Exam 2: Procedures and Administration

Exam 1: Introduction to Federal Taxation in Canada144 Questions

Exam 2: Procedures and Administration92 Questions

Exam 3: Income or Loss From an Office or Employment108 Questions

Exam 4: Taxable Income and Tax Payable for Individuals105 Questions

Exam 5: Capital Cost Allowance95 Questions

Exam 6: Income or Loss From a Business103 Questions

Exam 7: Income From Property89 Questions

Exam 8: Capital Gains and Capital Losses104 Questions

Exam 9: Other Income, Other Deductions, and Other Issues130 Questions

Exam 10: Retirement Savings and Other Special Income Arrangements95 Questions

Exam 11: Taxable Income and Tax Payable for Individuals Revisited106 Questions

Exam 12: Taxable Income and Tax Payable for Corporations89 Questions

Exam 13: Taxation of Corporate Investment Income79 Questions

Exam 14: Other Issues in Corporate Taxation96 Questions

Exam 15: Corporate Taxation and Management Decisions93 Questions

Exam 16: Rollovers Under Section 8585 Questions

Exam 17: Other Rollovers and Sale of an Incorporated Business92 Questions

Exam 18: Partnerships96 Questions

Exam 19: Trusts and Estate Planning92 Questions

Exam 20: International Issues in Taxation66 Questions

Exam 21: Gst-Hst82 Questions

Select questions type

With respect to the filing of an individual income tax return, which of the following statements is correct?

(Multiple Choice)

4.9/5  (39)

(39)

PS Swim Inc. has a year end of November 30. It is a small CCPC. For its 2020 taxation year, its income tax return is due on:

(Multiple Choice)

4.9/5  (37)

(37)

Chemco Inc. has a December 31 year end and is not a small CCPC. For 2018, its taxes payable were $146,300, while for 2019, the amount was $94,650. For 2020, its estimated taxes payable are $52,300. What would be the minimum instalment payments for the 2020 taxation year and when would they be due? How would your answer differ if Chemco Inc. qualified as a small CCPC?

(Essay)

4.7/5  (26)

(26)

Gloria Klump dies on December 1, 2020. Much of her 2020 income resulted from an unincorporated business which she operated. By what date must her representatives file her 2020 income tax return? Explain your answer.

(Essay)

4.8/5  (43)

(43)

The taxation year end for Lawnco Inc. is January 31, 2020. Lawnco Inc. is a Canadian public company and does not qualify for the small business deduction. Indicate the date on which the corporate tax return must be filed, as well as the date on which any final payment of taxes is due.

(Essay)

4.9/5  (29)

(29)

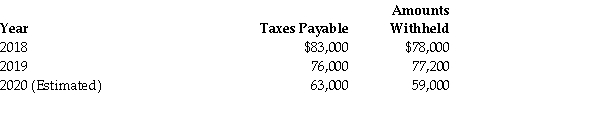

At the beginning of 2020, the following information relates to Jerry Farrow:  Is Mr. Farrow required to make instalment payments during 2020? If he is required to make instalment payments, indicate the amounts that would be required under each of the three alternative methods of calculating instalments. Indicate which alternative would be preferable.

Is Mr. Farrow required to make instalment payments during 2020? If he is required to make instalment payments, indicate the amounts that would be required under each of the three alternative methods of calculating instalments. Indicate which alternative would be preferable.

(Essay)

4.8/5  (36)

(36)

If a corporation that is not a small CCPC is required to make instalment payments on their income taxes, how are the required amounts determined?

(Essay)

4.7/5  (47)

(47)

Because the taxation year of an individual must be based on the calendar year, all individuals will have the same filing due date.

(True/False)

4.8/5  (35)

(35)

A corporation's balance due date is not the same as its return due date. Explain how these dates differ.

(Essay)

4.9/5  (43)

(43)

Norman Foster filed his 2020 tax return as was required on June 15, 2021. His Notice of Assessment dated August 28, 2021, indicated that his return was accepted as filed. On March 15, 2022, he receives a Notice of Reassessment dated March 8, 2022 indicating that he owes additional taxes, as well as interest on unpaid amounts. What is the latest date for filing a notice of objection for this reassessment? Explain your answer.

(Essay)

4.7/5  (41)

(41)

Which of the following is NOT one of the criteria that must be met before an adjustment to a previous year tax return is permitted?

(Multiple Choice)

4.7/5  (42)

(42)

Tom Arnold filed his 2020 tax return on March 1, 2021. The CRA mailed a notice of assessment to Tom dated May 15, 2021, and Tom received it on May 30, 2021. If Tom disagrees with the notice of assessment, what is the latest date he has to file a notice of objection?

(Multiple Choice)

4.7/5  (45)

(45)

Dora Burch files her 2020 income tax return on March 2, 2021. She receives a nil assessment on June 3, 2021. However, on December 28, 2021, she receives a reassessment indicating that she owes a substantial amount of additional tax. She would like to object to this reassessment. What is the latest date for her to file a notice of objection? (Ignore the effect of leap year if applicable.)

(Multiple Choice)

4.9/5  (37)

(37)

For the 2020 taxation year, John Bookman had a taxable capital gain of $45,000 and a net business loss of $45,000, resulting in a Taxable Income of nil. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (42)

(42)

Dustin Inc. has a September 30 year end and is not a small CCPC. For its taxation year ending September 30, 2018, its tax payable was $33,500. The corresponding figure for the year ending September 30, 2019 was $93,400. It is estimated that, for the year ending September 30, 2020, its tax payable will be $56,200. What would be the minimum instalment payments for the taxation year that ends on September 30, 2020, and when would they be due? How would your answer differ if Dustin Inc. qualified as a small CCPC?

(Essay)

4.8/5  (38)

(38)

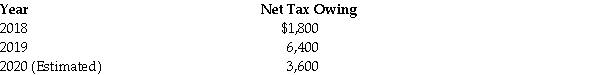

At the beginning of 2020, the following information relates to Sarah Elmsley:  Indicate whether Ms. Elmsley is required to make instalment payments during 2020. Explain your conclusion and, if your answer is positive, indicate the minimum instalments that will be required and when they are due.

Indicate whether Ms. Elmsley is required to make instalment payments during 2020. Explain your conclusion and, if your answer is positive, indicate the minimum instalments that will be required and when they are due.

(Essay)

4.8/5  (30)

(30)

Mr. Finlay, a retired individual whose only source of income was pension receipts, dies on August 15, 2020. By what date must Mr. Finlay's final tax return be filed?

(Multiple Choice)

4.8/5  (41)

(41)

Jason Marks has to pay his tax by instalments as a result of his significant investment income. His net tax owing in 2018 was $13,600. In 2019, it was $15,000. His estimate for 2020 is $17,000. If he decides to pay his 2020 tax instalments according to the prior year option, how much should he pay on September 15, 2020?

(Multiple Choice)

4.9/5  (31)

(31)

Showing 21 - 40 of 92

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)