Exam 20: Accounting Changes and Error Corrections

Exam 1: Environment and Theoretical Structure of Financial Accounting181 Questions

Exam 2: Review of the Accounting Process 139 Questions

Exam 3: The Balance Sheet and Financial Disclosures168 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows178 Questions

Exam 5: Revenue Recognition316 Questions

Exam 6: Time Value of Money Concepts126 Questions

Exam 7: Cash and Receivables187 Questions

Exam 8: Inventories: Measurement182 Questions

Exam 9: Inventories: Additional Issues153 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition149 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Disposition223 Questions

Exam 12: Investments183 Questions

Exam 13: Current Liabilities and Contingencies155 Questions

Exam 14: Bonds and Long-Term Notes256 Questions

Exam 15: Leases262 Questions

Exam 16: Accounting for Income Taxes176 Questions

Exam 17: Pensions and Other Postretirement Benefits246 Questions

Exam 20: Accounting Changes and Error Corrections152 Questions

Exam 21: The Statement of Cash Flows Revisited192 Questions

Select questions type

La Casita Restaurants changed from the FIFO method of inventory costing to the weighted average method during 2018. When reported in the 2018 comparative financial statements, the 2017 inventory amount will be:

(Multiple Choice)

4.8/5  (41)

(41)

Blue Co. has a patent on a communication process. The company has amortized the patent on a straight-line basis since 2014, when it was acquired at a cost of $36 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the end of 2018 (before adjusting and closing entries). What is the appropriate patent amortization expense in 2018?

(Multiple Choice)

4.8/5  (32)

(32)

Indicate the nature of each of the following situations:

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (33)

(33)

A company changes depreciation methods. Briefly describe the steps the company should take to report this accounting change in its current comparative financial statements.

(Essay)

4.8/5  (35)

(35)

Green Company overstated its inventory by $50 million at the end of 2018. The discovery of this error during 2019, before adjusting or closing entries, would require:

(Multiple Choice)

4.9/5  (31)

(31)

Hepburn Company bought a copyright for $90,000 on January 1, 2015, at which time the copyright had an estimated useful life of 15 years. On January 5, 2018, the company determined that the copyright would expire at the end of 2021. How much should Hepburn record as amortization expense for this copyright for 2018?

(Multiple Choice)

4.9/5  (36)

(36)

Colorado Consulting Company has been using the sum-of-the-years'-digits depreciation method to depreciate some office equipment that was acquired at the beginning of 2016. At the beginning of 2018, Colorado Consulting decided to change to the straight-line method. The equipment cost $120,000 and is expected to have no salvage value. The estimated useful life of the equipment is five years. Ignore income taxes.

Required:

1. Prepare the appropriate journal entry, if any, to record the accounting change.

2. Prepare the journal entry to record depreciation for 2018.

(Essay)

4.8/5  (32)

(32)

Early in 2018, Benton Well Supplies discovered that a five-year insurance premium payment of $50,000 at the beginning of 2015 was debited to insurance expense. The correcting entry would include:

(Multiple Choice)

4.8/5  (46)

(46)

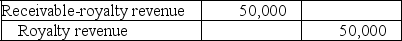

Johnson Company receives royalties on a patent it developed several years ago. Royalties are 5% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2017, and Johnson accrued royalty revenue of $50,000 on December 31, 2017, as follows:  Johnson received royalties of $65,000 on March 31, 2018, and $90,000 on September 30, 2018. In December, 2018, the patent user indicated to Johnson that sales subject to royalties for the second half of 2018 should be $600,000.

Required:

Prepare any journal entries Johnson should record during 2018 related to the royalty revenue.

Johnson received royalties of $65,000 on March 31, 2018, and $90,000 on September 30, 2018. In December, 2018, the patent user indicated to Johnson that sales subject to royalties for the second half of 2018 should be $600,000.

Required:

Prepare any journal entries Johnson should record during 2018 related to the royalty revenue.

(Essay)

4.8/5  (32)

(32)

C. Good Eyeglasses overstated its inventory by $30,000 at the end of 2018. If the error is not discovered until 2020, before adjusting or closing entries, C. Good would need:

(Multiple Choice)

4.8/5  (35)

(35)

In December 2018, Kojak Insurance Co. received $500,000 in premiums for a two-year property insurance policy. The company recorded the transaction by debiting cash and crediting insurance premium revenue for the full amount. An internal audit conducted in early 2019 flagged this transaction. The appropriate accounting treatment is that:

(Multiple Choice)

4.8/5  (40)

(40)

B Co. reported a deferred tax liability of $24 million for the year ended December 31, 2017, related to a temporary difference of $60 million. The tax rate was 40%. The temporary difference is expected to reverse in 2019 at which time the deferred tax liability will become payable. There are no other temporary differences in 2017-2019. Assume a new tax law is enacted in 2018 that causes the tax rate to change from 40% to 30% beginning in 2019. (The rate remains 40% for 2018 taxes.) Taxable income in 2018 is $90 million.

Required:

Determine the effect of the change and prepare the appropriate journal entry to record B's income tax expense in 2018. What adjustment, if any, is needed to revise retained earnings as a result of the change?

(Essay)

4.8/5  (36)

(36)

If inventory is understated at the end of 2017 and the error is not discovered, how will net income be affected in 2018?

(Essay)

4.9/5  (37)

(37)

Which of the following changes should be accounted for using the retrospective approach?

(Multiple Choice)

4.9/5  (45)

(45)

Which of the following changes would not be accounted for using the prospective approach?

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following changes in inventory costing usually should not be reported by revising the financial statements of prior periods?

(Multiple Choice)

4.8/5  (30)

(30)

Listed below are five terms followed by a list of phrases that describe or characterize each of the terms. Match each phrase with the correct term.

-Changes in reporting entity

(Multiple Choice)

4.8/5  (38)

(38)

All changes reported using the retrospective approach require cumulative effect adjustments of the change.

(True/False)

4.8/5  (33)

(33)

Listed below are five terms followed by a list of phrases that describe or characterize each of the terms. Match each phrase with the most correct term.

-Cumulative effect adjustment to income statement

(Multiple Choice)

4.7/5  (44)

(44)

Showing 81 - 100 of 152

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)