Exam 27: Managing Aggregate Demand: Fiscal Policy

An increase or decrease in taxes will have a multiplier effect on equilibrium GDP on the demand side.

True

Explain why a change in income tax rates causes the consumption schedule to change slope.

An income tax rate determines the portion of an increase in income that is taken in taxes. If the rate increases, then for any increase in income, disposable income increases by a smaller amount. When a portion of the increase in disposable income is consumed, the consumption spending is less than it would be if the income tax rate was lower. The smaller increase in consumption for a given increase in income means that the numerical value of the MPC is smaller, and the slope of the consumption schedule is flatter. Conversely, if the income tax rate decreases, then for any increase in income, disposable income increases by a larger amount. The larger increase in consumption for a change in income means that the numerical value of the MPC is larger and the consumption schedule is steeper.

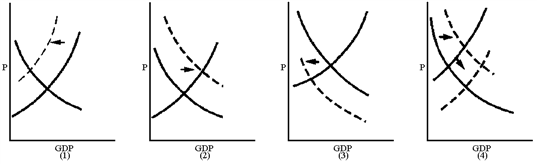

Figure 11-2

Which graph in Figure 11-2 best reflects a supply-sider's view of the impact of an increase in the personal income tax rate?

Which graph in Figure 11-2 best reflects a supply-sider's view of the impact of an increase in the personal income tax rate?

When the economy has an income tax that is variable, the multiplier is

One of the practical issues in the choice of government spending or taxes to change aggregate demand is how large a

Suppose that the U.S. personal income tax was eliminated and replaced with a fixed tax that raised the exact same amount of revenue. The multiplier would be

The government's fiscal policy is its plan to influence aggregate demand by changing

In order to maintain a balanced budget, Congress has decided to cut taxes and government spending both by $25 billion. What will happen to GDP?

If a state government reduces property taxes for residents at the same time that it increases the state income tax, what will happen to the expenditures schedule of the residents of this state?

Government purchases have the same multiplier effect as business investment spending.

Explain some of the steps that a government would wish to adopt in an inflationary environment.

Tax cuts associated with supply-side economics often lead to increased

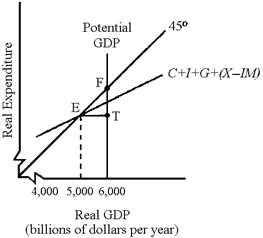

Figure 11-1

In Figure 11-1, the economy is experiencing a(n)

In Figure 11-1, the economy is experiencing a(n)

If a "liberal" wanted to decrease aggregate demand, which of the following would he or she tend to favor?

If all variable taxes in the United States were removed and only fixed taxes remained, what would be the effect on the expenditures schedule?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)