Exam 4: Equivalence for Repeated Cash Flows

Exam 1: Making Economic Decisions9 Questions

Exam 2: Estimating Engineering Costs and Benefits12 Questions

Exam 3: Interest and Equivalence17 Questions

Exam 4: Equivalence for Repeated Cash Flows22 Questions

Exam 5: Present Worth Analysis16 Questions

Exam 6: Annual Cash Flow Analysis17 Questions

Exam 7: Rate of Return Analysis12 Questions

Exam 8: Choosing the Best Alternative12 Questions

Exam 9: Other Analysis Techniques18 Questions

Exam 10: Uncertainty in Future Events14 Questions

Exam 11: Depreciation16 Questions

Exam 12: Income Taxes for Corporations13 Questions

Exam 13: Replacement Analysis11 Questions

Exam 14: Inflation and Price Change9 Questions

Exam 15: Selection of a Minimum Attractive Rate of Return9 Questions

Exam 16: Economic Analysis in the Public Sector9 Questions

Exam 17: Accounting and Engineering Economy8 Questions

Select questions type

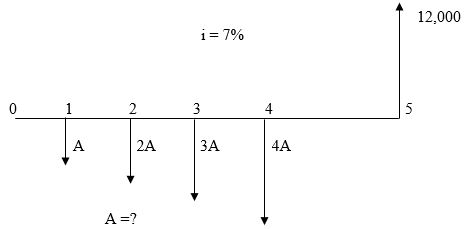

Given the cash flow diagram below, evaluate the value of "A" for an interest rate of 7%.

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

B

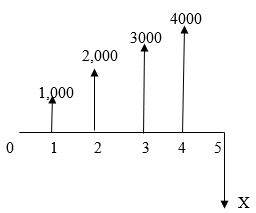

Given the cash flow diagram below, evaluate the "X" value using an interest rate of 8%.

Year 0 1 2 3 4 5 6 7 8 9 10 Cash flow -X 400 500 -X 700 800 900 1,000 1,100 1,200 1,300

Free

(Multiple Choice)

4.9/5  (47)

(47)

Correct Answer:

C

In developing cash flow diagrams the convention is to use a negative cash flow for receipts.

Free

(True/False)

4.8/5  (25)

(25)

Correct Answer:

False

In order to use the gradient series factors to solve a set of given cash flows, the cash flows must increase or decrease gradually by the same amount every year, starting year 2 and must have zero cash flow in year 1.

(True/False)

4.9/5  (38)

(38)

IAN Tech is saving $10,000 a month in a money fund to pay for equipment that will cost $700,000 five years from now. If the interest rate is 1/4% per month, how much additional funds will be needed to pay for this equipment?

(Multiple Choice)

4.8/5  (45)

(45)

Mary is planning to repay a debt of 50,000 with a quarterly payment $2,400 for the next 23 quarters and a final payment of "X" dollars at the end of 24-th quarter. If the interest rate is 12% per year, compounded quarterly, how much will be Mary's final payment?

(Multiple Choice)

4.8/5  (39)

(39)

Determine the unknown from the cash flow diagram shown below. i = 10%.

(Multiple Choice)

4.8/5  (38)

(38)

If the uniform series capital recovery factor is 0.1359 and the sinking fund factor is 0.0759, then the interest rate is 6%.

(True/False)

4.9/5  (45)

(45)

What is the present worth of the cash flows in table below? Use an interest rate of 6% compounded annually.

Year 1 2 3 4 5 6-20 Cash flow 6,000 5,000 4,000 3,000 2,000 10,000

(Multiple Choice)

4.9/5  (44)

(44)

A set of cash flows are given in table below, using the principles of equivalence, determine the value "Y" for an interest rate of 8% compounded annually.

Year 0 1 2 3 4 5 5-10 Cash flow in \ -5,000 0 0 0 -1,000 -1,000 Y

(Multiple Choice)

4.8/5  (38)

(38)

Ben invested $20,000 into a money market account and took out $5,000 at the end of year 5. He found out at the end of 10 years that he had as of $50,000 in the account.

What is the annual interest rate Ben had earned on this investment?

(Multiple Choice)

4.8/5  (25)

(25)

Determine the value of P from the cash flows shown in table below. Interest rate = 10%.

Year 0 1 2 3 4 5 6 7 8 9 10 Cash flow -X 400 500 -X 700 800 900 1,000 1,100 1,200 1,300

(Multiple Choice)

4.8/5  (34)

(34)

Choose the equation below that can be used to determine the value of "P" for a known interest rate, i.

Year 0 1 2 3 4 5 6 7 8 9 10 Cash flow -X 400 500 -X 700 800 900 1,000 1,100 1,200 1,300

(Multiple Choice)

4.9/5  (31)

(31)

Tom started investing, as soon as he started his first job, at the rate of $400 per month as soon as get paid into a savings account that earns an interest of 1% per month. Which of the following expression may be used to determine the account value 10 years from now?

(Multiple Choice)

4.8/5  (35)

(35)

For an interest rate of 10% compounded annually, evaluate the value of "X" from the cash flows given in table below.

Year 0 1 2 3 4 5 Cash flows -10,000+X 1,600 1,700 1,800 1,900 3,500

(Multiple Choice)

4.9/5  (40)

(40)

The weekly payment for a $500 loan to be paid back in 104 payments at an interest rate of 0.25% per week is $6.82.

(True/False)

4.8/5  (37)

(37)

Given the cash flow table below, determine the unknown value "X" for an interest rate of 6%.

Year 0 1 2 3 4 5 6 7 8 9 10 Cash flow -X 400 500 -X 700 800 900 1,000 1,100 1,200 1,300

(Multiple Choice)

4.8/5  (33)

(33)

Interest compounding daily than continuous compounding for a known interest rate will provide a larger yield.

(True/False)

4.8/5  (37)

(37)

Case Study 4

Daniel borrowed $20,000 with a promise to repay the loan in 6 years with a uniform monthly payment and a single payment of $2,000 at the end of six years at a nominal interest rate of 12% per year.

-A. What is the amount of each payment?

B. What is the amount of interest paid in the first payment?

C. What will be the loan balance immediately after the 48th payment?

(Essay)

4.9/5  (37)

(37)

Showing 1 - 20 of 22

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)