Exam 36: Exchange Rates and the Macroeconomy

Exam 1: What Is Economics261 Questions

Exam 2: The Economy: Myth and Reality185 Questions

Exam 3: The Fundamental Economic Problem: Scarcity and Choice290 Questions

Exam 4: Supply and Demand: an Initial Look337 Questions

Exam 21: An Introduction to Macroeconomics216 Questions

Exam 22: The Goals of Macroeconomic Policy212 Questions

Exam 23: Economic Growth: Theory and Policy228 Questions

Exam 24: Aggregate Demand and the Powerful Consumer219 Questions

Exam 25: Demand-Side Equilibrium: Unemployment or Inflation216 Questions

Exam 26: Bringing in the Supply Side: Unemployment and Inflation228 Questions

Exam 27: Managing Aggregate Demand: Fiscal Policy210 Questions

Exam 28: Money and the Banking System224 Questions

Exam 29: Monetary Policy: Conventional and Unconventional210 Questions

Exam 30: The Financial Crisis and the Great Recession66 Questions

Exam 31: The Debate Over Monetary and Fiscal Policy219 Questions

Exam 32: Budget Deficits in the Short and Long Run215 Questions

Exam 33: The Trade-Off Between Inflation and Unemployment219 Questions

Exam 34: International Trade and Comparative Advantage226 Questions

Exam 35: The International Monetary System: Order or Disorder218 Questions

Exam 36: Exchange Rates and the Macroeconomy219 Questions

Exam 37: Contemporary Issues in the Us Economy23 Questions

Select questions type

The different effects of fiscal and monetary policy in an open economy with mobile capital hinges on their different effect on

(Multiple Choice)

5.0/5  (39)

(39)

A currency appreciation should _______ net exports, and, therefore, _________aggregate demand.

(Multiple Choice)

4.9/5  (38)

(38)

In an open economy, aggregate supply consists of domestic production plus imports.

(True/False)

4.7/5  (38)

(38)

What are the results of a contractionary monetary policy in an open economy with floating exchange rates and internationally mobile capital?

(Multiple Choice)

4.8/5  (35)

(35)

To eliminate the trade deficits in the late 1990s would have required, in addition to the reduction of the federal budget deficit, an increase in

(Multiple Choice)

4.7/5  (37)

(37)

International trade tends to lower the value of the multiplier because

(Multiple Choice)

4.9/5  (33)

(33)

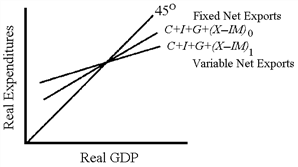

Figure 36 -9

Figure 36-9 shows aggregate expenditures when net exports are fixed and aggregate expenditures are variable. The autonomous spending multiplier is

Figure 36-9 shows aggregate expenditures when net exports are fixed and aggregate expenditures are variable. The autonomous spending multiplier is

(Multiple Choice)

4.8/5  (30)

(30)

Currency appreciation should reduce net exports and, therefore, decrease aggregate demand.

(True/False)

4.7/5  (29)

(29)

If European economies experience a strong economic recovery, U.S. net exports will

(Multiple Choice)

4.9/5  (47)

(47)

A decline in interest rates tends to expand the economy by

(Multiple Choice)

5.0/5  (39)

(39)

The U.S. trade deficits of the 1980s and 1990s may represent a problem because they will require

(Multiple Choice)

4.9/5  (37)

(37)

If Asian economies suffer a serious economic slump, U.S. net exports will

(Multiple Choice)

4.8/5  (41)

(41)

Under a floating exchange rate system with mobile international capital, it is always true that current account

(Multiple Choice)

4.8/5  (41)

(41)

The government budget deficit must be equal to the surplus

(Multiple Choice)

4.8/5  (31)

(31)

Assume that Country X and Country Y are trading partners and the exchange rates are fixed. If prices in Country Y fall, which of the following is expected to happen?

(Multiple Choice)

4.9/5  (32)

(32)

A currency depreciation would _____ net exports, and therefore ___________ aggregate demand.

(Multiple Choice)

4.9/5  (33)

(33)

An increase in the price level in the economies of U.S. trading partners will cause the aggregate expenditures function in the United States to

(Multiple Choice)

4.7/5  (46)

(46)

Table 36-1 Suppose the economy of Macroland is described by the following: C = 200 + 0.8 DI (DI = disposable income)

I = 300 + 0.2 Y − 50 r ( Y = GDP)

( r , the interest rate, is measured in percentage points. For example, a 9 percent interest rate is r = 9). For this economy, assume that the Federal Reserve uses its monetary policy to peg the interest rate at

R = 5

G = 750

T = 0.25 Y

X = 200

M = 150 + 0.2 Y

Hint: DI = Y − T

From Table 36-1, find the budget deficit or surplus for Macroland.

(Multiple Choice)

4.9/5  (29)

(29)

Suppose that the Fed decides to increase the growth rate of the money supply in the United States. What is most likely to happen to the U.S. trade deficit and to GDP?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 181 - 200 of 219

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)