performed in the correct manner, this means that the firm:

(Multiple Choice)

4.8/5  (35)

(35)

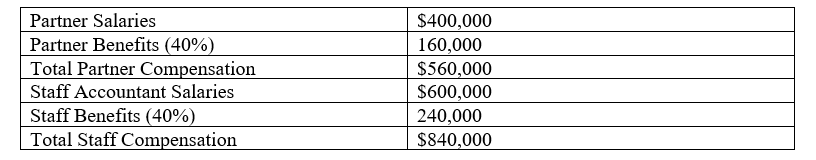

Use the following labor budget data for Roy & Miller Accounting, LLP to answer the following Questions

The budgeted overhead cost for the year is $1,260,000. The company has estimated that one-third of the budgeted over¬head cost is incurred to support the firm’s two partners, and two-thirds goes to support the staff accountants. The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material,

-What is the overhead rate for partners, if separate rates are used for partners and staff accountants?

The budgeted overhead cost for the year is $1,260,000. The company has estimated that one-third of the budgeted over¬head cost is incurred to support the firm’s two partners, and two-thirds goes to support the staff accountants. The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material,

-What is the overhead rate for partners, if separate rates are used for partners and staff accountants?

(Multiple Choice)

4.9/5  (35)

(35)

Electricity costs that were incurred by a company's production processes should be debited to Utilities Expense.

(True/False)

4.8/5  (32)

(32)

In traditional product-costing systems, the measure of productive activity is usually some volume-based cost driver, like direct-labor hours.

(True/False)

4.9/5  (43)

(43)

Showing 61 - 80 of 95

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)