Exam 12: Performance Evaluation and Decentralization

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts238 Questions

Exam 3: Cost Behavior231 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool185 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management125 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis173 Questions

Exam 12: Performance Evaluation and Decentralization167 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis190 Questions

Select questions type

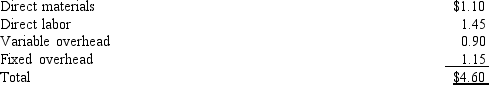

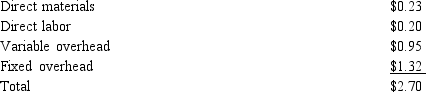

Paige Inc. has a division that makes paint and another division that constructs subdivisions. The paint division incurs the following costs for one gallon of paint:

The Paint Division can make 1,000,000 gallons per year, and expects to produce 1,000,000 gallons next year. The construction division currently buys 200,000 gallons of paint from an outside supplier for $5.20 per gallon (the same price that the Paint Division receives).

The Paint Division can make 1,000,000 gallons per year, and expects to produce 1,000,000 gallons next year. The construction division currently buys 200,000 gallons of paint from an outside supplier for $5.20 per gallon (the same price that the Paint Division receives).

(Essay)

4.8/5  (45)

(45)

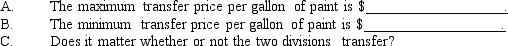

The Southern Division of Jenkins Company had income of $48,300, average assets of $345,000 and sales of $241,500. The minimum rate of return for Jenkins Company is 12%.

(Essay)

4.9/5  (34)

(34)

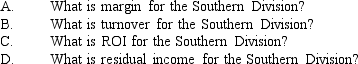

If the National Division of American Products Company had a turnover ratio of 4.2 and a margin of 0.10, the return on investment would be

(Multiple Choice)

4.9/5  (40)

(40)

In a decentralized company, central management is able to focus on strategic planning and decision making.

(True/False)

4.7/5  (42)

(42)

The Balanced Scorecard perspective that describes the economic consequences of actions taken in the other three perspectives is the ____ perspective.

(Multiple Choice)

4.9/5  (40)

(40)

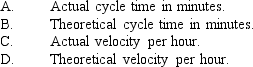

Figure 12-6.

The First National Bank has a mortgage loan office with conversion cost of $73,950 per month. There are five employees who each work 170 hours per month. Last month, 1,020 loan applications were processed, but the staff believes that system improvements could lead to the processing of as many as 1,700 per month.

-Refer to Figure 12-6. Calculate the following:

(Essay)

4.7/5  (30)

(30)

The selling division is forced to transfer a product internally when a cost-based transfer pricing policy is set by top management.

(True/False)

4.8/5  (37)

(37)

Using Economic Value Added (EVA) to calculate residual income, the cost of capital employed is

(Multiple Choice)

5.0/5  (39)

(39)

Select the appropriate definition for each of the items listed below.

a.

Turnover

b.

Margin

c.

ROI

d.

Residual income

-The ratio of sales to average operating assets.

(Short Answer)

4.9/5  (30)

(30)

Last night, Shirley worked on her accounting homework for one and one half hours. During that time, she completed 6 problems. What is the velocity in problems per hour?

(Multiple Choice)

4.8/5  (41)

(41)

_______________ indicate the minimum ROI necessary to accept an investment.

(Short Answer)

4.9/5  (40)

(40)

In a decentralized company, overall profit margins can mask inefficiencies within the various subdivisions.

(True/False)

4.7/5  (29)

(29)

Residual income is the difference between operating income and the product of the hurdle rate and the company's average operating assets.

(True/False)

4.9/5  (41)

(41)

A price charged for a component by the selling division to the buying division of the same company is called a(n)

(Multiple Choice)

4.8/5  (32)

(32)

If there is a competitive outside market for the transferred product, then the best transfer price is the _____________.

(Short Answer)

4.8/5  (38)

(38)

Using EVA to calculate residual income, the dollar cost of capital employed is the actual percentage cost of capital multiplied by the total capital employed.

(True/False)

4.8/5  (30)

(30)

Turnover is the most common measure of performance for an investment center.

(True/False)

4.7/5  (40)

(40)

Figure 12-4.

Quinn Inc. has a number of divisions. One division, Style, makes zippers that are used in the manufacture of boots. Another division, LeatherStuff, makes boots that use the zippers and needs 90,000 zippers per year. Style incurs the following costs for one zipper:

Quinn has capacity to make 950,000 zippers per year, but due to a soft market, only plans to produce and sell 620,000 zippers next year. LeatherStuff currently buys zippers from an outside supplier for $3.50 each (the same price that Style receives).

-Refer to Figure 12-4. Assume that Style and LeatherStuff have agreed on a transfer price of $3.25. What is the total benefit for Style?

Quinn has capacity to make 950,000 zippers per year, but due to a soft market, only plans to produce and sell 620,000 zippers next year. LeatherStuff currently buys zippers from an outside supplier for $3.50 each (the same price that Style receives).

-Refer to Figure 12-4. Assume that Style and LeatherStuff have agreed on a transfer price of $3.25. What is the total benefit for Style?

(Multiple Choice)

4.7/5  (38)

(38)

Showing 41 - 60 of 167

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)