Exam 8: Accounts Receivable and Further Record-Keeping

Exam 1: Introduction to Financial Accounting29 Questions

Exam 2: Measuring and Evaluating Financial Position and Financial Performance32 Questions

Exam 3: The Double-Entry System31 Questions

Exam 4: Record-Keeping26 Questions

Exam 5: Accrual Accounting Adjustments26 Questions

Exam 6: Financial Reporting Principles, Accounting Standards and Auditing16 Questions

Exam 7: Internal Control and Cash19 Questions

Exam 8: Accounts Receivable and Further Record-Keeping19 Questions

Exam 9: Inventory28 Questions

Exam 10: Noncurrent Assets24 Questions

Exam 11: Liabilities21 Questions

Exam 13: Revenue and Expense Recognition: Additional Concepts23 Questions

Exam 14: The Statement of Cash Flows36 Questions

Exam 15: Financial Statement Analysis31 Questions

Exam 16: Accounting Policy Choices17 Questions

Exam 17: Sustainability Reporting13 Questions

Select questions type

The Allowance for doubtful debts account would appear in the balance sheet under:

Free

(Multiple Choice)

4.7/5  (33)

(33)

Correct Answer:

A

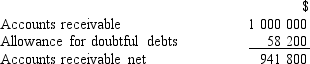

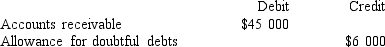

S Ltd has the following balance sheet information on 28 February 2019:  On 28 February 2019, the company receives notification from R Ltd that it has filed for bankruptcy. The controller of S Ltd decides to write off R Ltd's account for $10 600. Which of the following statements is TRUE?

On 28 February 2019, the company receives notification from R Ltd that it has filed for bankruptcy. The controller of S Ltd decides to write off R Ltd's account for $10 600. Which of the following statements is TRUE?

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

D

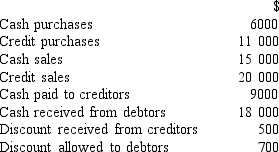

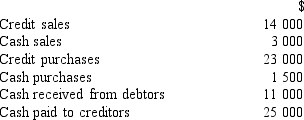

Wrigley Ltd uses subsidiary ledgers for debtors and creditors. At 1 July 2018 debtors owed $7 000 and creditors were owed $4 000. Transactions for year ended 30 June 2019 were as follows:  What was the balance of the creditors control account at 30 June 2019?

What was the balance of the creditors control account at 30 June 2019?

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

D

Blue Shoes Ltd has gone bankrupt and will not pay $10 000 to XYZ. XYZ has accounts receivable of $12 million and an allowance for doubtful debts of $500 000. XYZ does not adjust its accounts for the $10 000 that will not be paid by Blue Shoes Ltd. Which of the following remarks is true about the financial statements?

(Multiple Choice)

4.9/5  (32)

(32)

Which of these items is the source document for the purchase journal?

(Multiple Choice)

4.9/5  (41)

(41)

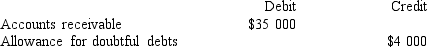

The trial balance of Anderson Ltd included the following balances:  On 1 October 2019, an account for $1 600 was determined to be uncollectable. The journal entry to be made on that date would include a debit to:

On 1 October 2019, an account for $1 600 was determined to be uncollectable. The journal entry to be made on that date would include a debit to:

(Multiple Choice)

4.7/5  (37)

(37)

Wrigley Ltd uses subsidiary ledgers for debtors and creditors. At 1 July 2018 debtors owed $7 000 and creditors were owed $4 000. Transactions for year ended 30 June 2019 were as follows:  What was the balance of the debtors' control account at 30 June 2019?

What was the balance of the debtors' control account at 30 June 2019?

(Multiple Choice)

4.8/5  (41)

(41)

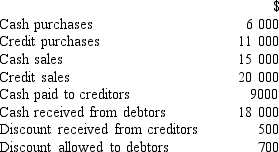

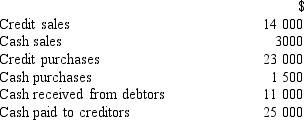

Gum Ltd maintains subsidiary ledgers for debtors and creditors. At 1 July 2018, debtors owed $4 000, and creditors were owed $7 200. Transactions for year ended 30 June 2019 were as follows:  What was the balance of the creditors' control account at 30 June 2019?

What was the balance of the creditors' control account at 30 June 2019?

(Multiple Choice)

4.7/5  (38)

(38)

Which of the following is NOT a purpose served by special journals?

(Multiple Choice)

4.9/5  (34)

(34)

At year end Dodgy Ltd had a balance in Accounts receivable of $40 000 and an Allowance for doubtful debts of $2 000. It was decided to write off as irrecoverable the debt of Houdini Ltd totalling $3 500. It was further decided that the Allowance for doubtful debts should stand at 10 per cent of Accounts receivable. What was the journal entry needed to bring the Allowance for doubtful debts to the required level after writing off the debt of Houdini Ltd?

(Multiple Choice)

4.8/5  (43)

(43)

Which of these items is the source document for the sales journal?

(Multiple Choice)

4.9/5  (37)

(37)

The trial balance of Wentworth Ltd included the following balances:  It was decided to increase the allowance account by $3 000. The journal entry to be made on that date would include a debit to:

It was decided to increase the allowance account by $3 000. The journal entry to be made on that date would include a debit to:

(Multiple Choice)

4.9/5  (37)

(37)

Management uses the ageing approach method to calculate the allowance for doubtful debts. An analysis of the ageing of accounts receivable shows a substantial increase in the accounts receivable in the over-90-days category. Management does not adjust the allowance for doubtful debts at year-end. As a result:

(Multiple Choice)

4.9/5  (28)

(28)

Griffin Ltd made a sale of $800 to a customer on terms of 2/10, n/30 on 1 July. The account was paid on 8 July. Griffin Ltd would make which of the following postings to the ledger on 8 July?

(Multiple Choice)

4.9/5  (40)

(40)

At 30 June 2019 Shifty Ltd had a balance of Accounts receivable of $90 000 and an Allowance for doubtful debts of $4 000. It was further decided that the Allowance for doubtful debts should stand at 5 per cent of Accounts receivable. What was the journal entry needed to adjust the allowance account?

(Multiple Choice)

4.7/5  (35)

(35)

Gum Ltd maintains subsidiary ledgers for debtors and creditors. At 1 July 2018, debtors owed $4 000, and creditors were owed $7 200. Transactions for year ended 30 June 2019 were as follows:  What was the balance of the debtors' control account at 30 June 2019?

What was the balance of the debtors' control account at 30 June 2019?

(Multiple Choice)

4.8/5  (29)

(29)

At year end Dodgy Ltd had a balance in Accounts receivable of $40 000 and an Allowance for doubtful debts of $2 000. It was decided to write off as irrecoverable the debt of Houdini Ltd totalling $3 500. It was further decided that the Allowance for doubtful debts should stand at 10 per cent of Accounts receivable. What was the journal entry needed to write off the debt of Houdini Ltd as irrecoverable?

(Multiple Choice)

4.9/5  (40)

(40)

The general ledger account representing the subsidiary ledger is known as a control account because:

(Multiple Choice)

4.7/5  (40)

(40)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)