Exam 5: Elasticity

Exam 1: Exploring Economics3 Questions

Exam 2: Production, Economic Growth, and Trade17 Questions

Exam 3: Supply and Demand26 Questions

Exam 4: Markets and Government24 Questions

Exam 5: Elasticity407 Questions

Exam 6: Consumer Choice and Demand394 Questions

Exam 7: Production and Costs322 Questions

Exam 8: Perfect Competition333 Questions

Exam 9: Monopoly309 Questions

Exam 10: Monopolistic Competition, Oligopoly, and Game Theory307 Questions

Exam 11: The Labor Market393 Questions

Exam 12: Land, Capital Markets, and Innovation267 Questions

Exam 13: Externalities and Public Goods342 Questions

Exam 14: Network Goods353 Questions

Exam 15: Poverty and Income Distribution303 Questions

Exam 16: International Trade17 Questions

Select questions type

Suppose the price elasticity of demand is 3.0 and the price elasticity of supply is 0.08. The incidence of an excise tax

(Multiple Choice)

4.9/5  (31)

(31)

The current equilibrium price in the market is $12.50, while the equilibrium quantity is 7,500 units. Suppose the government places a $5 per unit tax on the market, leading to a new equilibrium demanded price of $15 and equilibrium quantity of 5,000 units. Using the midpoint method, the price elasticity of demand will be

(Multiple Choice)

4.7/5  (35)

(35)

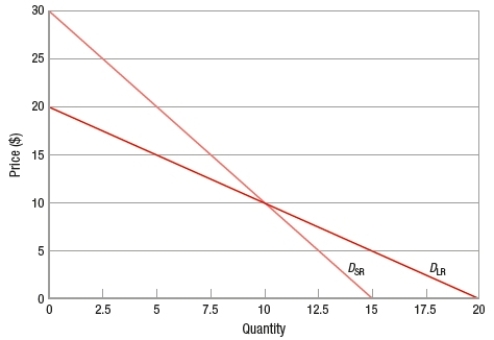

(Figure) The figure shows two demand curves for two different periods for the same product. Based on the information in the graph, which statement is TRUE?

(Multiple Choice)

4.8/5  (34)

(34)

Suppose that the price of unlimited monthly wireless data plans increases from $80 to $120, and as a result, the quantity demanded of this plan decreases by 10%. Using the midpoint method, the price elasticity of demand is

(Multiple Choice)

4.9/5  (31)

(31)

The current equilibrium price and quantity in the market for walnuts are $5 per pound with 10,000 pounds supplied. Supermarkets are expecting to see sales rise to 15,000 pounds due to an unusually large crop of walnuts. If the price elasticity of demand is 1.8, what is the new price per pound of walnuts?

(Multiple Choice)

4.8/5  (26)

(26)

If the income elasticity of demand for tea is 0.50, tea is a

(Multiple Choice)

4.8/5  (30)

(30)

Moving upward along a linear demand curve, responsiveness to a change in price becomes more elastic.

(True/False)

4.8/5  (38)

(38)

A positive cross elasticity of demand between two goods suggests that the goods are

(Multiple Choice)

4.8/5  (27)

(27)

A tax that falls in percentage of income as income increases is a

(Multiple Choice)

4.7/5  (38)

(38)

Which of these could be a possible cross elasticity of demand measure for butter and margarine?

(Multiple Choice)

4.9/5  (36)

(36)

If the price increases by 100% and the quantity demanded decreases by 50%, then the elasticity of demand is

(Multiple Choice)

4.8/5  (31)

(31)

If the price elasticity of demand is 1.5, then the demand curve is inelastic.

(True/False)

4.7/5  (32)

(32)

The tax incidence falls more heavily on producers when demand is relatively more price inelastic than supply.

(True/False)

4.9/5  (36)

(36)

The economist Henry George proposed that all tax revenue be collected via taxes on land. If land were perfectly inelastic in supply, then a property tax on land would

(Multiple Choice)

4.9/5  (38)

(38)

If the price of electricity falls by 10% per kilowatt hour, and the quantity demanded of electricity subsequently increases by 8%, the price elasticity of demand for electricity is _____, and it would be classified as _____.

(Multiple Choice)

4.7/5  (30)

(30)

Elasticity of supply measures the responsiveness of buyers to a change in price.

(True/False)

4.8/5  (37)

(37)

Showing 81 - 100 of 407

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)