Exam 5: Accounting for Inventories

Exam 1: An Introduction to Accounting173 Questions

Exam 2: Accounting for Accruals150 Questions

Exam 3: Accounting for Deferrals136 Questions

Exam 4: Accounting for Merchandising Businesses187 Questions

Exam 5: Accounting for Inventories169 Questions

Exam 6: Internal Control and Accounting for Cash132 Questions

Exam 7: Accounting for Receivables174 Questions

Exam 8: Accounting for Long-Term Operational Assets200 Questions

Exam 9: Accounting for Current Liabilities and Payroll146 Questions

Exam 10: Accounting for Long-Term Debt171 Questions

Exam 11: Proprietorships, Partnerships, and Corporations144 Questions

Exam 12: Statement of Cash Flows159 Questions

Exam 13: The Double-Entry Accounting System167 Questions

Exam 14: Financial Statement Analysis Available Online in Connect170 Questions

Select questions type

In an inflationary environment, which inventory cost flow method, FIFO or LIFO, reports the lowest amount of net income?

(Essay)

4.8/5  (27)

(27)

Vargas Company uses the perpetual inventory system and the FIFO cost flow method. During the current year, Vargas purchased 400 units of inventory that cost $15.00 each. At a later date during the year, the company purchased an additional 800 units of inventory that cost $18.00 each. Vargas sold 500 units of inventory for $27.00. What is the amount of cost of goods sold that will appear on the current year's income statement?

(Multiple Choice)

4.8/5  (34)

(34)

A company's gross margin reported on the income statement is not affected by the inventory cost flow method it uses.

(True/False)

4.9/5  (35)

(35)

The following information is for Lattimore Company for Year 2:

Required:Assuming that Lattimore uses the LIFO cost flow method:

a)Determine the cost of goods sold during Year 2.b)Determine the inventory balance at the end of Year 2.c)Calculate the average number of days to sell inventory for Year 2. (Round your answer to the nearest day.)

Required:Assuming that Lattimore uses the LIFO cost flow method:

a)Determine the cost of goods sold during Year 2.b)Determine the inventory balance at the end of Year 2.c)Calculate the average number of days to sell inventory for Year 2. (Round your answer to the nearest day.)

(Essay)

4.8/5  (39)

(39)

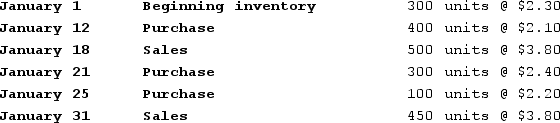

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

(Multiple Choice)

4.8/5  (46)

(46)

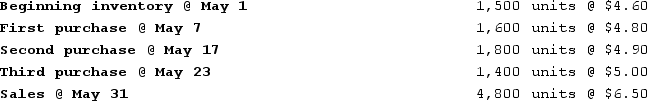

The Atkins Company uses the FIFO cost flow method. The company had the following beginning inventory, purchases, and sales of inventory during the first quarter of Year 2:

Required:1)Determine the cost of goods sold during the first quarter of Year 22)Determine the ending inventory at Year 2.

Required:1)Determine the cost of goods sold during the first quarter of Year 22)Determine the ending inventory at Year 2.

(Essay)

4.8/5  (31)

(31)

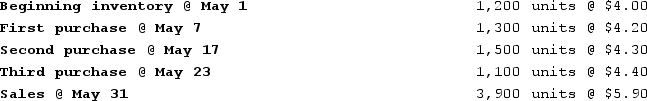

The inventory records for Radford Company reflected the following:  What is the amount of gross margin assuming the weighted-average inventory cost flow method? (Round your intermediate calculations to two decimal places.)

What is the amount of gross margin assuming the weighted-average inventory cost flow method? (Round your intermediate calculations to two decimal places.)

(Multiple Choice)

4.8/5  (38)

(38)

If prices are rising, which inventory cost flow method will produce the lowest amount of cost of goods sold?

(Multiple Choice)

4.8/5  (34)

(34)

When the cost of purchasing inventory is declining, which inventory cost flow method will produce the highest amount of cost of goods sold?

(Multiple Choice)

4.8/5  (40)

(40)

Taylor Company had beginning inventory of $400 and ending inventory of $600. Taylor Company had cost of goods sold amounting to $1,800. What is the amount of inventory that was purchased during the period?

(Multiple Choice)

4.9/5  (39)

(39)

If a company is using the lower-of-cost-or-market rule and a write-down is required, how will that write-down affect the company's financial statements?

(Multiple Choice)

4.8/5  (27)

(27)

Assuming that longer inventory holding periods act to increase expenses, which of the three companies would be expected to have the lowest inventory holding costs? (Use 365 days in a year.)

Assuming that longer inventory holding periods act to increase expenses, which of the three companies would be expected to have the lowest inventory holding costs? (Use 365 days in a year.)

(Multiple Choice)

4.7/5  (41)

(41)

On December 31, Year 1, Owings Corporation overstates the ending inventory by $5,000. How will this affect the amount of retained earnings shown on the balance sheet at December 31, Year 2?

(Multiple Choice)

4.8/5  (39)

(39)

Indicate whether each of the following statements is true or false.________ a)The FIFO cost flow method assumes that the company physically rotates inventory so that the oldest inventory is sold first.________ b)In a period of rising inventory prices, FIFO gives higher cost of goods sold than LIFO.________ c)Under the weighted-average cost flow method, the average cost per unit equals the cost of goods available for sale divided by the number of units available for sale.________ d)In a period of declining inventory prices, LIFO will result in higher income tax expense than FIFO.________ e)In a period of rising inventory prices, FIFO gives higher ending inventory than LIFO does.

(True/False)

4.8/5  (44)

(44)

Explain the meaning of the terms, cost and market, as used in the application of the lower-of-cost-or-market rule.

(Essay)

4.8/5  (39)

(39)

How is the lower-of-cost-or-market rule applied to each individual inventory item?

(Essay)

4.7/5  (49)

(49)

The inventory records for Radford Company reflected the following:  What is the amount of cost of goods sold assuming the LIFO cost flow method?

What is the amount of cost of goods sold assuming the LIFO cost flow method?

(Multiple Choice)

4.9/5  (33)

(33)

The Warren Company uses the perpetual inventory system and has computed the cost of its inventory to be $12,800 as follows: 200 units of Product A at a cost per unit of $20; 300 units of Product B at a cost per unit of $24; and 100 units of Product C at a cost per unit of $16. The current replacement cost of each of the above items is $25, $22 and $14, respectively. Warren's accountant is not sure yet whether to apply the lower-of-cost-or-market rule to each individual item or to the entire stock of inventory in the aggregate. Indicate whether each of the following statements pertaining to the Warren Company is true or false.________ a)When referring to Product B, the "cost" totals $7,200.________ b)If Warren applies the lower-of-cost-or-market rule to each individual inventory item, Product A would be listed at $25 per unit.________ c)Warren would record a write-down of inventory if it applies this rule to each individual inventory item but would not have a write-down if it applies the rule to the entire stock of inventory in the aggregate.________ d)If Warren applies this rule to each individual inventory item, inventory of $12,000 will be shown on the balance sheet.________ e)The lower of cost or market is $1,600 for the 100 units of Product C.

(True/False)

4.8/5  (41)

(41)

Anton Company uses the perpetual inventory system and FIFO cost flow method. During the year, Anton purchased 1,080 units of inventory that cost $7 each and then purchased an additional 1,110 units of inventory that cost $9 each. If Anton sells 1,550 units of inventory, what is the amount of cost of goods sold?

(Multiple Choice)

4.9/5  (47)

(47)

Showing 121 - 140 of 169

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)