Exam 4: Individual Income Tax Overview, Dependents, and Filing Status

Exam 1: An Introduction to Tax134 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities109 Questions

Exam 3: Tax Planning Strategies and Related Limitations137 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status130 Questions

Exam 5: Gross Income and Exclusions152 Questions

Exam 6: Individual Deductions117 Questions

Exam 7: Investments93 Questions

Exam 8: Individual Income Tax Computation and Tax Credits179 Questions

Exam 9: Business Income, Deductions, and Accounting Methods129 Questions

Exam 10: Property Acquisition and Cost Recovery131 Questions

Exam 11: Property Dispositions132 Questions

Exam 12: Compensation122 Questions

Exam 13: Retirement Savings and Deferred Compensation157 Questions

Exam 14: Tax Consequences of Home Ownership126 Questions

Exam 15: Entities Overview87 Questions

Exam 16: Corporate Operations126 Questions

Exam 17: Accounting for Income Taxes125 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions122 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation121 Questions

Exam 20: Forming and Operating Partnerships131 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions118 Questions

Exam 22: S Corporations157 Questions

Exam 23: State and Local Taxes139 Questions

Exam 24: The Us Taxation of Multinational Transactions105 Questions

Exam 25: Transfer Taxes and Wealth Planning145 Questions

Select questions type

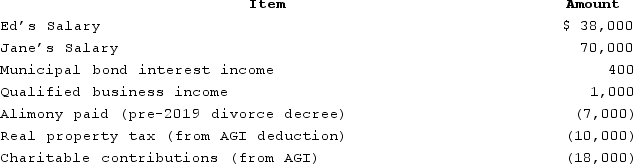

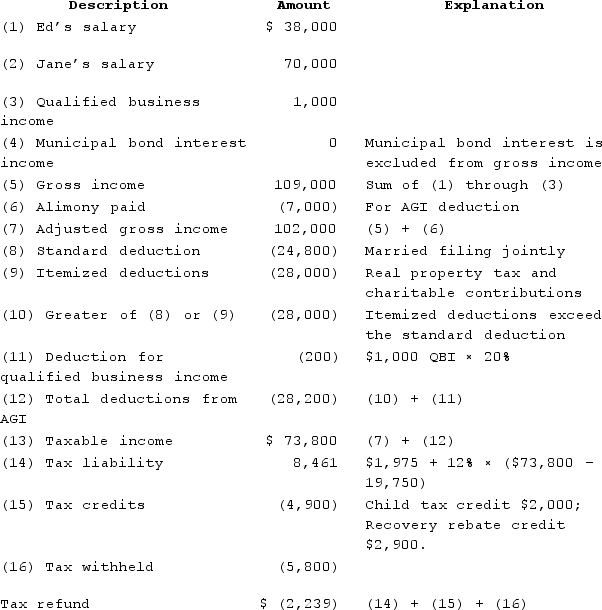

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

The Rochester's qualified for a $2,000 child tax credit and $2,900 in recovery rebate credit ($2,400 for themselves and $500 for their child). Assume the Rochesters did not receive the recovery rebate in advance. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's tax due or tax refund? (Use the tax rate schedules, not tax tables.)

The Rochester's qualified for a $2,000 child tax credit and $2,900 in recovery rebate credit ($2,400 for themselves and $500 for their child). Assume the Rochesters did not receive the recovery rebate in advance. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's tax due or tax refund? (Use the tax rate schedules, not tax tables.)

Free

(Essay)

4.9/5  (41)

(41)

Correct Answer:

$2,239 tax refund, see calculations below.

All of the following are tests for determining qualifying relative status except _____.

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

D

The character of income is a factor in determining the rate at which the income is taxed.

Free

(True/False)

4.8/5  (35)

(35)

Correct Answer:

True

Jasmine and her husband, Arty, have been married for 25 years. In May of this year, the couple divorced. During the year, Jasmine provided all the support for herself and her 22-year-old child, Dexter, who lived in the same home as Jasmine for the entire year. Dexter is employed full time, earning $29,000 this year. What is Jasmine's most favorable filing status for the year?

(Multiple Choice)

4.7/5  (35)

(35)

If no one qualifies as the dependent of an unmarried taxpayer, the unmarried taxpayer may still be able to qualify for the head of household filing status.

(True/False)

4.8/5  (41)

(41)

Sally received $60,000 of compensation from her employer and she received $500 of interest from a corporate bond. What is the amount of Sally's gross income from these items?

(Multiple Choice)

5.0/5  (43)

(43)

In Year 1, the Bennetts' 25-year-old daughter, Jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. In previous years, Jane has never worked and her parents have always been able to claim her as a dependent. In Year 1, a kind neighbor offers to pay for all of Jane's educational and living expenses. Which of the following statements is most accurate regarding whether Jane's parents would be allowed to claim Jane as a dependent for Year 1, assuming the neighbor pays for all of Jane's support?

(Multiple Choice)

4.9/5  (43)

(43)

Sam andTracy have been married for 25 years. They have filed a joint return every year of their marriage. They have two sons, Christopher and Zachary. Christopher is 19 years old and Zachary is 14 years old. Christopher lived in his parents' home from January through August and he lived in his own apartment from September through December. During the year, Christopher attended college for one month before dropping out. Christopher's living expenses totaled $12,000 for the year. Of that, Christopher paid $5,000 from income he received while working a part-time job. Sam and Tracy provided the remaining $7,000 of Christopher's support. Zachary lived at home the entire year and did not earn any income. Whom are Sam and Tracy allowed to claim as dependents?

(Essay)

4.9/5  (29)

(29)

Lydia and John Wickham filed jointly in Year 1. They divorced in Year 2.Late in Year 2, the IRS discovered that the Wickhamshad underpaid their Year 1 taxes by $2,000. Both Lydia and John worked in Year 1 and received equal income but John had $2,000 less tax withheld than Lydia did. Who is legally liable for the tax underpayment?

(Multiple Choice)

4.9/5  (33)

(33)

Eric and Josephine were married in Year 1. In Year 2, Eric dies. The couple did not have any children. Assuming Josephine does not remarry, she may file as a qualifying widow in Year 3.

(True/False)

4.8/5  (32)

(32)

If a taxpayer does not provide more than half the support of a child, that child cannot qualify as the taxpayer's qualifying child.

(True/False)

4.9/5  (40)

(40)

John Maylor is a self-employed plumber of John's John Service, his sole proprietorship. In the current year, John's John Service had revenue of $120,000 and $40,000 of business expenses.

John also received $2,000 of interest income from corporate bonds.

What is John's adjusted gross income, assuming he had no other income or expenses? (ignore any deduction for self-employment tax.)

(Essay)

4.8/5  (42)

(42)

In June of Year 1, Edgar's wife, Cathy, died, and Edgar did not remarry during the year. What is his filing status for Year 1 (assuming they did not have any dependents)?

(Multiple Choice)

4.8/5  (26)

(26)

In order to be a qualifying relative of another, an individual's gross income must be less than _______.

(Multiple Choice)

4.9/5  (40)

(40)

William and Charlotte Collins divorced in November of Year 1. William moved out and Charlotte remained in their house with their 10-month-old daughter, Autumn. Diana, Charlotte's mother, lived in the home and acted as Autumn's nanny for all of Year 1. William provided 70 percent of Autumn's support, Diana provided 20 percent, and Charlotte provided 10 percent. When the time came to file their tax returns for Year 1, William, Charlotte, and Diana each wanted to claim Autumn as a dependent. Their respective adjusted gross incomes for Year 1 were $50,000, $35,000, and $52,000. Who has priority to claim Autumn as a dependent?

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following statements regarding tax deductions is false?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)