Exam 10: Financial Statement Analysis

Exam 1: Introduction to Accounting48 Questions

Exam 2: Types of Organisations and the Financial Reporting Framework102 Questions

Exam 3: Ethics and Corporate Governance33 Questions

Exam 4: Wealth and the Measurement of Profit43 Questions

Exam 5: Presentation of Financial Position and the Worksheet77 Questions

Exam 6: Presentation of Financial Performance and the Worksheet74 Questions

Exam 7: Presentation of Cash Flows59 Questions

Exam 8: Accounting for Selected Assets126 Questions

Exam 9: Liabilities and Sources of Financing82 Questions

Exam 10: Financial Statement Analysis86 Questions

Exam 11: Worksheet to Debits and Credits27 Questions

Exam 12: An Introduction to Management Accounting: a Strategic Perspective54 Questions

Exam 13: Performance Measurement and the Balanced Scorecard49 Questions

Exam 14: Costs and Cost Behaviour63 Questions

Exam 15: Budgets55 Questions

Exam 16: Cost-Volume-Profit Analysis43 Questions

Exam 17: Accounting for Decision Making: With and Without Resource Constraints56 Questions

Exam 18: Capital Investment Decisions62 Questions

Select questions type

Thorpedo Ltd reported a return on assets of 15% for the year ending 31 December. It also acquired a licence for cash by paying $1m at the end of the year ending 31 December. This licence is expected to generate net profits of $0.1m per year and the asset is not amortised. Assuming the results for the next financial year mirror the year ending 31 December and the licence did increase net profit by $0.1m. What is the effect on Thorpedo Ltd's return on assets for this subsequent financial year?

(Multiple Choice)

4.8/5  (44)

(44)

The use of debt to increase a company's return on equity is:

(Multiple Choice)

4.8/5  (34)

(34)

The owners of a small entity, such as a sole trader, have greater access to the entity's accounting information than the equity participants of a large entity such as a public company. However, for the purposes of financial statement analysis, the accounting information needs of equity participants are the same.

(True/False)

4.8/5  (34)

(34)

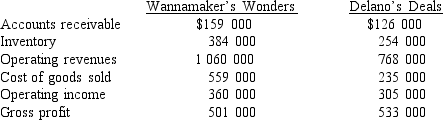

Use the following information to answer questions 25 and 26.

-Assuming that all sales have been made on credit and rounding up to two decimal places, what are the accounts receivables turnovers for Wannamaker's and Delano's?

-Assuming that all sales have been made on credit and rounding up to two decimal places, what are the accounts receivables turnovers for Wannamaker's and Delano's?

(Multiple Choice)

4.8/5  (35)

(35)

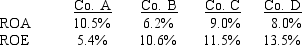

Which of the following companies, whose ROE and ROA are given, is probably the most valued by shareholders?

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following statements concerning the comparison of financial information between firms is not true?

(Multiple Choice)

4.9/5  (37)

(37)

For financial information to be useful for analysis, it must be both relevant and reliable. Other required qualitative characteristics are:

(Multiple Choice)

4.9/5  (45)

(45)

Which of the following is a measure of short-term solvency?

(Multiple Choice)

4.9/5  (34)

(34)

The most common information needs of users of financial statement analysis relate to profitability, liquidity and risk.

(True/False)

4.9/5  (41)

(41)

The 'true and fair view' of the auditor with respect to the financial statements of an entity, asserts that the financial assertions contained in the report are accurate in detail.

(True/False)

4.8/5  (34)

(34)

The owners of an entity are regarded as equity investors whether they are sole traders, partnerships or shareholders in a multinational corporation, whereas preference shareholders may be classified as equity or debt investors depending on the characteristics of the shares.

(True/False)

4.8/5  (37)

(37)

If a company has a debt to equity ratio of 1:48, it means that for every $1 of equity, the company has $1.48 in liabilities.

(True/False)

4.8/5  (27)

(27)

Which of the following assets would be used in calculating the current ratio but not normally in determining the quick ratio?

(Multiple Choice)

4.8/5  (38)

(38)

Unlike ordinary shareholders, preference shareholders are more likely to be interested in the extent to which profit is safe, rather than in profit growth, due to the fact that the return on their investment is typically fixed.

(True/False)

4.7/5  (34)

(34)

Effective financial analysis relies on internal sources of information such as the financial statements and notes to the accounts, as well as external sources such as the financial press and trade journals.

(True/False)

4.8/5  (42)

(42)

Showing 21 - 40 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)