Exam 10: Noncurrent Assets

Exam 1: Introduction to Financial Accounting29 Questions

Exam 2: Measuring and Evaluating Financial Position and Financial Performance32 Questions

Exam 3: The Double-Entry System31 Questions

Exam 4: Record-Keeping26 Questions

Exam 5: Accrual Accounting Adjustments26 Questions

Exam 6: Financial Reporting Principles, Accounting Standards and Auditing16 Questions

Exam 7: Internal Control and Cash19 Questions

Exam 8: Accounts Receivable and Further Record-Keeping19 Questions

Exam 9: Inventory28 Questions

Exam 10: Noncurrent Assets24 Questions

Exam 11: Liabilities21 Questions

Exam 13: Revenue and Expense Recognition: Additional Concepts23 Questions

Exam 14: The Statement of Cash Flows36 Questions

Exam 15: Financial Statement Analysis31 Questions

Exam 16: Accounting Policy Choices17 Questions

Exam 17: Sustainability Reporting13 Questions

Select questions type

Where there is an asset revaluation increment that does not reverse a previous decrement, the amount of the increment is credited to:

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

Equipment with a cost of $160 000 has an estimated residual value of $10 000 and an estimated useful life of four years. The equipment is to be depreciated by the reducing balance method (at twice the straight-line rate). What is the amount of depreciation for the first full year?

Free

(Multiple Choice)

4.9/5  (28)

(28)

Correct Answer:

C

A machine purchased on 1 July 2019 cost $100 000 and has a zero estimated salvage value. The useful life of the machine is five years. If the machine was sold on 30 September 2021, what would its net book value be?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

Tanner Ltd purchased an item of equipment on the first day of the financial period, 1 July 2018, for $200 000. The equipment was depreciated using the reducing balance method and a rate of 40 per cent. It was sold on 1 July 2020. If the machine was sold for $59 000 on 1 July 2019, what was the gain or loss on disposal?

(Multiple Choice)

4.9/5  (33)

(33)

Equipment with a cost of $160 000 has an estimated residual value of $10 000 and an estimated useful life of four years. Using the straight-line method, what is the amount of depreciation for the first full year?

(Multiple Choice)

4.9/5  (35)

(35)

When the accumulated depreciation is deducted from the long-term asset account, the figure is known as the:

(Multiple Choice)

4.7/5  (33)

(33)

Squires Ltd purchased equipment for $90 000 on 1 July 2018. It had an estimated life of 200 000 units. The machine was depreciated using the units of production method. The financial period of Squires Ltd ends on 30 June. What was the depreciation expense for year ended 30 June 2019 if 26 000 units were produced in that year?

(Multiple Choice)

4.9/5  (36)

(36)

Brown Ltd purchased a machine on the first day of the financial period, 1 July 2018, for $100 000. The machine was depreciated using the reducing balance method and a rate of 20 per cent. It was sold on 1 July 2019. If the machine was sold for $60 000, what was the gain or loss on disposal?

(Multiple Choice)

4.7/5  (33)

(33)

On 1 January 2018, a new motor vehicle with a useful life of four years and an estimated trade-in value of $12 000 was purchased by a business for $54 000. The straight-line method is employed and the financial year ends on 31 December. What was the depreciation expense for year ended 31 December 2019?

(Multiple Choice)

4.8/5  (36)

(36)

When a company discards machinery that is fully depreciated, this transaction will be recorded with which of the following entries?

(Multiple Choice)

4.9/5  (36)

(36)

On 1 January 2018, a new motor vehicle with a useful life of four years and an estimated trade-in value of $12 000 was purchased by a business for $54 000. The straight-line method is employed and the financial year ends on 31 December. What was the accumulated depreciation at 31 December 2020?

(Multiple Choice)

4.9/5  (32)

(32)

Where there is an asset revaluation decrement that does not reverse a previous increment, the amount is debited to:

(Multiple Choice)

4.9/5  (41)

(41)

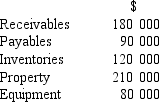

Bully Ltd acquires all the business assets and liabilities of Small Ltd for $800 000 cash. The best estimates of the fair market values of the assets and liabilities are:  What is the value of goodwill acquired by Bully Ltd?

What is the value of goodwill acquired by Bully Ltd?

(Multiple Choice)

4.9/5  (38)

(38)

A used machine with a purchase price of $85 000, requiring an overhaul costing $8 000, installation costs of $4 000 and testing costs of $2 000, would have a cost basis of:

(Multiple Choice)

4.8/5  (38)

(38)

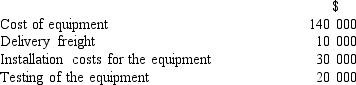

A company purchases equipment on 1 January 2019. The following costs are incurred:  The equipment has an estimated life of five years and no salvage value. What is the depreciation expense in 2019 if the straight-line method is used?

The equipment has an estimated life of five years and no salvage value. What is the depreciation expense in 2019 if the straight-line method is used?

(Multiple Choice)

4.7/5  (45)

(45)

Which of the following should NOT be included in the cost of a new machine?

(Multiple Choice)

4.8/5  (43)

(43)

Which method can result in annual depreciation expense going up and down from period to period?

(Multiple Choice)

4.9/5  (29)

(29)

Equipment with a cost of $15 000 and accumulated depreciation of $12 500 was sold for $1 700. The journal entry to record the disposal would include:

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following would be included in property, plant and equipment?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 1 - 20 of 24

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)