Exam 14: Financial Statement Analysis Available Online in Connect

Exam 1: An Introduction to Accounting173 Questions

Exam 2: Accounting for Accruals150 Questions

Exam 3: Accounting for Deferrals136 Questions

Exam 4: Accounting for Merchandising Businesses187 Questions

Exam 5: Accounting for Inventories169 Questions

Exam 6: Internal Control and Accounting for Cash132 Questions

Exam 7: Accounting for Receivables174 Questions

Exam 8: Accounting for Long-Term Operational Assets200 Questions

Exam 9: Accounting for Current Liabilities and Payroll146 Questions

Exam 10: Accounting for Long-Term Debt171 Questions

Exam 11: Proprietorships, Partnerships, and Corporations144 Questions

Exam 12: Statement of Cash Flows159 Questions

Exam 13: The Double-Entry Accounting System167 Questions

Exam 14: Financial Statement Analysis Available Online in Connect170 Questions

Select questions type

A banker may perform a financial ratio analysis to assess a firm's ability to repay debt in a timely manner.

(True/False)

4.8/5  (44)

(44)

Indicate whether each of the following statements about financial statement analysis is true or false.________ a)Ratio analysis may involve studying relationships between an item reported on the balance sheet and another reported on the income statement.________ b)Comparing sales in Year 2 with sales for Year 1 is a form of vertical analysis.________ c)Comparing net income in Year 2 with sales for Year 2 is a form of horizontal analysis.________ d)Liquidity ratios measure a company's ability to generate cash flows in the short term.________ e)Working capital is calculated by using the following formula: current assets − current liabilities.

(True/False)

4.8/5  (35)

(35)

A company has an obligation to provide highly detailed information on its financial statements.

(True/False)

5.0/5  (38)

(38)

Comparative income statements for Pearle Company are provided below:

Required: Perform a horizontal analysis of Pearle Company's income statement by computing horizontal percentages for each item. Round your answer to one decimal place (i.e. 22.5%).

Required: Perform a horizontal analysis of Pearle Company's income statement by computing horizontal percentages for each item. Round your answer to one decimal place (i.e. 22.5%).

(Essay)

4.9/5  (39)

(39)

Milton Company has total current assets of $50,000, including inventory of $12,500, and current liabilities of $26,000. The company's current ratio is:

(Multiple Choice)

4.7/5  (34)

(34)

Many companies have to monitor closely certain ratios, such as the current ratio, due to debt covenants. Selected transactions are provided below for a company that uses a perpetual inventory system; sells its merchandise at a selling price that exceeds cost; and had a current ratio of 1.85 and a quick ratio of 1.19 before the event occurred.

Required:In the above table, indicate whether each transaction would increase (+), decrease (−), or not affect (0)the company's current ratio and quick ratio.

Required:In the above table, indicate whether each transaction would increase (+), decrease (−), or not affect (0)the company's current ratio and quick ratio.

(Essay)

4.8/5  (34)

(34)

Indicate whether each of the following statements about financial statement analysis is true or false.________ a)Both dividends and earnings performance are indicators of the value of a company's stock.________ b)The most widely quoted measure of a company's earnings performance is return on equity.________ c)Earnings per share is calculated for a company's common stock.________ d)Investors need to understand that the value of a company's earnings per share is affected by its choices of accounting principles and assumptions.________ e)The book value per share measures the market value of a corporation's stock.

(True/False)

4.8/5  (41)

(41)

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $29,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant purchased merchandise on account for $4,000. Which of the following statements is true?

(Multiple Choice)

4.9/5  (35)

(35)

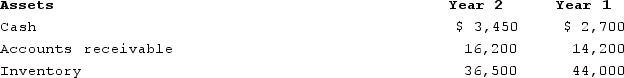

The following balance sheet information is provided for Gaynor Company:  Assuming Year 2 cost of goods sold is $122,000, what is the company's inventory turnover?

Assuming Year 2 cost of goods sold is $122,000, what is the company's inventory turnover?

(Multiple Choice)

4.8/5  (26)

(26)

You are considering an investment in Frontier Airlines stock and wish to assess the firm's earnings performance. All of the following ratios can be used to assess profitability except:

(Multiple Choice)

4.9/5  (48)

(48)

The most frequently quoted measure of earnings performance is the stockholders' equity ratio.

(True/False)

4.9/5  (47)

(47)

Earnings before interest and taxes divided by interest expense is the formula for which of these analytical measures?

(Multiple Choice)

4.9/5  (38)

(38)

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant collected $5,200 of accounts receivable. As a result of this transaction, Gant's working capital will:

(Multiple Choice)

4.9/5  (37)

(37)

Indicate whether each of the following statements about financial statement analysis is true or false.________ a)The asset turnover ratio is calculated by dividing net income by average total assets.________ b)The asset turnover ratio is likely to be high in an industry in which operations require only a minimal investment in assets.________ c)Return on equity measures the wealth generated by the amount of assets invested in a business.________ d)A higher value for the return on investment ratio would generally indicate more effective company management.________ e)The use of financial leverage often causes a business's return on equity to be lower than its return on investment.

(True/False)

4.9/5  (40)

(40)

Accrual accounting requires the use of many estimates, including:

(Multiple Choice)

4.7/5  (40)

(40)

Osgood Company provided the following income statement for Year 1 and Year 2:

Required: (a)Perform vertical analysis on Osgood's income statements for Year 1 and Year 2. Round your answer to one decimal place (i.e. 22.4%)

(b)Comment on the results, comparing Year 1 to Year 2.

Required: (a)Perform vertical analysis on Osgood's income statements for Year 1 and Year 2. Round your answer to one decimal place (i.e. 22.4%)

(b)Comment on the results, comparing Year 1 to Year 2.

(Essay)

4.8/5  (35)

(35)

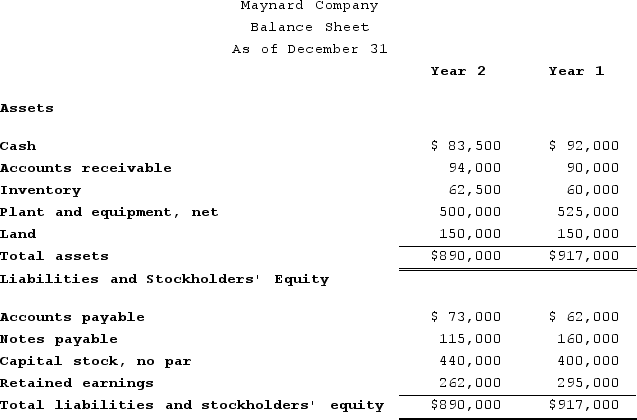

Maynard Company's balance sheet and income statement are provided below:

The company paid cash dividends of $2.00 per share during Year 2. On December 31, Year 2, the stock was listed on the stock exchange at a price of $78.25 per share.Required:Compute the following ratios for Year 2:(a)Accounts receivable turnover(b)Average days to collect receivables(c)Inventory turnover(d)Average days to sell inventory(e)Debt to assets ratio(f)Debt to equity ratio(g)Net margin(h)Asset turnover(i)Return on investment(j)Dividend yieldRound your answers to one decimal place.

The company paid cash dividends of $2.00 per share during Year 2. On December 31, Year 2, the stock was listed on the stock exchange at a price of $78.25 per share.Required:Compute the following ratios for Year 2:(a)Accounts receivable turnover(b)Average days to collect receivables(c)Inventory turnover(d)Average days to sell inventory(e)Debt to assets ratio(f)Debt to equity ratio(g)Net margin(h)Asset turnover(i)Return on investment(j)Dividend yieldRound your answers to one decimal place.

(Essay)

4.8/5  (37)

(37)

In terms of solvency, the larger the number of times interest is earned, the better.

(True/False)

4.9/5  (32)

(32)

Bernard Company provided the following information from its financial records:  What is the company's book value per share?

What is the company's book value per share?

(Multiple Choice)

4.9/5  (28)

(28)

Indicate whether each of the following statements about financial statement analysis is true or false.________ a)Solvency ratios measure a company's short-term debt paying ability and its financial structure.________ b)A company with a high debt to assets ratio probably would be considered to have a high level of financial risk.________ c)The debt to equity ratio and debt to assets ratio are two ways to measure the same relationship.________ d)From the point of view of stockholders, a decline in the debt to equity ratio is always good news.________ e)The lower the debt to equity ratio, the higher a company's financial leverage.

(True/False)

4.9/5  (33)

(33)

Showing 121 - 140 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)