Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges

Exam 1: Introduction to Taxation122 Questions

Exam 2: Working With the Tax Law101 Questions

Exam 3: Taxes on the Financial Statements70 Questions

Exam 4: Gross Income100 Questions

Exam 5: Business Deductions143 Questions

Exam 6: Losses and Loss Limitations147 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges126 Questions

Exam 8: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions119 Questions

Exam 9: Individuals As the Taxpayer132 Questions

Exam 10: Individuals: Income, Deductions, and Credits129 Questions

Exam 11: Individuals As Employees and Proprietors116 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules136 Questions

Exam 13: Corporations: Earnings and Profits and Distributions127 Questions

Exam 14: Partnerships and Limited Liability Entities142 Questions

Exam 15: S Corporations109 Questions

Exam 16: Multijurisdictional Taxation91 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax94 Questions

Exam 18: Comparative Forms of Doing Business84 Questions

Select questions type

Kelly inherits land that had a basis to the decedent of $95,000 and a fair market value of $50,000 on August 4, 2019, the date of the decedent's death.The executor distributes the land to Kelly on November 12, 2019, at which time the fair market value is $49,000.The fair market value on February 4, 2020, is $45,000.In filing the estate tax return, the executor elects the alternate valuation date.Kelly sells the land on June 10, 2020, for $48,000.What is her recognized gain or loss?

(Multiple Choice)

4.9/5  (40)

(40)

Taylor inherited 100 acres of land on the death of his father in 2019.A Federal estate tax return was filed and this land was valued therein at $650,000, its fair market value at the date of the father's death.The father had originally acquired the land in 1973 for $112,000 and prior to his death, he had expended $20,000 on permanent improvements.Determine Taylor's holding period for the land.

(Multiple Choice)

4.8/5  (43)

(43)

An involuntary conversion results from the destruction (complete or partial), theft, seizure, requisition or condemnation, or the sale or exchange under threat or imminence of requisition or condemnation of the taxpayer's property.

(True/False)

4.8/5  (42)

(42)

Paul sells property with an adjusted basis of $45,000 to his daughter Dean for $38,000.Dean subsequently sells the property to her brother, Preston, for $38,000.Three years later, Preston sells the property to Hun, an unrelated party, for $50,000.What is Preston's recognized gain or loss on the sale of the property to Hun?

(Multiple Choice)

4.8/5  (37)

(37)

Parker bought a brand new Ferrari on January 1, 2019, for $125,000.Parker was fatally injured in an auto accident on June 23, 2019, when the fair market value of the car was $105,000.Parker was driving a loaner car from the Ferrari dealership while his car was being serviced.In his will, Parker left the Ferrari to his best friend, Ryan.Ryan's holding period for the Ferrari begins on January 1, 2019.

(True/False)

4.9/5  (42)

(42)

The basis for gain and loss of personal use property converted to business use is the lower of the adjusted basis or the fair market value on the date of conversion.

(True/False)

4.9/5  (37)

(37)

The basis for depreciation on depreciable gift property received is the donor's adjusted basis of the property at the date of the gift (assuming no gift taxes are paid).The rule applies regardless of whether the fair market value at the date of the gift is greater than or less than the donor's adjusted basis.

(True/False)

5.0/5  (42)

(42)

If losses are disallowed in a related-party transaction, the holding period for the buyer includes the holding period of the seller.

(True/False)

4.8/5  (42)

(42)

Terry exchanges real estate (acquired on August 25, 2013) held for investment for other real estate to be held for investment on September 1, 2019.None of the realized gain of $10,000 is recognized, and Terry's adjusted basis for the new real estate is a carryover basis of $80,000.Consequently, Terry's holding period for the new real estate begins on August 25, 2013.

(True/False)

4.9/5  (31)

(31)

Arthur owns a tract of undeveloped land (adjusted basis of $145,000) that he sells to his son, Ned, for its fair market value of $105,000.What is Arthur's recognized gain or loss and Ned's basis in the land?

(Multiple Choice)

4.8/5  (36)

(36)

Reggie owns all the stock of Amethyst, Inc.(adjusted basis of $100,000).If he receives a distribution from Amethyst of $90,000 and corporate earnings and profits are $15,000, Reggie has a capital gain of $5,000 and an adjusted basis for his Amethyst stock of $0.

(True/False)

4.7/5  (35)

(35)

In computing the amount realized when the fair market value of the property received cannot be determined, the fair market value of the property surrendered may be used.

(True/False)

4.8/5  (37)

(37)

Gene purchased for $45,000 an SUV that he uses 100% for personal purposes.When the SUV is worth $30,000, he contributes it to his business.The gain basis is $45,000, the loss basis is $30,000, and the basis for cost recovery is $45,000.

(True/False)

4.9/5  (38)

(38)

If the recognized gain on an involuntary conversion equals the realized gain because of a reinvestment deficiency, the basis of the replacement property will be more than its cost (cost plus realized gain).

(True/False)

4.7/5  (44)

(44)

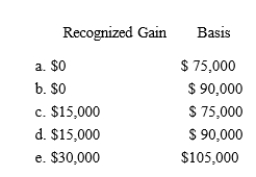

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

(Short Answer)

4.7/5  (43)

(43)

A building located in Virginia (used in business) exchanged for a building located in France (used in business) cannot qualify for like-kind exchange treatment.

(True/False)

4.8/5  (36)

(36)

The fair market value of property received in a sale or other disposition is the price at which property will change hands between a willing seller and a willing buyer when neither is compelled to sell or buy.

(True/False)

4.8/5  (41)

(41)

Realized losses from the sale or exchange of stock are disallowed if within 30 days before or 30 days after the sale or exchange, the taxpayer acquires substantially identical stock.

(True/False)

4.8/5  (37)

(37)

Bria's office building (basis of $225,000 and fair market value $275,000) is destroyed by a hurricane.Due to a 30% co-insurance clause, Bria receives insurance proceeds of $192,500 two months after the date of the loss.One month later, Bria uses the insurance proceeds to purchase a new office building for $275,000.Her adjusted basis for the new building is $307,500 ($275,000 cost + $32,500 postponed loss).

(True/False)

4.9/5  (38)

(38)

Wade is a salesman for a real estate development company.Because he is the "salesperson of the year," he is permitted to purchase a lot from the developer for $90,000.The fair market value of the lot is $150,000 and the developer's adjusted basis is $100,000.Wade must recognize a gain of $10,000 ($100,000 developer's adjusted basis - $90,000 cost to Wade), and his adjusted basis for the lot is $100,000 ($90,000 cost + $10,000 recognized gain).

(True/False)

4.8/5  (39)

(39)

Showing 61 - 80 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)