Exam 17: Oligopoly.

Exam 1: Ten Principles of Economics.349 Questions

Exam 2: Thinking Like an Economist.535 Questions

Exam 3: Interdependence and the Gains from Trade.443 Questions

Exam 4: The Market Forces of Supply and Demand.571 Questions

Exam 5: Elasticity and Its Application510 Questions

Exam 6: Supply, Demand, And Government Policies.557 Questions

Exam 7: Consumers, Producers, and the Efficiency of Markets.460 Questions

Exam 8: Application: The Costs of Taxation.424 Questions

Exam 9: Application: International Trade.410 Questions

Exam 10: Externalities.441 Questions

Exam 11: Public Goods and Common Resources.349 Questions

Exam 12: The Design of the Tax System.478 Questions

Exam 13: The Costs of Production.533 Questions

Exam 14: Firms in Competitive Markets.478 Questions

Exam 15: Monopoly.526 Questions

Exam 16: Monopolistic Competition.497 Questions

Exam 17: Oligopoly.410 Questions

Exam 18: The Market For the Factors of Production.463 Questions

Exam 19: Earnings and Discrimination.398 Questions

Exam 20: Income Inequality and Poverty.374 Questions

Exam 21: The Theory of Consumer Choice.462 Questions

Exam 22: Frontiers in Microeconomics.353 Questions

Select questions type

Scenario 17-2. Imagine that two oil companies, Mobile and Cargo, own adjacent oil fields. Under the fields is a common pool of oil worth $96 million. Drilling a well to recover oil costs $3 million per well. If each company drills one well, each will get half of the oil and earn a $45 million profit ($48 million in revenue - $3 million in costs). Assume that having X percent of the total wells means that a company will collect X percent of the total revenue.

-Refer to Scenario 17-2.If Mobile were to drill a second well,what would its profit be if Cargo did not drill a second well?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

B

Scenario 17-5

Assume that a local bank sells two services, checking accounts and ATM card services. The bank's only two customers are Mr. Donethat and Ms. Beenthere. Mr. Donethat is willing to pay $8 a month for the bank to service his checking account and $2 a month for unlimited use of his ATM card. Ms. Beenthere is willing to pay only $5 for a checking account, but is willing to pay $9 for unlimited use of her ATM card. Assume that the bank can provide each of these services at zero marginal cost.

-Refer to Scenario 17-5.If the bank is able to use tying to price checking account and ATM services,what is the profit-maximizing price to charge for the "tied" good?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

B

Table 17-23

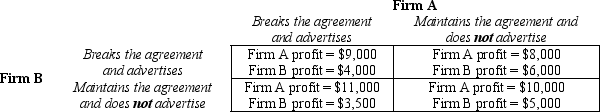

Two bottled beverage manufacturers (Firm A and Firm B) determine that they could lower their costs, and thus increase their profits, if they reduced their advertising budgets. But in order for the plan to work, each firm must agree to refrain from advertising. Each firm believes that advertising works by increasing the demand for the firm's product, but each firm also believes that if neither firm advertises, the costs savings will outweigh the lost sales. Listed in the table below are the individual profits for each firm.

-Refer to Table 17-23.At the Nash equilibrium,how much profit will Firm A earn?

-Refer to Table 17-23.At the Nash equilibrium,how much profit will Firm A earn?

(Multiple Choice)

4.8/5  (41)

(41)

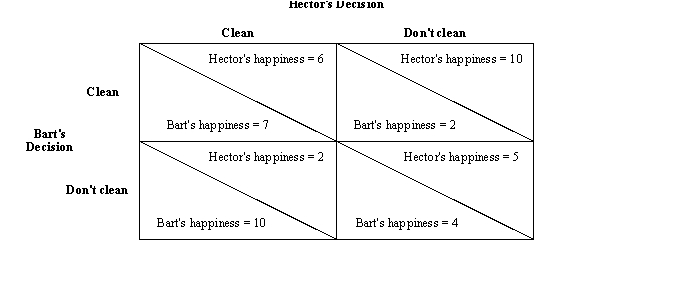

Figure 17-2. Hector and Bart are roommates. On a particular day, their apartment needs to be cleaned. Each person has to decide whether to take part in cleaning. At the end of the day, either the apartment will be completely clean (if one or both roommates take part in cleaning), or it will remain dirty (if neither roommate cleans). With happiness measured on a scale of 1 (very unhappy) to 10 (very happy), the possible outcomes are as follows:

-Refer to Figure 17-2.The dominant strategy for Hector is to

-Refer to Figure 17-2.The dominant strategy for Hector is to

(Multiple Choice)

4.7/5  (37)

(37)

A cooperative agreement among oligopolists is less likely to be maintained,

(Multiple Choice)

4.8/5  (27)

(27)

The Sherman Antitrust Act prohibits competing firms from even talking about fixing prices.

(True/False)

4.7/5  (38)

(38)

A tit-for-tat strategy,in a repeated game,is one in which a player starts by cooperating and then does whatever the other player did last time.

(True/False)

4.8/5  (37)

(37)

Laurel and Janet are competitors in a local market and each is trying to decide if it is worthwhile to advertise.If both of them advertise,each will earn a profit of $5,000.If neither of them advertise,each will earn a profit of $10,000.If one advertises and the other doesn't,then the one who advertises will earn a profit of $12,000 and the other will earn $2,000.In this version of the prisoners' dilemma,if the game is played only once,Laurel should

(Multiple Choice)

4.8/5  (29)

(29)

In 1971,Congress passed a law that banned cigarette advertising on television.After the ban it is most likely that the

(i)profits of cigarette companies increased.

(ii)prices of cigarettes increased.

(iii)total costs incurred by cigarette companies increased.

(Multiple Choice)

4.8/5  (30)

(30)

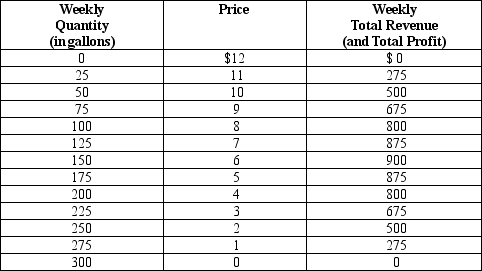

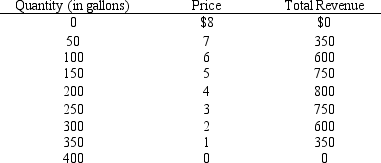

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

-Refer to Table 17-5.As long as Kunal and Naj operate as a profit-maximizing monopoly,what will their combined weekly revenue amount to?

-Refer to Table 17-5.As long as Kunal and Naj operate as a profit-maximizing monopoly,what will their combined weekly revenue amount to?

(Multiple Choice)

4.9/5  (26)

(26)

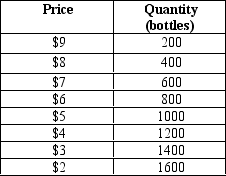

Table 17-8. For a certain small town, the table shows the demand schedule for water. Assume the marginal cost of supplying water is constant at $4 per bottle.

-Refer to Table 17-8.If there are two suppliers of water,Victor and Sami,and if they have successfully formed a cartel,then what would be the price and the market quantity?

-Refer to Table 17-8.If there are two suppliers of water,Victor and Sami,and if they have successfully formed a cartel,then what would be the price and the market quantity?

(Multiple Choice)

4.8/5  (33)

(33)

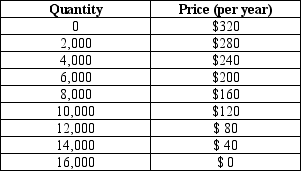

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

-Refer to Table 17-4.Assume there are two high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.What price will they charge for a subscription when this market reaches a Nash equilibrium?

-Refer to Table 17-4.Assume there are two high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.What price will they charge for a subscription when this market reaches a Nash equilibrium?

(Multiple Choice)

4.9/5  (31)

(31)

Scenario 17-4. Consider two cigarette companies, PM Inc. and Brown Inc. If neither company advertises, the two companies split the market and earn $50 million each. If they both advertise, they again split the market, but profits are lower by $10 million since each company must bear the cost of advertising. Yet if one company advertises while the other does not, the one that advertises attracts customers from the other. In this case, the company that advertises earns $60 million while the company that does not advertise earns only $30 million.

-Refer to Scenario 17-4.PM Inc.'s dominant strategy is to

(Multiple Choice)

4.8/5  (33)

(33)

In some games,the noncooperative equilibrium is bad for the players and bad for society.

(True/False)

4.8/5  (38)

(38)

The oligopoly price will be greater than marginal cost but less than the monopoly price when

(Multiple Choice)

4.8/5  (41)

(41)

If all of the firms in an oligopoly successfully collude and form a cartel,then total profit for the cartel is equal to what it would be if the market were a monopoly.

(True/False)

4.8/5  (37)

(37)

Table 17-10

The table shows the town of Driveaway's demand schedule for gasoline. Assume the town's gasoline seller(s) incurs a cost of $2 for each gallon sold, with no fixed cost.

-Refer to Table 17-10.If there are exactly five sellers of gasoline in Driveaway and if they collude,then which of the following outcomes is most likely?

-Refer to Table 17-10.If there are exactly five sellers of gasoline in Driveaway and if they collude,then which of the following outcomes is most likely?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 410

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)