Exam 3: Job-Order Costing: Cost Flows and External Reporting

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

Two of the reasons why manufacturing overhead may be underapplied are: (1) the estimated total manufacturing overhead cost may have been too high; and (2) the estimated total amount of the allocation base may have been too low.

(True/False)

4.7/5  (33)

(33)

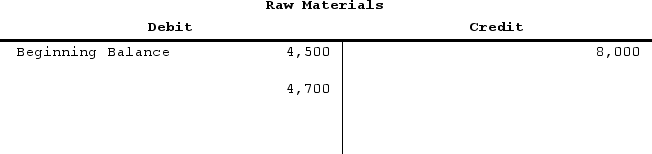

Leak Enterprises LLC recorded the following transactions for the just completed month. The company had no beginning inventories.(1) Raw materials purchased for cash, $96,000(2) Direct materials requisitioned for use in production, $69,000(3) Indirect materials requisitioned for use in production, $22,000(4) Direct labor wages incurred and paid, $129,000(5) Indirect labor wages incurred and paid, $16,000(6) Additional manufacturing overhead costs incurred and paid, $121,000(7) Manufacturing overhead costs applied to jobs, $163,000(8) All of the jobs in process were completed.(9) All of the completed jobs were shipped to customers.(10) Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold.Use the following T-accounts to answer the following question.

The ending balance in the Raw Materials account is closest to:

The ending balance in the Raw Materials account is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Baka Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $239,700 and 4,700 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $242,000 and actual direct labor-hours were 4,600.The applied manufacturing overhead for the year was closest to:

(Multiple Choice)

4.9/5  (41)

(41)

Baka Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $240,200 and 4,780 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $242,000 and actual direct labor-hours were 4,610.The predetermined overhead rate for the year was closest to:

(Multiple Choice)

4.8/5  (33)

(33)

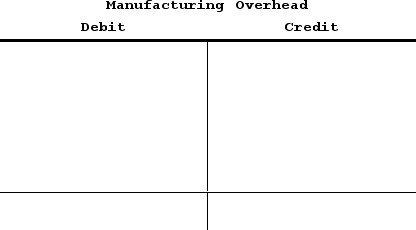

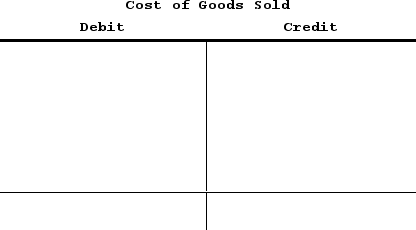

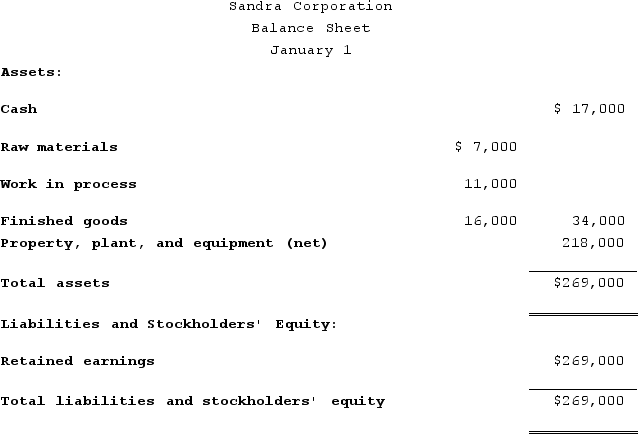

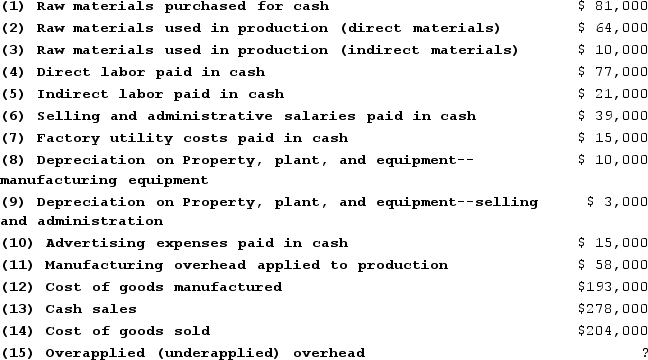

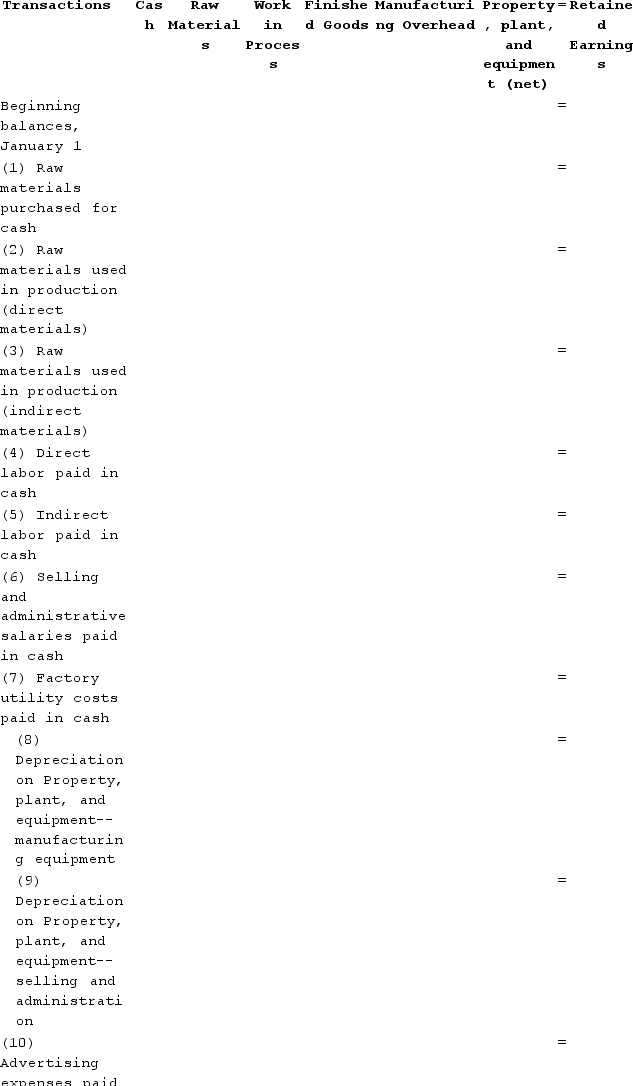

Sandra Corporation uses a job-order costing system to assign manufacturing costs to jobs. At the end of the month it closes out any overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Its balance sheet on January 1 appears below:

Summaries of the transactions completed during January appear below:

Summaries of the transactions completed during January appear below:

Required:Complete the spreadsheet below.

Required:Complete the spreadsheet below.

(Essay)

4.9/5  (41)

(41)

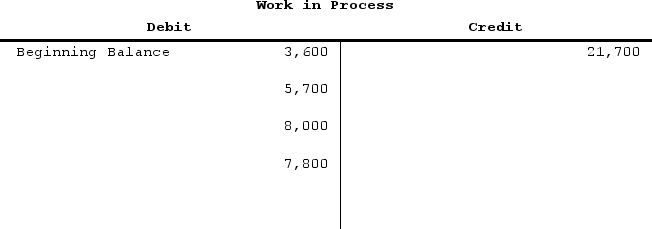

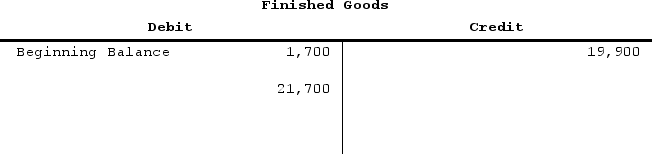

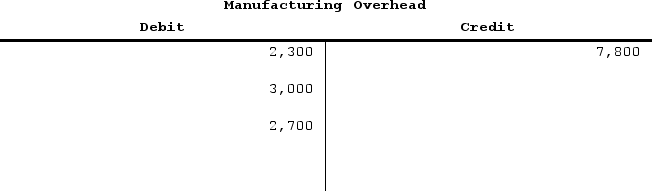

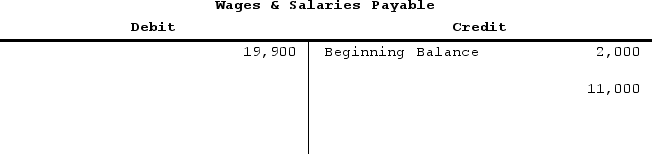

The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year:

The manufacturing overhead was:

The manufacturing overhead was:

(Multiple Choice)

4.9/5  (45)

(45)

Able Corporation uses a job-order costing system. In reviewing its records at the end of the year, the company has discovered that $2,000 of raw materials has been drawn from the storeroom and used in the production of Job 110, but that no entry has been made in the accounting records for the use of these materials. Job 110 has been completed but it is unsold at year end. This error will cause:

(Multiple Choice)

4.7/5  (40)

(40)

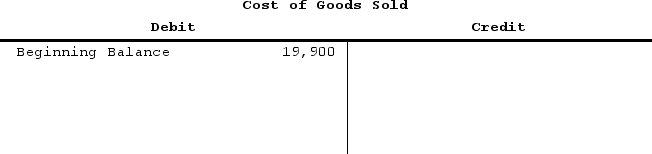

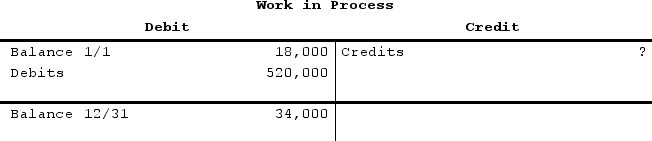

Maysonet Corporation uses a job-order costing system and has provided the following partially completed T-account summary for the past year.  The cost of completed jobs transferred from Work in Process to Finished Goods during the year was:

The cost of completed jobs transferred from Work in Process to Finished Goods during the year was:

(Multiple Choice)

4.7/5  (33)

(33)

A credit balance in the Manufacturing Overhead account at the end of the year means that manufacturing overhead was overapplied.

(True/False)

4.7/5  (40)

(40)

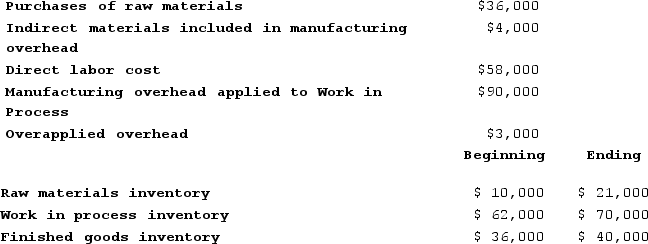

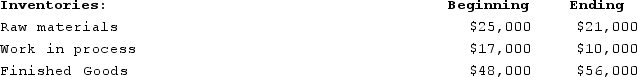

Cienfuegos Corporation has provided the following data concerning last month's operations.  The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold. How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold. How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

(Multiple Choice)

4.8/5  (34)

(34)

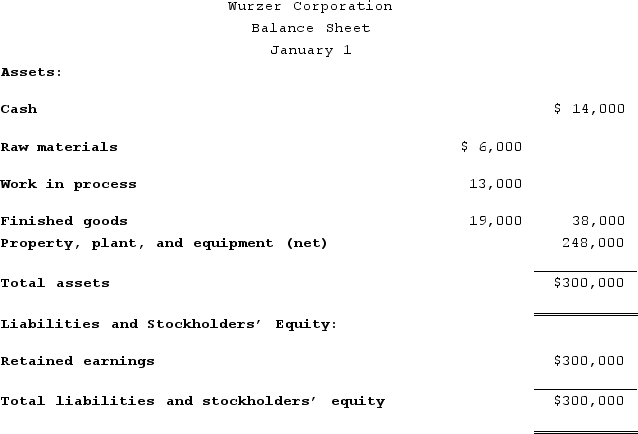

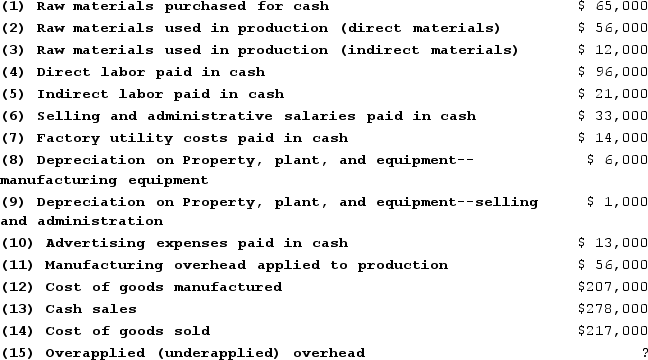

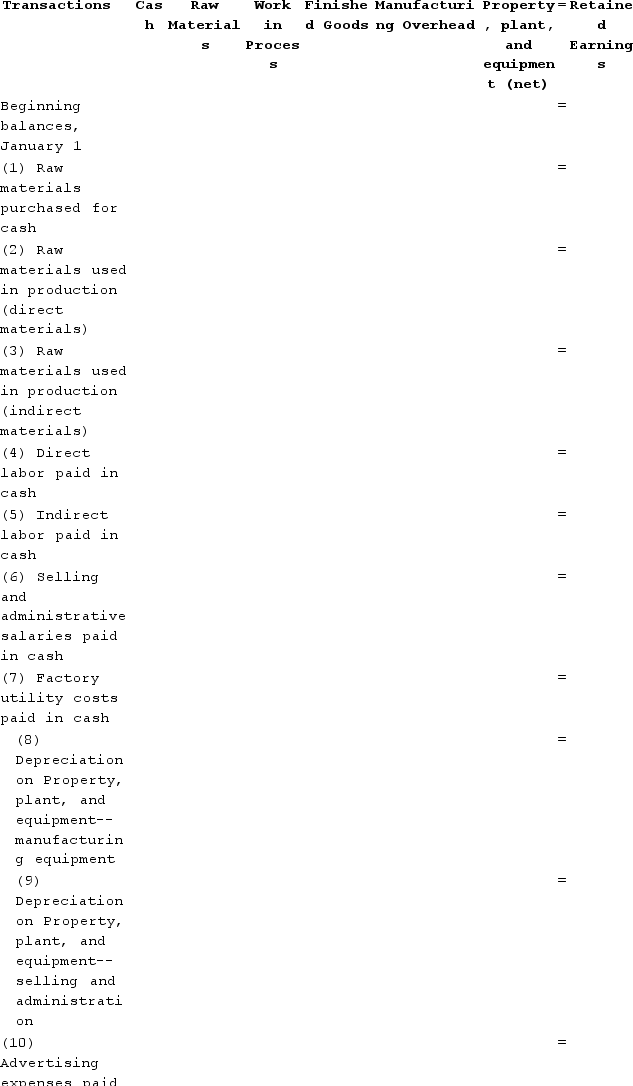

Wurzer Corporation uses a job-order costing system to assign manufacturing costs to jobs. At the end of the month it closes out any overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Its balance sheet on January 1 appears below:

Summaries of the transactions completed during January appear below:

Summaries of the transactions completed during January appear below:

Required:a. Completely fill in the spreadsheet below.

Required:a. Completely fill in the spreadsheet below.

b. Prepare a Balance Sheet for the company for January 31.c. Prepare a Schedule of Cost of Goods Manufactured for the company for January.d. Prepare a Schedule of Cost of Goods Sold for the company for January.e. Prepare an Income Statement for the company for January.

b. Prepare a Balance Sheet for the company for January 31.c. Prepare a Schedule of Cost of Goods Manufactured for the company for January.d. Prepare a Schedule of Cost of Goods Sold for the company for January.e. Prepare an Income Statement for the company for January.

(Essay)

4.7/5  (37)

(37)

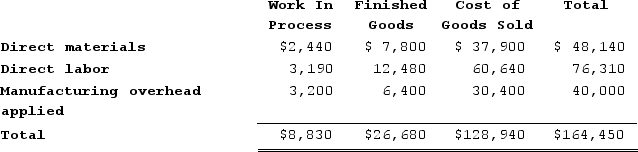

Bledsoe Corporation has provided the following data for the month of November:

Additional information:

Additional information:

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.Required:Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold.

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.Required:Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold.

(Essay)

4.8/5  (38)

(38)

Sagon Corporation has provided data concerning the Corporation's Manufacturing Overhead account for the month of September. Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $91,000 and the total of the credits to the account was $64,000. Which of the following statements is true?

(Multiple Choice)

4.9/5  (27)

(27)

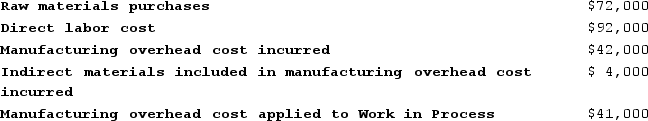

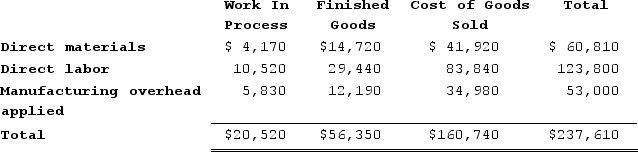

Jaquish Incorporated has provided the following data for the month of January. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was underapplied by $6,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The finished goods inventory at the end of January after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was underapplied by $6,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The finished goods inventory at the end of January after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

(Multiple Choice)

4.8/5  (30)

(30)

Pine Publishing Corporation uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. At the beginning of the year the Corporation estimated its total manufacturing overhead cost at $500,000 and its direct labor-hours at 125,000 hours. The actual overhead cost incurred during the year was $450,000 and the actual direct labor-hours incurred on jobs during the year was 115,000 hours. The manufacturing overhead for the year would be:

(Multiple Choice)

4.8/5  (38)

(38)

Vogel Corporation's cost of goods manufactured last month was $136,000. The beginning finished goods inventory was $35,000 and the ending finished goods inventory was $48,000. Overhead was overapplied by $6,000. Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

(Multiple Choice)

4.9/5  (41)

(41)

In the Schedule of Cost of Goods Manufactured, Total raw materials available = Ending raw materials inventory + Purchases of raw materials.

(True/False)

4.9/5  (27)

(27)

Boursaw Corporation has provided the following data concerning last month's operations.  Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

How much is the cost of goods manufactured for the month on the Schedule of Cost of Goods Manufactured?

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

How much is the cost of goods manufactured for the month on the Schedule of Cost of Goods Manufactured?

(Multiple Choice)

4.9/5  (36)

(36)

Weatherhead Incorporated has provided the following data for the month of March. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $3,000.The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.The work in process inventory at the end of March after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was overapplied by $3,000.The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.The work in process inventory at the end of March after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

(Multiple Choice)

4.9/5  (47)

(47)

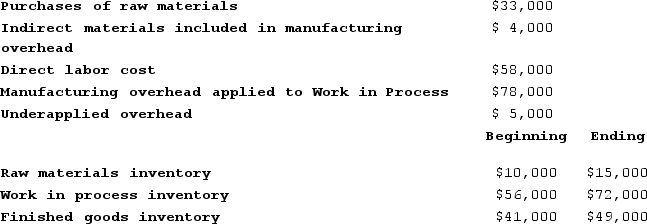

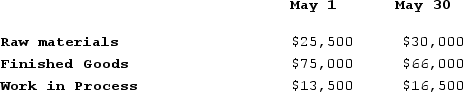

Tyare Corporation had the following inventory balances at the beginning and end of May:  During May, $58,500 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $7,050 of direct materials cost. The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.The direct materials cost in the May 1 Work in Process inventory account totaled:

During May, $58,500 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $7,050 of direct materials cost. The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.The direct materials cost in the May 1 Work in Process inventory account totaled:

(Multiple Choice)

4.9/5  (43)

(43)

Showing 181 - 200 of 314

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)