Exam 16: Financial Statement Analysis

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts238 Questions

Exam 3: Cost Behavior231 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool185 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management125 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis173 Questions

Exam 12: Performance Evaluation and Decentralization167 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis190 Questions

Select questions type

Terms of sale can produce statistical variations among companies within the same industry.

(True/False)

4.9/5  (32)

(32)

Wellston Company's net income last year was $300,000. The company has 100,000 shares of common stock and 30,000 shares of preferred stock outstanding. There was no change in the number of common or preferred shares outstanding during the year. The company declared and paid dividends last year of $1.90 per share on the common stock and $1.70 per share on the preferred stock. The earnings per share of common stock is closest to

(Multiple Choice)

4.8/5  (42)

(42)

The two major forms of common-size analysis are horizontal analysis and vertical analysis. What type of information or insights can be obtained by using these two techniques of financial statement analysis? Explain how the output of horizontal analysis and vertical analysis can be compared to industry averages and/or competitive companies.

(Essay)

4.9/5  (34)

(34)

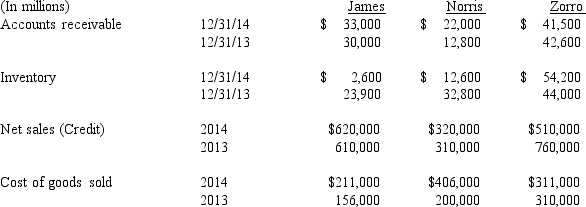

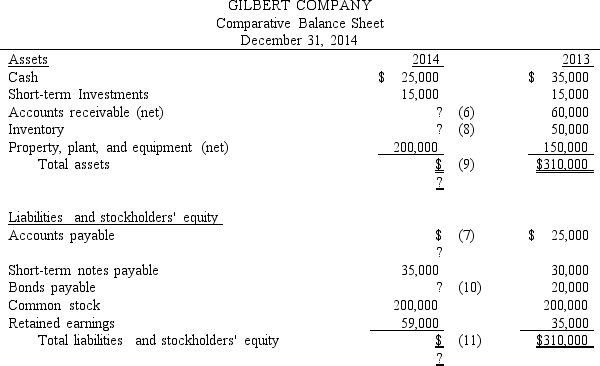

Figure 16-5.

The following information that was obtained from the 2014 and 2013 financial statements of James Company, Norris Corporation, and Zorro Company:

-Refer to Figure 16-5. Compare the three companies and answer the following:

-Refer to Figure 16-5. Compare the three companies and answer the following:

(Essay)

4.8/5  (29)

(29)

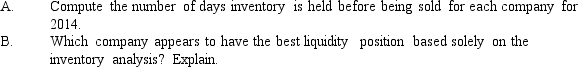

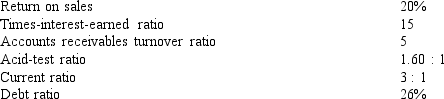

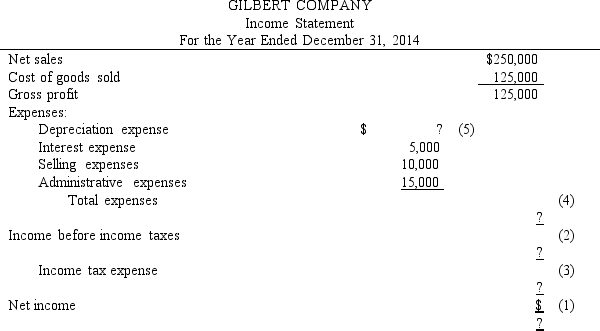

The following ratios have been computed for Gilbert Company for 2014.

Gilbert Company's 2014 financial statements with missing information follow:

Gilbert Company's 2014 financial statements with missing information follow:

Required: Use the above ratios and information from the Gilbert Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

Required: Use the above ratios and information from the Gilbert Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

(Essay)

4.9/5  (35)

(35)

______________ and ____________ are the two major sources of capital.

(Essay)

4.7/5  (42)

(42)

Industrial statistics should be taken as absolute norms as far as standards for comparability.

(True/False)

4.9/5  (26)

(26)

The measures of the ability of a company to meets its long- and short-term obligations are known as _______________.

(Short Answer)

4.9/5  (32)

(32)

Industrial figures, standards and statistics should be used with so much care that they are not a very good reference point to compare companies.

(True/False)

4.7/5  (34)

(34)

ABC Company issued additional shares of stock for cash. The effect of the transaction is

(Multiple Choice)

4.8/5  (36)

(36)

Vertical analysis is a technique that expresses each item in a financial statement

(Multiple Choice)

4.7/5  (31)

(31)

Which profitability ratio requires the use of earnings per share in its calculation?

(Multiple Choice)

4.7/5  (32)

(32)

The average stockholders' equity for Holloway Co. last year was $2,000,000. Included in this figure was $200,000 par value of 8% preferred stock. If the return on common stockholders' equity was 12.5% for the year, net income was

(Multiple Choice)

4.8/5  (34)

(34)

The current ratio is a measure of the ability of a company to pay its short-term liabilities out of short-term assets.

(True/False)

4.8/5  (34)

(34)

MATCHING

Match the classifications of ratios with each description.

a.

Liquidity Ratio

b.

Leverage Ratio

c.

Profitability Ratio

d.

Horizontal Analysis

e.

Trend Analysis

-Dividend payout ratio

(Short Answer)

4.8/5  (42)

(42)

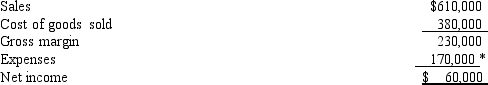

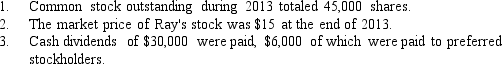

The income statement for Ray Company for the year ended December 31, 2013, appears below.

*Includes $30,000 of interest expense and $18,000 of income tax expense.

Additional information:

*Includes $30,000 of interest expense and $18,000 of income tax expense.

Additional information:

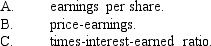

Required: Compute the following ratios for 2013:

Required: Compute the following ratios for 2013:

(Essay)

4.9/5  (30)

(30)

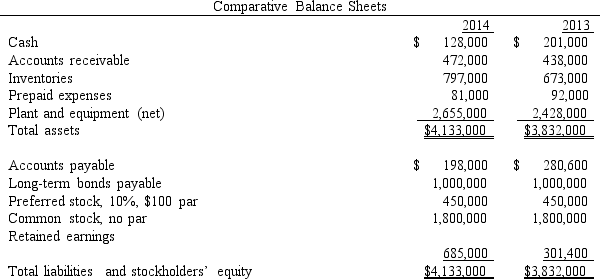

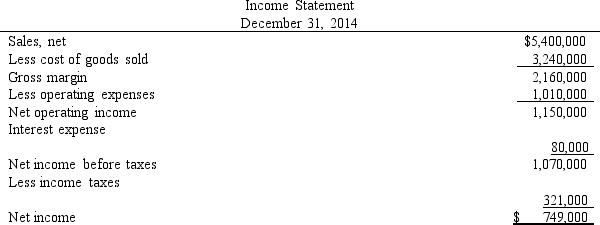

Figure 16-4.

Condensed financial statements for Black Company appear below:

There were 72,000 shares of common stock outstanding throughout the 2014. Dividends on common stock amounted to $320,400 and dividends on preferred stock amounted to $45,000. The market value of a share of common stock was $54 at the end of 2014. The income tax rate is 30%.

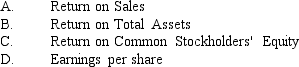

-Refer to Figure 16-4.

Required: Calculate the following profitability ratios for 2014.

There were 72,000 shares of common stock outstanding throughout the 2014. Dividends on common stock amounted to $320,400 and dividends on preferred stock amounted to $45,000. The market value of a share of common stock was $54 at the end of 2014. The income tax rate is 30%.

-Refer to Figure 16-4.

Required: Calculate the following profitability ratios for 2014.

(Essay)

4.7/5  (35)

(35)

Fastlane Company has 50,000 shares of common stock and 20,000 shares of preferred stock outstanding. There was no change in the number of common or preferred shares outstanding during the year. Preferred stockholders received dividends this year totaling $120,000. Common stockholders received dividends totaling $200,000. If the dividend payout ratio for the year was 80%, then the net income was

(Multiple Choice)

4.7/5  (33)

(33)

Showing 21 - 40 of 190

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)