Exam 13: Revenue and Expense Recognition: Additional Concepts

Exam 1: Introduction to Financial Accounting29 Questions

Exam 2: Measuring and Evaluating Financial Position and Financial Performance32 Questions

Exam 3: The Double-Entry System31 Questions

Exam 4: Record-Keeping26 Questions

Exam 5: Accrual Accounting Adjustments26 Questions

Exam 6: Financial Reporting Principles, Accounting Standards and Auditing16 Questions

Exam 7: Internal Control and Cash19 Questions

Exam 8: Accounts Receivable and Further Record-Keeping19 Questions

Exam 9: Inventory28 Questions

Exam 10: Noncurrent Assets24 Questions

Exam 11: Liabilities21 Questions

Exam 13: Revenue and Expense Recognition: Additional Concepts23 Questions

Exam 14: The Statement of Cash Flows36 Questions

Exam 15: Financial Statement Analysis31 Questions

Exam 16: Accounting Policy Choices17 Questions

Exam 17: Sustainability Reporting13 Questions

Select questions type

Under which of the following circumstances would revenue normally be recognised?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

Highrise Constructions Ltd had a large three-year project with total revenue of $5 000 000 and estimated total costs of $4 200 000. The project was 25 per cent complete at the end of the first year, 55 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the first year if the percentage of completion method was used?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

A

Leslie Ltd has found an error in its revenue account: an invoice for $3 000 was recorded as revenue in 2018 when it should have been recorded in 2019. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. What is the effect of the error on the 2018 net profit?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

B

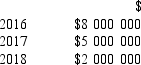

On 1 January 2016, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:  The project was completed in December 2018. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

The project was completed in December 2018. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

(Multiple Choice)

4.7/5  (32)

(32)

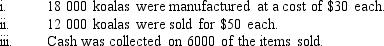

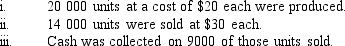

Toy Company manufactures toy koalas. Transactions for the year 2018 were as follows:  What was the reported profit for the year 2018 if revenue was recognised at the point of sale?

What was the reported profit for the year 2018 if revenue was recognised at the point of sale?

(Multiple Choice)

4.7/5  (38)

(38)

Multi-Storey Builders Ltd had a large three-year project with total revenue of $8 000 000 and estimated total costs of $6 500 000. The project was 20 per cent complete at the end of the first year, 70 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the second year if the percentage of completion method was used?

(Multiple Choice)

4.9/5  (39)

(39)

The profit for a particular project of Blue Fin Ltd, using the percentage of completion method, was $470 000 for year 1 and $690 000 for year 2 (completion). What difference would there be to profit for year 2 if the completion of production method were used?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following transactions should not result in revenue recognition in 2018?

(Multiple Choice)

4.9/5  (42)

(42)

Junction Company had the following transactions, among others, during August. Which transaction represented an expense during August?

(Multiple Choice)

4.9/5  (45)

(45)

Leslie Ltd has found an error in its revenue account: an invoice for $3 000 was recorded as revenue in 2018 when it should have been recorded in 2019. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. What is the effect of the error on 2018 cash from operations?

(Multiple Choice)

4.8/5  (43)

(43)

With respect to services provided, it is customary to recognise revenue when the:

(Multiple Choice)

4.9/5  (43)

(43)

On 1 January 2016, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:  The project was completed in December 2018. Using the completed contract method, how much profit would Romulus Ltd report in 2018?

The project was completed in December 2018. Using the completed contract method, how much profit would Romulus Ltd report in 2018?

(Multiple Choice)

5.0/5  (36)

(36)

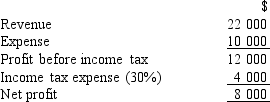

The income statement of Berrima Barbed Wire Ltd is:  If revenue increased by 30 per cent, with no effect on expenses other than income tax, what would be the effect on net after tax profit?

If revenue increased by 30 per cent, with no effect on expenses other than income tax, what would be the effect on net after tax profit?

(Multiple Choice)

4.9/5  (30)

(30)

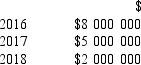

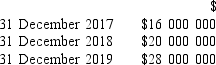

On 1 January 2017, Peter Ltd signed a contract worth $64 000 000 to construct the Cycling Stadium. The stadium was to be built over three years, with progress payments as follows:  Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2017, 75 per cent complete at the end of 2018 and 100 per cent complete at the end of 2019. Revenues and costs were as estimated. How much profit was earned during 2019 if the percentage of completion method was used?

Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2017, 75 per cent complete at the end of 2018 and 100 per cent complete at the end of 2019. Revenues and costs were as estimated. How much profit was earned during 2019 if the percentage of completion method was used?

(Multiple Choice)

4.8/5  (40)

(40)

The percentage of completion profit for a particular project of Redgate Ltd was $200 000 for year 1 and $220 000 for year 2 (completion). What difference would there be in profit for year 1 if the completion of production method were used?

(Multiple Choice)

4.9/5  (38)

(38)

Opec Ltd manufactures crystal balls. Transactions for year ended 31 December 2018 were as follows:  What was the reported profit for the year 2018?

What was the reported profit for the year 2018?

(Multiple Choice)

4.8/5  (32)

(32)

Highrise Constructions Ltd had a large three-year project with total revenue of $5 000 000 and estimated total costs of $4 200 000. The project was 25 per cent complete at the end of the first year, 55 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the third year if the completion of production method was used?

(Multiple Choice)

4.9/5  (30)

(30)

Although revenue may be recognised at various points in the revenue generation sequence, it is normally recognised when:

(Multiple Choice)

4.9/5  (31)

(31)

Showing 1 - 20 of 23

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)