Exam 4: Financial Markets and Net Present Value: First Principles of Finance

Exam 1: Introduction to Corporate Finance38 Questions

Exam 2: Accounting Statements and Cash Flow59 Questions

Exam 3: Financial Planning and Growth39 Questions

Exam 4: Financial Markets and Net Present Value: First Principles of Finance36 Questions

Exam 5: The Time Value of Money73 Questions

Exam 6: How to Value Bonds and Stocks81 Questions

Exam 7: Net Present Value and Other Investment Rules57 Questions

Exam 8: Net Present Value and Capital Budgeting48 Questions

Exam 9: Risk Analysis, Real Options, and Capital Budgeting35 Questions

Exam 10: Risk and Return: Lessons From Market History51 Questions

Exam 11: Risk and Return: the Capital Asset Pricing Model65 Questions

Exam 12: An Alternative View of Risk and Return: the Arbitrage Pricing Theory42 Questions

Exam 13: Risk, Return, and Capital Budgeting63 Questions

Exam 14: Corporate Financing Decisions and Efficient Capital Markets46 Questions

Exam 15: Long-Term Financing: an Introduction46 Questions

Exam 16: Capital Structure: Basic Concepts56 Questions

Exam 17: Capital Structure: Limits to the Use of Debt53 Questions

Exam 18: Valuation and Capital Budgeting for the Levered Firm54 Questions

Exam 19: Dividends and Other Payouts47 Questions

Exam 20: Issuing Equity Securities to the Public43 Questions

Exam 21: Long-Term Debt50 Questions

Exam 22: Leasing42 Questions

Exam 23: Options and Corporate Finance: Basic Concepts63 Questions

Exam 24: Options and Corporate Finance: Extensions and Applications24 Questions

Exam 25: Warrants and Convertibles47 Questions

Exam 26: Derivatives and Hedging Risk50 Questions

Exam 27: Short-Term Finance and Planning51 Questions

Exam 28: Cash Management35 Questions

Exam 29: Credit Management31 Questions

Exam 30: Mergers and Acquisitions55 Questions

Exam 31: Financial Distress22 Questions

Exam 32: International Corporate Finance54 Questions

Select questions type

A financial instrument, by its possession, that entitles the holder to receive the payments are called:

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

D

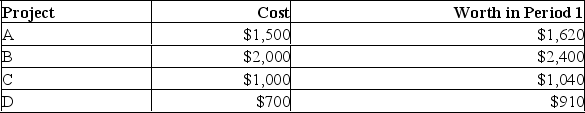

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

Free

(Essay)

4.7/5  (41)

(41)

Correct Answer:

Individual must borrow $11,000 from period 1 income which comes at a cost of $11,000 (1.06) = $11,660. Therefore, max period 1 dollars is: $42,000 - $11,660 + $18,000 = $48,340

One of the functions of financial intermediaries is to make sure the market clears. This means:

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

B

The ray that connects the maximum one can consume in Year 0 with the maximum one can consume in Year 1 represents:

(Multiple Choice)

4.7/5  (37)

(37)

A lender with no investment opportunities has equal income in period 0 and in period 1. Which of the following correctly describes the consequence of an increase in the interest rate?

(Multiple Choice)

4.9/5  (37)

(37)

The separation theorem in financial markets is fundamental to allowing managers to maximize all shareholders wealth. Explain the separation theorem and how the financial markets provide for all different types of investors.

(Essay)

4.9/5  (33)

(33)

If the amount of money to be lent is exactly equal to the amount desired to be borrowed then the market is cleared at:

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following conditions do not characterize perfect capital markets?

(Multiple Choice)

4.9/5  (38)

(38)

The first or basic principle of finance dictates that an individual will invest in a project if:

(Multiple Choice)

4.9/5  (45)

(45)

You have an investment opportunity available to you that requires $400,000. You have no funds available but you will have income of $120,000 this year. The investment will have a net payoff $33,000 at the end of the year. If the market rate is 7.5% will you make the investment?

(Multiple Choice)

4.8/5  (38)

(38)

An individual has $60,000 income in period 0 and $30,000 income in period 1. If the individual desires to consume $19,000 in period 1 and the market interest rate is 8%, what is the maximum amount of consumption in period 0?

(Multiple Choice)

4.8/5  (39)

(39)

The following statement, that the value of an investment to an individual is not dependent on consumption preferences, is called the:

(Multiple Choice)

4.8/5  (46)

(46)

You have an investment opportunity available to you that requires $400,000. You have no funds available but you will have income of $120,000 this year. The investment will have a payoff $433,000 at the end of the year. If the market rate is 8.25% what is the net present value?

(Multiple Choice)

4.8/5  (44)

(44)

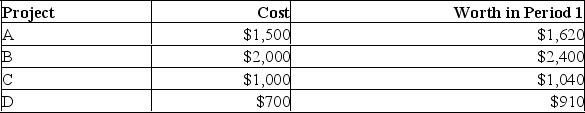

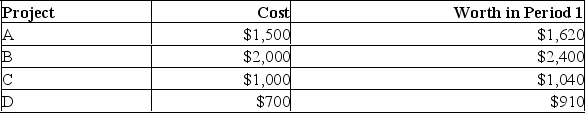

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

An individual has income of $15,000 in period 0 and $20,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $11,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 0 if the individual consumes $26,000 in period 1?

An individual has income of $15,000 in period 0 and $20,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $11,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 0 if the individual consumes $26,000 in period 1?

(Essay)

4.8/5  (31)

(31)

A corporation has the following opportunity to invest in a project with a return of $42,000 in one period. The current investment is $46,900. The financial market rate is 14%.

If the corporation had cash on hand of $25,000 before raising any capital for the investment and the financial market rate is 9%. How much will the current shareholders earn.?

(Essay)

4.9/5  (31)

(31)

According to the net present value rule, an investment should be made if:

(Multiple Choice)

4.8/5  (36)

(36)

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

Suppose that the market interest rate falls to 5%. What is the maximum possible consumption in period 1 if the individual takes on the optimal set of investment projects?

D.

Period 1 consumption is $1,620 + $2,400 + $910 = $4,930

Suppose that the market interest rate falls to 5%. What is the maximum possible consumption in period 1 if the individual takes on the optimal set of investment projects?

D.

Period 1 consumption is $1,620 + $2,400 + $910 = $4,930

(Essay)

4.8/5  (30)

(30)

Diagrams illustrating the consumption choices for a corporation show the two period trade-off as originating in the northwest quadrant, or (-X, Y), because:

(Multiple Choice)

4.9/5  (32)

(32)

An individual with no investment opportunities has income of $15,000 in period 0 and income of $10,000 in period 1. If the interest rate is 7%, which of the following points is on the individual's consumption possibility line?

(Multiple Choice)

4.8/5  (32)

(32)

A corporation has the following opportunity to invest in a project with a return of $42,000 in one period. The current investment is $46,900. The financial market rate is 14%.

The financial market rate is 5%. Graph and explain the investment choice the corporation should make. (Hint: Determine the NPV.) NPV = -42,000 + (46,900/1.05) = -

(Short Answer)

4.8/5  (37)

(37)

Showing 1 - 20 of 36

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)