Exam 5: Comparison Methods: Part Ii

Exam 1: Engineering Decision Making42 Questions

Exam 2: Time Value of Money67 Questions

Exam 3: Cash Flow Analysis66 Questions

Exam 4: Comparison Methods: Part I51 Questions

Exam 5: Comparison Methods: Part Ii50 Questions

Exam 6: Financial Accounting and Business Plans42 Questions

Exam 7: Replacement Decisions52 Questions

Exam 8: Taxes49 Questions

Exam 9: Inflation52 Questions

Exam 10: Public Sector Decision Making49 Questions

Exam 11: Project Management50 Questions

Exam 12: Dealing With Uncertainty and Risk48 Questions

Select questions type

For two mutually exclusive projects with equal lives, the one with

(Multiple Choice)

4.8/5  (31)

(31)

If you invest $1 000 now, you will receive this amount back in two years plus dividends of $200 each year. What is the IRR of this investment?

(Essay)

4.8/5  (32)

(32)

Sarah is considering the purchase of ski equipment for $300. It could save her the $60 per year of rental fees she envisions over the six year life of the ski equipment. What is the IRR of investing in the ski equipment?

(Essay)

4.8/5  (41)

(41)

Steve is a professional web-site designer. He just bought a powerful computer for $5 000. According to the existing market, he will be able to sell this computer for $1 000 three years from now. In order for Steve to get 10% internal rate of return on his computer, what annual revenue should he generate over the three-year period?

(Essay)

4.9/5  (31)

(31)

Explain how you would compare two mutually exclusive projects on the basis of the internal rate of return.

(Essay)

4.8/5  (31)

(31)

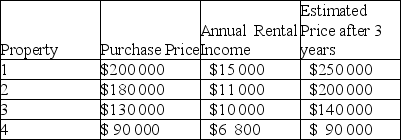

An investor has the following properties to invest in over a period of three years and uses a MARR of 9%:

Using incremental IRR, which property, if any, should she invest in?

Using incremental IRR, which property, if any, should she invest in?

(Essay)

4.9/5  (40)

(40)

There are two options to buy a plot of land for construction: (i)upfront payment of $250 000, or (ii)four equal payments of $50 000 in years 1-4 and the fifth payment of $150 000 in year 5. What is the implied IRR of choosing the second option over the first?

(Essay)

4.8/5  (27)

(27)

You can buy a car for $40 000 paying cash now or you can finance it through a bank loan paying $700 per month for 5 years. What is the IRR of the financing option in annual terms?

(Essay)

4.9/5  (39)

(39)

A project requires an initial investment of $100 000 and immediately pays $25 000. The next year this project requires an additional investment of $50 000 and does not pay anything. In the following year the project pays $150 000. The internal rate of return (i)for this project can be obtained by

(Multiple Choice)

4.9/5  (29)

(29)

Showing 41 - 50 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)