Exam 4: Consolidation of Non-Wholly Owned Subsidiaries

Exam 1: Conceptual and Case Analysis Frameworks for Financial Reporting41 Questions

Exam 2: Investments in Equity Securities32 Questions

Exam 3: Business Combinations60 Questions

Exam 4: Consolidation of Non-Wholly Owned Subsidiaries56 Questions

Exam 5: Consolidation Subsequent to Acquisition Date41 Questions

Exam 6: Intercompany Inventory and Land Profits42 Questions

Exam 7: A Intercompany Profits in Depreciable Assets B Intercompany Bondholdings62 Questions

Exam 8: Consolidated Cash Flows and Changes in Ownership45 Questions

Exam 9: Other Consolidation Reporting Issues62 Questions

Exam 10: Foreign Currency Transactions63 Questions

Exam 11: Translation and Consolidation of Foreign Operations17 Questions

Exam 12: Accounting for Not-For-Profit and Public Sector Organizations61 Questions

Select questions type

On that date, which of the following statements pertaining to Non-Controlling Interest is TRUE?

(Multiple Choice)

4.7/5  (32)

(32)

Which consolidation theory should be used in preparing consolidated financial statements in accordance with IFRS?

(Multiple Choice)

4.8/5  (40)

(40)

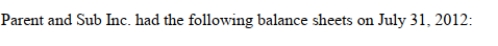

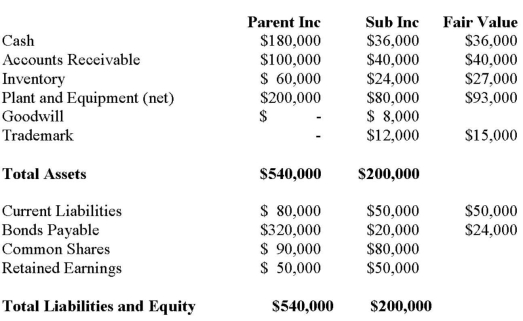

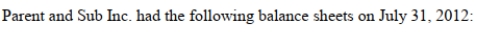

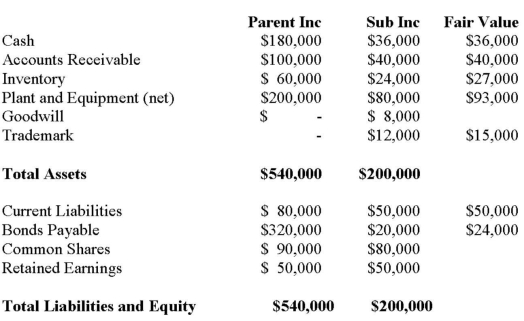

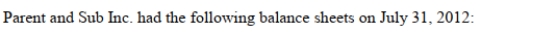

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming Parent purchased 80% of Sub Inc. for $180,000; the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under the Entity Method?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming Parent purchased 80% of Sub Inc. for $180,000; the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under the Entity Method?

(Multiple Choice)

4.9/5  (44)

(44)

Under the Parent Company Theory, which of the following statements pertaining to Consolidated Financial Statements is TRUE?

(Multiple Choice)

4.8/5  (45)

(45)

In an inflationary economy, under which consolidation theory would total assets in the consolidated balance sheet at the acquisition date be greatest?

(Multiple Choice)

4.8/5  (28)

(28)

A business combination involves a contingent consideration. It is considered 70% probable that a payment of $500,000 will become payable three years after the acquisition date. Using a 7% discount rate, how much interest expense should be recorded on the liability for the first year after acquisition?

(Multiple Choice)

4.8/5  (42)

(42)

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. If Parent Company purchased 80% of Sub Inc. for $180,000, the Liabilities section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under GAAP after January 1, 2011?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. If Parent Company purchased 80% of Sub Inc. for $180,000, the Liabilities section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under GAAP after January 1, 2011?

(Multiple Choice)

4.8/5  (39)

(39)

IFRS permits several methods to be used to determine the fair value of the non-controlling interest in a subsidiary at the acquisition date. Which of the following is NOT an appropriate method to determine the fair value of the non-controlling interest (NCI)?

(Multiple Choice)

4.7/5  (40)

(40)

The focus of the Consolidated Financial Statements on the shareholders of the parent company is characteristic of:

(Multiple Choice)

4.8/5  (35)

(35)

When preparing the consolidated balance sheet on the date of acquisition, the parent's investment (in subsidiary company) is:

(Multiple Choice)

4.7/5  (31)

(31)

Non-Controlling Interest is presented in the Shareholders' Equity section of the Balance Sheet under:

(Multiple Choice)

4.7/5  (44)

(44)

Why might the fair value of the noncontrolling interest in a subsidiary on the date that it is acquired in a business combination not be proportionate to the price per share paid by the parent company to acquire control? How do the IFRS recognize this?

(Essay)

4.9/5  (35)

(35)

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc. purchased 80% of Sub's voting shares on the date of acquisition (August 1, 2012) for $180,000, what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc. purchased 80% of Sub's voting shares on the date of acquisition (August 1, 2012) for $180,000, what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

(Multiple Choice)

4.8/5  (39)

(39)

On the date of formation of a 100% owned subsidiary by the parent, which of the following statements pertaining to Consolidated Financial Statements is TRUE?

(Multiple Choice)

4.9/5  (39)

(39)

If a business combination occurs and the consideration paid exceeds the fair value of the identifiable net assets of the subsidiary on the acquisition date and the parent acquires less than 100% of the outstanding common shares of the subsidiary, which consolidation method will result in the highest value for non-controlling interest on the acquisition date?

(Multiple Choice)

4.8/5  (41)

(41)

After the introduction of the entity method in Canada, many companies opted to value the noncontrolling interest in subsidiaries based on the fair value of the subsidiary's identifiable net assets at the acquisition date instead of valuing the noncontrolling interest at its fair value. That is, they opted to use the parent company extension approach rather than the entity method when preparing consolidated financial statements. What motivation might preparers of consolidated financial statements have that would cause them to have this preference?

(Essay)

4.8/5  (33)

(33)

Which accounts on the consolidated balance sheet will be different when the entity method is used from when the parent company extension theory is used?

(Multiple Choice)

5.0/5  (30)

(30)

Discuss the disclosure requirements for long term investments including accounting policies and NCI.

(Essay)

4.9/5  (37)

(37)

Contingent consideration will be classified as a liability when:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 21 - 40 of 56

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)