Exam 13: Retirement Savings and Deferred Compensation

Exam 1: An Introduction to Tax134 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities109 Questions

Exam 3: Tax Planning Strategies and Related Limitations137 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status130 Questions

Exam 5: Gross Income and Exclusions152 Questions

Exam 6: Individual Deductions117 Questions

Exam 7: Investments93 Questions

Exam 8: Individual Income Tax Computation and Tax Credits179 Questions

Exam 9: Business Income, Deductions, and Accounting Methods129 Questions

Exam 10: Property Acquisition and Cost Recovery131 Questions

Exam 11: Property Dispositions132 Questions

Exam 12: Compensation122 Questions

Exam 13: Retirement Savings and Deferred Compensation157 Questions

Exam 14: Tax Consequences of Home Ownership126 Questions

Exam 15: Entities Overview87 Questions

Exam 16: Corporate Operations126 Questions

Exam 17: Accounting for Income Taxes125 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions122 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation121 Questions

Exam 20: Forming and Operating Partnerships131 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions118 Questions

Exam 22: S Corporations157 Questions

Exam 23: State and Local Taxes139 Questions

Exam 24: The Us Taxation of Multinational Transactions105 Questions

Exam 25: Transfer Taxes and Wealth Planning145 Questions

Select questions type

Which of the following statements concerning nonqualified deferred compensation plans is true?

(Multiple Choice)

4.8/5  (29)

(29)

This year, Ryan contributed 10 percent of his $83,000 annual salary to a Roth 401(k)account sponsored by his employer, XYZ. XYZ offers a dollar-for-dollar match up to 10 percent of the employee's salary. The employer contributions are placed in a traditional 401(k)account on the employee's behalf. Ryan expects to earn an 8-percent before-tax rate of return on contributions to his Roth and traditional 401(k)accounts. Assuming Ryan leaves the funds in the accounts until he retires in 25 years, what are his after-tax accumulations in the Roth 401(k)and in the traditional 401(k)accounts if his marginal tax rate at retirement is 30 percent? If Ryan's marginal tax rate this year is 35 percent, will he earn a higher after-tax rate of return from the Roth 401(k)or the traditional 401(k)? Explain. (Round future value factors to five decimal places and the future value and final answers to the nearest whole number.)

(Essay)

4.8/5  (31)

(31)

Carmello and Leslie (ages 34 and 35, respectively)are married and want to contribute to a Roth IRA. In 2020, their AGI totaled $42,000 before any IRA-related transactions. Of the $42,000, Carmello earned $35,000 and Leslie earned $7,000. How much can each spouse contribute to a Roth IRA if they file jointly? How much can each spouse contribute to a Roth IRA if they file separately?

(Essay)

4.8/5  (36)

(36)

Qualified distributions from traditional IRAs are nontaxable while qualified distributions from Roth IRAs are fully taxable as ordinary income.

(True/False)

4.8/5  (33)

(33)

If a taxpayer's marginal tax rate is decreasing, a taxpayer contributing to a traditional IRA can earn an after-tax rate of return greater than her before-tax rate of return.

(True/False)

4.9/5  (34)

(34)

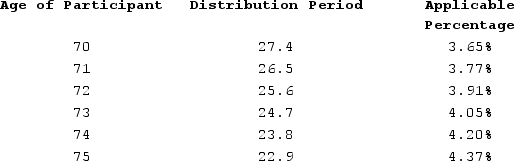

Sean (age 73 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,740,000 and the balance in his account on December 31, 2020, was $1,805,000. Using the Treasury table below, what is Sean's required minimum distribution for 2020?

(Essay)

4.8/5  (32)

(32)

Which of the following statements regarding Roth IRA distributions is true?

(Multiple Choice)

4.8/5  (37)

(37)

When employees contribute to a traditional 401(k)plan, they _____ allowed to deduct the contributions and they ______ taxed on distributions from the plan.

(Multiple Choice)

4.9/5  (32)

(32)

An employer may contribute to an employee's traditional 401(k)account but the employer may not contribute to an employee's Roth 401(k)account.

(True/False)

4.8/5  (43)

(43)

When an employer matches an employee's contribution to the employee's 401(k)account, the employee is immediately taxed on the amount of the employer's matching contribution.

(True/False)

4.9/5  (31)

(31)

Dean has earned $70,250 annually for the past six years working as an architect for WCC Incorporated Under WCC's defined benefit plan (which uses a seven-year graded vesting schedule)employees earn a benefit equal to 4.0 percent of the average of their three highest annual salaries for every full year of service with WCC. Dean has worked for six full years for WCC and his vesting percentage is 80 percent. What is Dean's vested benefit (or annual retirement benefit he has earned so far)?

(Multiple Choice)

4.9/5  (39)

(39)

Aiko (single, age 29)earned $40,900 in 2020. He was able to contribute $2,340 ($195/month)to his employer-sponsored 401(k). What is the total saver's credit that Aiko can claim for 2020?

(Essay)

4.9/5  (43)

(43)

Kathy is 60 years of age and self-employed. During 2020 she reported $100,000 of revenues and $40,000 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a SEP IRA for 2020? (Round your final answer to the nearest whole number.)

(Multiple Choice)

4.9/5  (37)

(37)

Kathy is 48 years of age and self-employed. During 2020 she reported $100,000 of revenues and $40,000 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a SEP IRA for 2020? (Round your final answer to the nearest whole number.)

(Multiple Choice)

4.9/5  (43)

(43)

Kathy is 48 years of age and self-employed. During 2020, she reported $100,000 of revenues and $40,000 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401(k)for 2020?Assume she paid $8,478 of self-employment tax for 2020. (Round your final answer to the nearest whole number.)

(Multiple Choice)

4.8/5  (35)

(35)

Just like distributions from qualified retirement plans, distributions from nonqualified deferred compensation plans are taxed as ordinary income to the recipient.

(True/False)

4.8/5  (29)

(29)

Joan recently started her career with PDEK Accounting LLP, which provides a defined benefit plan for all employees. Employees receive 1.5 percent of the average of their three highest annual salaries for each full year of service. Plan benefits vest under a five-year cliff schedule. Joan worked five and a half years at PDEK before leaving for another opportunity. She received an annual salary of $49,000, $52,000, $58,000, $65,000, and $75,000 for years one through five, respectively. Joan earned $40,000 of her $80,000 annual salary in year six. What is the vested benefit Joan is entitled to receive from PDEK for her retirement? Use Exhibit 13-1.

(Essay)

4.9/5  (31)

(31)

Kathy is 60 years of age and self-employed. During 2020, she reported $534,000 of revenues and $106,800 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401(k)for 2020?Assume she pays $28,348 in self-employment for 2020. (Round your final answer to the nearest whole number.)

(Multiple Choice)

4.8/5  (34)

(34)

Retired taxpayers over 59½ years of age at the end of the year must receiverequired minimum distributions from defined contribution plans or they are subject to a penalty.

(True/False)

4.9/5  (43)

(43)

Aiko (single, age 29)earned $40,000 in 2020. He was able to contribute $1,800 ($150/month)to his employer-sponsored 401(k). What is the total saver's credit that Aiko can claim for 2020? Exhibit 13-8

(Essay)

4.7/5  (30)

(30)

Showing 21 - 40 of 157

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)