Exam 5: Accounting for Inventories

Exam 1: An Introduction to Accounting173 Questions

Exam 2: Accounting for Accruals150 Questions

Exam 3: Accounting for Deferrals136 Questions

Exam 4: Accounting for Merchandising Businesses187 Questions

Exam 5: Accounting for Inventories169 Questions

Exam 6: Internal Control and Accounting for Cash132 Questions

Exam 7: Accounting for Receivables174 Questions

Exam 8: Accounting for Long-Term Operational Assets200 Questions

Exam 9: Accounting for Current Liabilities and Payroll146 Questions

Exam 10: Accounting for Long-Term Debt171 Questions

Exam 11: Proprietorships, Partnerships, and Corporations144 Questions

Exam 12: Statement of Cash Flows159 Questions

Exam 13: The Double-Entry Accounting System167 Questions

Exam 14: Financial Statement Analysis Available Online in Connect170 Questions

Select questions type

Melbourne Company uses the perpetual inventory system and LIFO cost flow method. Melbourne purchased 500 units of inventory that cost $4.00 each. At a later date, the company purchased an additional 600 units of inventory that cost $5.00 each. If the company sells 800 units of inventory, what amount of ending inventory will appear on a balance sheet prepared immediately after the sale?

(Multiple Choice)

5.0/5  (42)

(42)

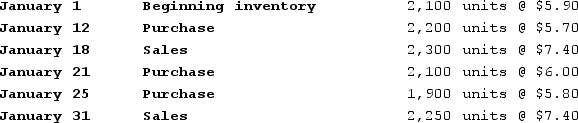

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a FIFO cost flow method, what is the cost of goods sold for the sales transaction on January 31?

Assuming Chase uses a FIFO cost flow method, what is the cost of goods sold for the sales transaction on January 31?

(Multiple Choice)

4.8/5  (34)

(34)

Stan's Surf Shack purchased five surfboards for $200 each. Later it purchased two additional surfboards for $250 each. Stan's sold a total of six surfboards during the period for $350 cash each. The company uses the perpetual inventory system and has not yet accrued any income taxes for the period.Indicate how the event described in the question affects the elements of the financial statements. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = IDecrease = DNot Affected = NAStan's pays the income taxes incurred for the current accounting period.

(Essay)

4.8/5  (32)

(32)

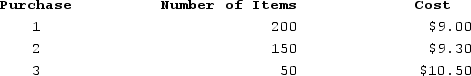

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each. During the period, the company purchased inventory items as follows:  Glasgow sold 220 units after purchase 3 for $17.00 each.

What is Glasgow's ending inventory under weighted-average (rounded)?

Glasgow sold 220 units after purchase 3 for $17.00 each.

What is Glasgow's ending inventory under weighted-average (rounded)?

(Multiple Choice)

4.8/5  (35)

(35)

Barker Company paid cash to purchase two identical inventory items. The first purchase cost $18.00 cash and the second cost $20.00 cash. Barker sold one inventory item for $30.00 cash. Based on this information alone, without considering the effect of income taxes, which of the following statements is correct?

(Multiple Choice)

4.8/5  (43)

(43)

In an inflationary period, which inventory cost flow method, FIFO or LIFO, is more desirable from a tax standpoint? Why?

(Essay)

4.9/5  (37)

(37)

Taylor Company had beginning inventory of $830 and ending inventory of $1,200. Taylor Company had cost of goods sold amounting to $2,610. What is the amount of inventory that was purchased during the period?

(Multiple Choice)

4.9/5  (39)

(39)

Indicate whether each of the following statements is true or false.________ a)To compute cost of goods sold under the weighted-average method, it is necessary to first compute the average cost per unit.________ b)The average cost per unit is computed by dividing the total cost of goods purchased by the number of units sold.________ c)Under the FIFO method, each time units are sold, the cost per unit of the oldest inventory is applied to the number of units sold.________ d)If a company uses the perpetual inventory system and sales and purchases occur intermittently, the company will not be able to use the LIFO method of cost flow.________ e)A U.S. company can use LIFO for income tax purposes only if it also uses LIFO for financial reporting purposes.

(True/False)

4.8/5  (38)

(38)

Koontz Company uses the perpetual inventory method and the weighted-average method. On January 1, Year 1, the company's first day of operations, Koontz purchased 400 units of inventory that cost $7.50 each. On January 10, Year 1, the company purchased an additional 600 units of inventory that cost $9.00 each. If the company sells 550 units of inventory, what is the amount of inventory that would appear on the balance sheet immediately following the sale?

(Multiple Choice)

4.7/5  (33)

(33)

Singleton Company's perpetual inventory records included the following information:

(True/False)

4.9/5  (50)

(50)

If a company uses the FIFO cost flow method for its income tax return it must also use FIFO for financial reporting.

(True/False)

4.8/5  (34)

(34)

The gross margin method of estimating inventory is not useful in detecting inventory fraud.

(True/False)

4.9/5  (43)

(43)

In most businesses, the physical flow of goods occurs on a FIFO basis, but a different cost flow method is allowed under generally accepted accounting principles.

(True/False)

4.8/5  (45)

(45)

The specific identification inventory method is not practical for companies that sell many low-priced, high turnover items.

(True/False)

4.8/5  (39)

(39)

Which of the following methods of applying the lower-of-cost-or-market rule will result in the fewest number of inventory write-downs?

(Multiple Choice)

4.9/5  (41)

(41)

Generally accepted accounting principles restrict or limit a company's freedom to change inventory cost flow methods from one year to the next.

(True/False)

4.9/5  (37)

(37)

Kincaid Camera Shop applies the lower-of-cost-or-market rule to individual items of inventory. During the year, some of Kincaid's inventory items decreased in market value due to obsolescence. Other items increased in market value during the year. In total, the market value of Kincaid's inventory was higher at the end of the year than the cost of the inventory. Would Kincaid have an adjustment to make at the end of the year due to the lower-of-cost-or-market rule? Why or why not? Would the answer be any different if Kincaid applied the rule to the entire stock of inventory in the aggregate rather than to individual items?

(Essay)

4.7/5  (37)

(37)

Warner Company purchased thirty-eight units of a product for $19 eachand later purchased nineteen more for $20.00. If the company uses the weighted average cost flow method, and it sold one unit of the product for $30, its gross margin would be $10.67.

(True/False)

4.8/5  (30)

(30)

Rowe Company has six different categories of inventory. Quantity, cost, and market value information for each inventory category is shown below:

Required:a)Determine the value of ending inventory after applying the lower-of-cost-or-market rule to each individual category of inventory.b)Determine the value of ending inventory after applying the lower-of-cost-or-market rule to the entire stock of inventory in the aggregate.

Required:a)Determine the value of ending inventory after applying the lower-of-cost-or-market rule to each individual category of inventory.b)Determine the value of ending inventory after applying the lower-of-cost-or-market rule to the entire stock of inventory in the aggregate.

(Essay)

4.9/5  (45)

(45)

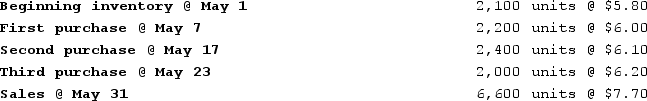

The inventory records for Radford Company reflected the following:  If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 141 - 160 of 169

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)