Exam 3: Job-Order Costing: Cost Flows and External Reporting

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

When manufacturing overhead is applied to production, it is added to:

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

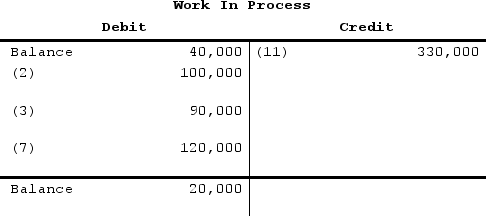

Alberta Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

(1) Direct materials requisitioned for use in production, $170,000(2) Indirect materials requisitioned for use in production, $11,000(3) Direct labor wages incurred, $105,000(4) Indirect labor wages incurred, $103,000(5) Depreciation recorded on factory equipment, $38,000(6) Additional manufacturing overhead costs incurred, $63,000(7) Manufacturing overhead costs applied to jobs, $200,000(8) Cost of jobs completed and transferred from Work in Process to Finished Goods, $450,000Required:

a. Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts.

b. Determine the underapplied or overapplied overhead for the month.

Free

(Essay)

4.8/5  (38)

(38)

Correct Answer:

a.

</div> <div style=" display: inline-block;">

</div> <div style=" display: inline-block;">

b. The overhead is $15,000 underapplied because the actual manufacturing overhead cost incurred of $215,000 exceeds the manufacturing overhead applied of $200,000 by $15,000

b. The overhead is $15,000 underapplied because the actual manufacturing overhead cost incurred of $215,000 exceeds the manufacturing overhead applied of $200,000 by $15,000

Rist Corporation uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. The Corporation estimated that it would incur $255,000 in manufacturing overhead during the year and that it would work 100,000 machine-hours. The Corporation actually worked 105,000 machine-hours and incurred $270,000 in manufacturing overhead costs. By how much was manufacturing overhead underapplied or overapplied for the year?

Free

(Multiple Choice)

4.8/5  (29)

(29)

Correct Answer:

D

Dacosta Corporation had only one job in process on May 1. The job had been charged with $2,500 of direct materials, $6,966 of direct labor, and $10,132 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $19.80 per direct labor-hour.During May, the following activity was recorded:  Work in process inventory on May 30 contains $3,867 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The balance in the raw materials inventory account on May 30 was:

Work in process inventory on May 30 contains $3,867 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The balance in the raw materials inventory account on May 30 was:

(Multiple Choice)

4.9/5  (39)

(39)

Acheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has provided the following data for its most recent year of operations.  The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.The applied manufacturing overhead for the year is closest to:

The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.The applied manufacturing overhead for the year is closest to:

(Multiple Choice)

4.7/5  (38)

(38)

On November 1, Arvelo Corporation had $32,000 of raw materials on hand. During the month, the company purchased an additional $78,000 of raw materials. During November, $95,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $3,000. Prepare journal entries to record these events. Use those journal entries to answer the following questions:The credits to the Raw Materials account for the month of November total:

(Multiple Choice)

4.8/5  (48)

(48)

Verrett Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year:  The journal entry to record the unadjusted Cost of Goods Sold is:

The journal entry to record the unadjusted Cost of Goods Sold is:

(Multiple Choice)

4.7/5  (41)

(41)

Held Incorporated has provided the following data for the month of June. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $1,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for June would include the following:

Manufacturing overhead for the month was overapplied by $1,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for June would include the following:

(Multiple Choice)

4.9/5  (45)

(45)

Blasi Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year:

Results of operations:

Results of operations:

Required:

a. What is the total manufacturing cost added to Work in Process during the year?

b. What is the cost of goods available for sale during the year?

c. What is the net operating income for the year?

Required:

a. What is the total manufacturing cost added to Work in Process during the year?

b. What is the cost of goods available for sale during the year?

c. What is the net operating income for the year?

(Essay)

4.8/5  (34)

(34)

Baka Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $245,100 and 10,100 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $245,600 and actual direct labor-hours were 6,400.The applied manufacturing overhead for the year was closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (35)

(35)

If the actual manufacturing overhead cost for a period exceeds the manufacturing overhead cost applied, then manufacturing overhead would be considered to be overapplied.

(True/False)

4.7/5  (41)

(41)

Tevebaugh Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year:  Results of operations:

Results of operations:

How much is the total manufacturing cost added to work in process during the year?

How much is the total manufacturing cost added to work in process during the year?

(Multiple Choice)

4.7/5  (27)

(27)

Matthias Corporation has provided data concerning the Corporation's Manufacturing Overhead account for the month of May. Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $53,000 and the total of the credits to the account was $69,000. Which of the following statements is true?

(Multiple Choice)

4.8/5  (37)

(37)

During March, Zea Incorporated transferred $55,000 from Work in Process to Finished Goods and recorded a Cost of Goods Sold of $61,000. The journal entries to record these transactions would include a:

(Multiple Choice)

4.9/5  (37)

(37)

The following partially completed T-accounts are for Stanford Corporation:

The indirect labor cost is:

The indirect labor cost is:

(Multiple Choice)

4.9/5  (41)

(41)

During December, Moulding Corporation incurred $87,000 of actual Manufacturing Overhead costs. During the same period, the Manufacturing Overhead applied to Work in Process was $85,000.Required:Prepare journal entries to record the incurrence of manufacturing overhead and the application of manufacturing overhead to Work in Process.

(Essay)

4.8/5  (35)

(35)

The accounting records of Omar Corporation contained the following information for last year:  If Omar Corporation applies overhead to jobs on the basis of direct labor-hours and Job 3 took 120 hours, how much overhead should be applied to that job?

If Omar Corporation applies overhead to jobs on the basis of direct labor-hours and Job 3 took 120 hours, how much overhead should be applied to that job?

(Multiple Choice)

4.9/5  (40)

(40)

Reith Incorporated has provided the following data for the month of November. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $4,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for November would include the following:

Manufacturing overhead for the month was overapplied by $4,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for November would include the following:

(Multiple Choice)

4.9/5  (35)

(35)

Caple Corporation applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $16,660. Actual manufacturing overhead for the year amounted to $25,000 and actual machine-hours were 1,460. The company's predetermined overhead rate for the year was $11.90 per machine-hour.The predetermined overhead rate was based on how many estimated machine-hours?

(Multiple Choice)

4.9/5  (27)

(27)

Entry (11) in the below T-account could represent overhead cost applied to Work in Process.

(True/False)

4.8/5  (34)

(34)

Showing 1 - 20 of 314

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)