Exam 14: Financial Statement Analysis Available Online in Connect

Exam 1: An Introduction to Accounting173 Questions

Exam 2: Accounting for Accruals150 Questions

Exam 3: Accounting for Deferrals136 Questions

Exam 4: Accounting for Merchandising Businesses187 Questions

Exam 5: Accounting for Inventories169 Questions

Exam 6: Internal Control and Accounting for Cash132 Questions

Exam 7: Accounting for Receivables174 Questions

Exam 8: Accounting for Long-Term Operational Assets200 Questions

Exam 9: Accounting for Current Liabilities and Payroll146 Questions

Exam 10: Accounting for Long-Term Debt171 Questions

Exam 11: Proprietorships, Partnerships, and Corporations144 Questions

Exam 12: Statement of Cash Flows159 Questions

Exam 13: The Double-Entry Accounting System167 Questions

Exam 14: Financial Statement Analysis Available Online in Connect170 Questions

Select questions type

Indicate whether each of the following statements about financial statement analysis is true or false.________ a)Meaningful comparisons between two companies generally should be made using percentage analysis or ratio analysis, not absolute amounts.________ b)The materiality of accounting information refers to whether it is viewed as favorable (good news)or unfavorable (bad news).________ c)Companies must account for immaterial items in compliance with generally accepted accounting principles.________ d)To judge the materiality of an absolute financial statement amount, one must consider the size of the company reporting it.________ e)Comparing percentages derived from financial statement analysis has the drawback of varying materiality levels.

(True/False)

4.9/5  (27)

(27)

Profitability ratios attempt to assess the company's ability to generate earnings.

(True/False)

4.9/5  (44)

(44)

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant recorded the sale of inventory. As a result of this transaction, Gant's quick ratio will:

(Multiple Choice)

4.9/5  (40)

(40)

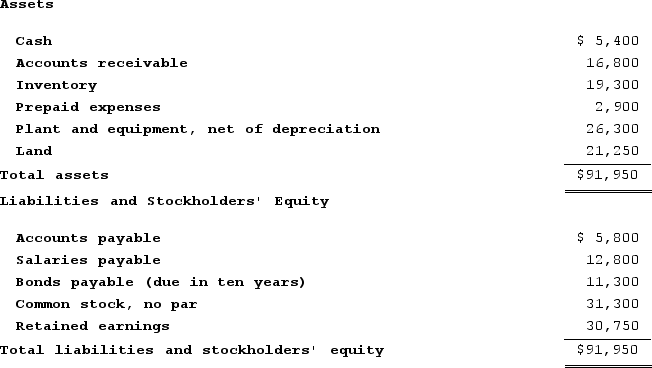

Alpha Company provided the following balance sheet for Year 2:  What is the company's plant assets to long-term liabilities ratio?

What is the company's plant assets to long-term liabilities ratio?

(Multiple Choice)

4.9/5  (38)

(38)

Benson Company received cash of $1,000,000 from issuing common stock at par value. As a result of this transaction, the company's debt-to-equity ratio will:

(Multiple Choice)

4.8/5  (39)

(39)

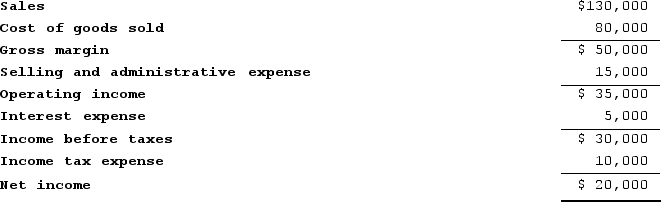

The Fortune Company reported the following income for Year 2:  What is the company's number of times interest earned ratio?

What is the company's number of times interest earned ratio?

(Multiple Choice)

4.7/5  (46)

(46)

Which of the following statements regarding the return on equity (ROE)measure is not true?

(Multiple Choice)

4.7/5  (43)

(43)

Knell Company paid its sales employees $15,000 in sales commissions. What impact will this transaction have on the firm's working capital?

(Multiple Choice)

4.8/5  (42)

(42)

On December 31, Year 1, Houston Company's total current assets were $560,000 and its total current liabilities were $420,000. On January 1, Year 2, Houston issued a long-term note to a bank for $30,000 cash.Required:(a)Compute Houston's working capital (1)before and (2)after issuing the note payable.(b)Compute Houston's current ratio (1)before and (2)after issuing the note payable. Round your answer to two decimal places.

(Essay)

4.9/5  (34)

(34)

The quick ratio although similar to the current ratio is more conservative.

(True/False)

4.8/5  (34)

(34)

Showing 161 - 170 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)