Exam 4: Individual Income Tax Overview, Dependents, and Filing Status

Exam 1: An Introduction to Tax134 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities109 Questions

Exam 3: Tax Planning Strategies and Related Limitations137 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status130 Questions

Exam 5: Gross Income and Exclusions152 Questions

Exam 6: Individual Deductions117 Questions

Exam 7: Investments93 Questions

Exam 8: Individual Income Tax Computation and Tax Credits179 Questions

Exam 9: Business Income, Deductions, and Accounting Methods129 Questions

Exam 10: Property Acquisition and Cost Recovery131 Questions

Exam 11: Property Dispositions132 Questions

Exam 12: Compensation122 Questions

Exam 13: Retirement Savings and Deferred Compensation157 Questions

Exam 14: Tax Consequences of Home Ownership126 Questions

Exam 15: Entities Overview87 Questions

Exam 16: Corporate Operations126 Questions

Exam 17: Accounting for Income Taxes125 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions122 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation121 Questions

Exam 20: Forming and Operating Partnerships131 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions118 Questions

Exam 22: S Corporations157 Questions

Exam 23: State and Local Taxes139 Questions

Exam 24: The Us Taxation of Multinational Transactions105 Questions

Exam 25: Transfer Taxes and Wealth Planning145 Questions

Select questions type

Miguel, a widower whose wife died in Year 1, maintains a household for himself and his daughter, who qualifies as his dependent. Miguel did not remarry. What is the most favorable filing status that Miguel qualifies for in Year 3?

(Multiple Choice)

4.9/5  (39)

(39)

Jennifer and Stephan are married at year-end and they file separate tax returns. If Jennifer itemizes deductions on her return, Stephan must also itemize deductions on his return even if his itemized deductions don't exceed his standard deduction.

(True/False)

4.9/5  (38)

(38)

In Year 1, Harold Weston's wife died. Since her death, he has maintained a household for their son, Frank (age 3), his qualifying child. Which is the most advantageous filing status available to Harold in Year 4?

(Multiple Choice)

4.9/5  (37)

(37)

For AGI deductions are commonly referred to as deductions "above the line."

(True/False)

4.8/5  (37)

(37)

In February of 2019, Lorna and Kirk were married. During 2020, Lorna received $40,000 of compensation from her employer and Kirk received $30,000 of compensation from his employer. The couple together reported $2,000 of itemized deductions. Lorna and Kirk filed separately in 2020. What is Lorna's taxable income and what is her tax liability? (tax rate schedules.)Use the applicable tax rate schedule. (Round your answers to the nearest whole number.)

(Essay)

4.8/5  (27)

(27)

An individual may be considered as a qualifying child of her parents and a qualifying child of her grandparents in the same year.

(True/False)

4.7/5  (33)

(33)

Madison's gross tax liability is $9,000. Madison had $3,000 of tax credits available and she had $8,000 of taxes withheld by her employer. What are Madison's taxes due (or taxes refunded)with her tax return?

(Multiple Choice)

4.8/5  (35)

(35)

Taxpayers are allowed to claim a child tax credit for their qualifying children and certain other qualifying dependents.

(True/False)

4.8/5  (31)

(31)

Earl and Lawanda Jackson have been married for 15 years. They have no children. Ned, who is an old friend from high school, has been living with the Jacksons during the current year. Which of the following is a true statement regarding whether the Jacksons can claim Ned as a dependent for the current year?

(Multiple Choice)

4.7/5  (40)

(40)

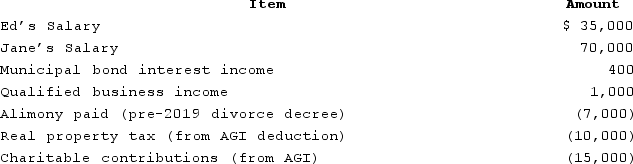

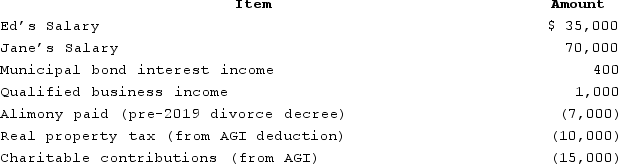

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's tax due or tax refund? (Use the tax rate schedules, not tax tables.)

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's tax due or tax refund? (Use the tax rate schedules, not tax tables.)

(Essay)

4.7/5  (42)

(42)

The Inouyes filed jointly in 2020. Their AGI is $78,000. They reported $3,000 of qualified business income and $22,000 of itemized deductions. They have two children, one of whom qualifies as their dependent as a qualifying child. The 2020 standard deduction amount for MFJ taxpayers is $24,800. What is the total amount of from AGI deductions they are allowed to claim on their 2020 tax return?

(Essay)

4.8/5  (38)

(38)

In June of Year 1, Eric's wife, Savannah, died. Eric did not remarry during Year 1, Year 2, or Year 3. Eric maintains the household for his dependent daughter, Catherine, in Year 1, Year 2, and Year 3. Which is the most advantageous filing status for Eric in Year 2?

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following statements regarding realized income is true?

(Multiple Choice)

5.0/5  (30)

(30)

In April of Year 1, Martin left his wife, Marianne. While the couple was apart, they were not legally divorced. Marianne found herself having to financially provide for the couple's only child (who qualifies as Marianne's dependent)and to pay all the costs of maintaining the household. When Marianne filed her tax return for Year 1, she filed a return separate from Martin. What is Marianne's most favorable filing status for Year 1?

(Multiple Choice)

5.0/5  (34)

(34)

Madison's gross tax liability is $13,200. Madison had $4,200 of tax credits available and she had $10,450 of taxes withheld by her employer. What are Madison's taxes due (or taxes refunded)with her tax return?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following statements about a qualifying person for head of household filing status is true?

(Multiple Choice)

4.8/5  (32)

(32)

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's gross income?

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's gross income?

(Essay)

4.8/5  (32)

(32)

Jan is unmarried and has no children, but she provides all of the financial support for her mother, who lives in an apartment across town. Jan's mother qualifies as Jan's dependent. Which is the most advantageous filing status available to Jan?

(Multiple Choice)

4.9/5  (43)

(43)

When determining whether a child meets the qualifying child support test for the child's grandparents, scholarships earned by the child do not count as self-support provided by the child.

(True/False)

4.9/5  (31)

(31)

Showing 81 - 100 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)