Exam 1: An Introduction to Accounting

Exam 1: An Introduction to Accounting204 Questions

Exam 2: Accounting for Accruals and Deferrals157 Questions

Exam 3: Accounting for Merchandising Businesses38 Questions

Exam 4: Internal Controls, Accounting for Cash, and Ethics38 Questions

Exam 5: Accounting for Receivables and Inventory Cost Flow57 Questions

Exam 6: Accounting for Long-Term Operational Assets157 Questions

Exam 7: Accounting for Liabilities208 Questions

Exam 8: Proprietorships, Partnerships, and Corporations144 Questions

Exam 9: Financial Statement Analysis172 Questions

Exam 10: An Introduction to Management Accounting155 Questions

Exam 11: Cost Behavior, Operating Leverage, and Profitability Analysis43 Questions

Exam 12: Cost Accumulation, Tracing, and Allocation211 Questions

Exam 13: Relevant Information for Special Decisions137 Questions

Exam 14: Planning for Profit and Cost Control156 Questions

Exam 15: Performance Evaluation162 Questions

Exam 16: Planning for Capital Investments172 Questions

Select questions type

Indicate whether each of the following statements about accounting information is true or false.Financial accounting is primarily intended to satisfy the information needs of internal stakeholders.Managerial accounting information includes financial and nonfinancial information.The accounting information intended to satisfy the needs of a company's employees is managerial accounting information. GAAP requires that companies adhere to financial accounting standards.Managerial accounting information is usually less detailed than financial accounting information.

(Essay)

4.8/5  (34)

(34)

At the beginning of Year 2, X Company had assets of $300, liabilities of $150, and common stock of $50. During Year 2, the company earned revenue of $500, incurred expenses of $200, and paid dividends of $50. All transactions were cash transactionsThe amount of total assets reported on X Company's December 31, Year 2 balance sheet would be

(Multiple Choice)

4.9/5  (40)

(40)

Turner Company reported assets of $20,000 (including cash of $9,000), liabilities of $8,000, common stock of $7,000, and retained earnings of $5,000. Based on this information, what can be concluded?

(Multiple Choice)

4.8/5  (34)

(34)

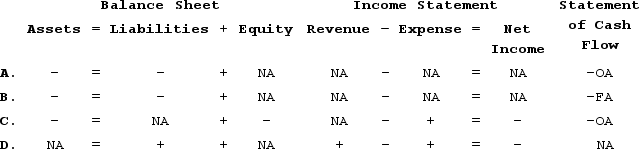

Which of the following does not describe the effects of an asset use transaction on the accounting equation?

(Multiple Choice)

4.8/5  (40)

(40)

Indicate how this event affects the accounting equation. Use the following letters to record your answer in the box shown below each element. If an event increases one account and decreases another account within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = I Decrease = D Not Affected = NAEpstein Company paid a $20,000 cash dividend to its stockholders.

(Essay)

4.7/5  (33)

(33)

Which of the following would not describe the effects of an asset source transaction on a company's financial statements?

(Multiple Choice)

4.9/5  (32)

(32)

Which types of accounts are closed out to retained earnings at the end of an accounting period?

(Essay)

4.9/5  (34)

(34)

As of December 31, Year 2, Bristol Company had $100,000 of assets, $40,000 of liabilities and $25,000 of retained earnings. What percentage of Bristol's assets were obtained from investors?

(Multiple Choice)

4.9/5  (36)

(36)

Indicate how this event affects the accounting equation. Use the following letters to record your answer in the box shown below each element. If an event increases one account and decreases another account within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = I Decrease = D Not Affected = NANguyen Company borrowed $50,000 cash from Metropolitan Bank.

(Essay)

4.9/5  (36)

(36)

Retained earnings reduces a company's commitment to use its assets for the benefit of its stockholders.

(True/False)

4.9/5  (34)

(34)

Indicate how this event affects the accounting equation. Use the following letters to record your answer in the box shown below each element. If an event increases one account and decreases another account within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = I Decrease = D Not Affected = NANorth Company issued a note to purchase a building.

(Essay)

4.9/5  (37)

(37)

Lexington Company engaged in the following transactions during Year 1, its first year of operations. (Assume all transactions are cash transactions.)Acquired $6,000 cash from issuing common stock.Borrowed $4,400 from a bank.Earned $6,200 of revenues.Incurred $4,800 in expenses.Paid dividends of $800.Lexington Company engaged in the following transactions during Year 2:Acquired an additional $1,000 cash from the issue of common stock.Repaid $2,600 of its debt to the bank.Earned revenues, $9,000.Incurred expenses of $5,500.Paid dividends of $1,280.The amount of total assets on Lexington's balance sheet at the end of Year 1 was:

(Multiple Choice)

4.9/5  (34)

(34)

Lexington Company engaged in the following transactions during Year 1, its first year of operations. (Assume all transactions are cash transactions.)Acquired $6,000 cash from issuing common stock.Borrowed $4,400 from a bank.Earned $6,200 of revenues.Incurred $4,800 in expenses.Paid dividends of $800.Lexington Company engaged in the following transactions during Year 2:Acquired an additional $1,000 cash from the issue of common stock.Repaid $2,600 of its debt to the bank.Earned revenues, $9,000.Incurred expenses of $5,500.Paid dividends of $1,280.What is the net cash flow from financing activities on Lexington's statement of cash flows for Year 2?

(Multiple Choice)

4.7/5  (32)

(32)

As of December 31, Year 1, Mason Company had $500 cash. During Year 2, Mason earned $1,200 of cash revenue and paid $800 of cash expenses. What is the amount of cash that would be reported on the balance sheet at the end of Year 2?

(Multiple Choice)

4.7/5  (43)

(43)

The transaction, "provided services for cash," affects which two accounts?

(Multiple Choice)

4.8/5  (31)

(31)

Stosch Company's balance sheet reported assets of $40,000, liabilities of $15,000 and common stock of $12,000 as of December 31, Year 1. If Retained Earnings on the balance sheet as of December 31, Year 2, amount to $18,000 and Stosch paid a $14,000 dividend during Year 2, then the amount of net income for Year 2 was which of the following?

(Multiple Choice)

4.8/5  (27)

(27)

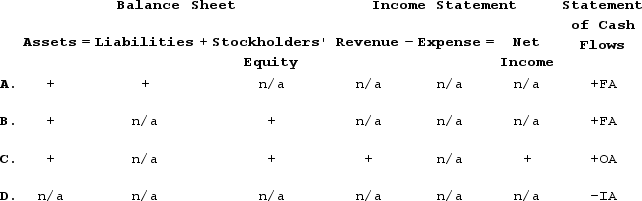

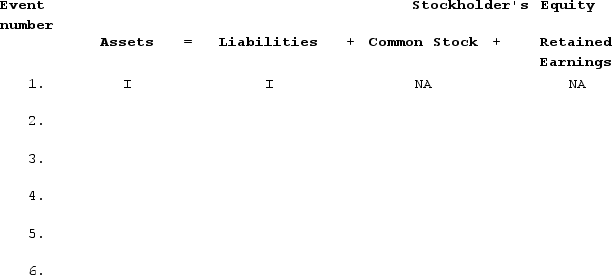

Montgomery Company experienced the following events during Year 1 (all were cash events):Issued a notePaid operating expensesIssued common stockProvided services to customersRepaid part of the note in event number 1Paid dividends to stockholdersRequired:

Indicate how each of these events affects the accounting equation by writing the letter I for increase, the letter D for decrease, and NA for not affected under each of the components of the accounting equation. Use only one item of entry in each column. The first event is done for you as an example.

(Not Answered)

This question doesn't have any answer yet

Indicate how this event affects the accounting equation. Use the following letters to record your answer in the box shown below each element. If an event increases one account and decreases another account within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = I Decrease = D Not Affected = NANguyen Company borrowed $50,000 cash from Metropolitan Bank.

(Essay)

5.0/5  (29)

(29)

If a company's total assets increased while liabilities and common stock were unchanged, then which of the following statements is true?

(Multiple Choice)

4.8/5  (48)

(48)

The following transactions apply to the Garber Corporation for Year 1, its first year in business.

The company issued stock to investors, $48,000.The company borrowed $42,000 cash from the bank.Services were provided to customers and $50,000 cash was received from those customers.The company acquired land for $44,000.The company paid $34,000 rent for the building in which it operates its business.The company paid $3,200 for supplies that were used during the period.The company sold the land acquired in number 5 for $44,000.The company paid a dividend of $1,000 to its stockholders.The company repaid $20,000 of the loan described in number 2.

Required: Prepare an income statement, statement of changes in stockholders' equity, and balance sheet for Year 1.Prepare a statement of cash flows for Year 1.

(Essay)

4.9/5  (29)

(29)

Showing 161 - 180 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)