Exam 7: Inventory

Exam 1: Financial Accounting and Business Decisions129 Questions

Exam 2: Processing Accounting Information91 Questions

Exam 3: Accrual Basis of Accounting133 Questions

Exam 4: Understanding Accounting Information72 Questions

Exam 5: Internal Control and Cash43 Questions

Exam 6: Receivables80 Questions

Exam 7: Inventory124 Questions

Exam 8: Property, Plant and Equipment and Intangible Assets134 Questions

Exam 9: Liabilities92 Questions

Exam 10: Stockholders Equity110 Questions

Exam 11: Statement of Cash Flows57 Questions

Exam 12: Analysis and Interpretation of Financial Statements55 Questions

Exam 13: Appendix A: The Language of Accountants: Debits and Credits128 Questions

Exam 14: Appendix B: Accounting for Investments and Consolidated Financial Statements29 Questions

Exam 15: Appendix C: Accounting and the Time Value of Money9 Questions

Select questions type

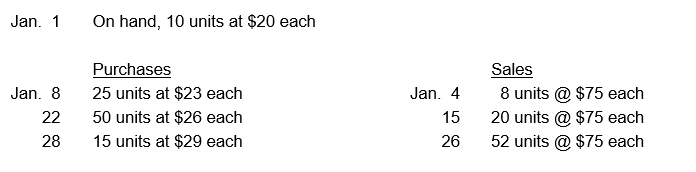

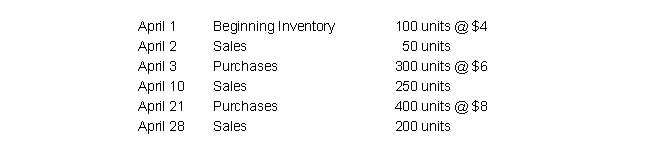

Use the following inventory related information for Questions below

-Calculate the company's Ending Inventory on January 31 using Periodic LIFO.

-Calculate the company's Ending Inventory on January 31 using Periodic LIFO.

(Multiple Choice)

4.9/5  (33)

(33)

Companies using LIFO are required to disclose the amount at which inventory would have been reported had the company used FIFO. The difference between LIFO and FIFO inventories is called the LIFO reserve.

(True/False)

4.7/5  (29)

(29)

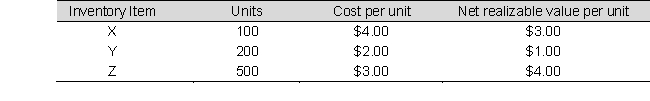

Nelson Corporation sells three different products. The following information is available on December 31:

When applying the lower of cost or net realizable value rule to each item, what will Nelson report as its cost of ending inventory on December 31?

When applying the lower of cost or net realizable value rule to each item, what will Nelson report as its cost of ending inventory on December 31?

(Multiple Choice)

4.7/5  (36)

(36)

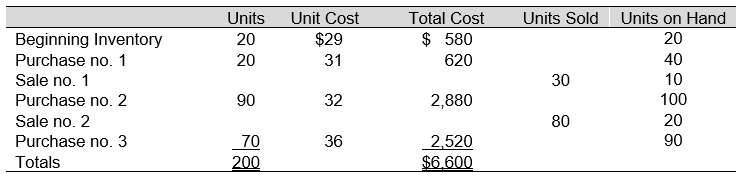

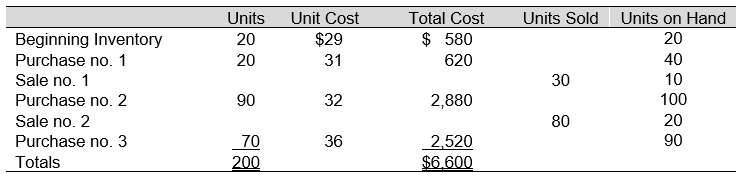

Use the following information to answer Questions below

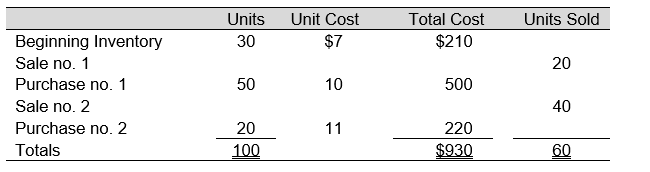

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of McKensie Company for an operating period.

-Assuming McKensie Company uses LIFO perpetual inventory procedures, sale no. 2 is recorded as an entry to Cost of Goods Sold for:

-Assuming McKensie Company uses LIFO perpetual inventory procedures, sale no. 2 is recorded as an entry to Cost of Goods Sold for:

(Multiple Choice)

4.8/5  (35)

(35)

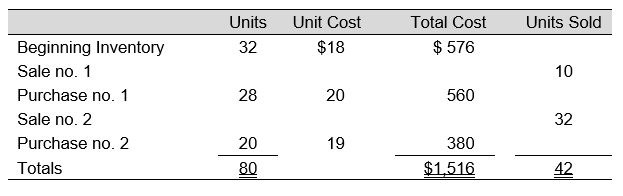

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Newtown, Inc. for an operating period.

-Assuming Newtown, Inc., uses weighted-average inventory procedures, the ending inventory cost is:

-Assuming Newtown, Inc., uses weighted-average inventory procedures, the ending inventory cost is:

(Multiple Choice)

4.9/5  (44)

(44)

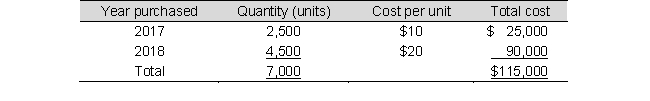

Crown Company imports and sells a product produced in Germany. In the summer of 2018, a natural disaster disrupted production, affecting its supply of product. Crown uses the LIFO inventory method. On January 1, 2019, Crown's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 50,000 units, because the cost had increased to $25 per unit. Crown sold 55,000 units during 2019 at a selling price of $50 per unit, which significantly depleted its inventory. The cost was expected to drop to $21 per unit by early January, 2020.

Required:

a. Assume that Crown makes no further purchases during 2019. Compute the gross profit for 2019.

b. Assume that Crown purchases 8,800 units before the end of December, 2019 at $25 each. Compute its gross profit for 2019.

c. If Crown's corporate tax rate is 30%, how much tax savings will result from the purchase of inventory before year end?

Through mid-December of 2019, purchases were limited to 50,000 units, because the cost had increased to $25 per unit. Crown sold 55,000 units during 2019 at a selling price of $50 per unit, which significantly depleted its inventory. The cost was expected to drop to $21 per unit by early January, 2020.

Required:

a. Assume that Crown makes no further purchases during 2019. Compute the gross profit for 2019.

b. Assume that Crown purchases 8,800 units before the end of December, 2019 at $25 each. Compute its gross profit for 2019.

c. If Crown's corporate tax rate is 30%, how much tax savings will result from the purchase of inventory before year end?

(Essay)

4.9/5  (37)

(37)

In its 2019 income statement, Riley Company reported cost of goods sold of $85,000. Later, Riley determined that beginning inventory was understated by $23,000, and the ending inventory was understated by $10,000.

What should be the corrected amount for cost of goods sold for 2019?

(Multiple Choice)

4.9/5  (32)

(32)

Tisdell Fabricators, Inc., has 10 units in beginning inventory costing $15 each. It purchased 90 more for $12 each during the month. The company sold 80 units during the month.

Calculate cost of goods sold using:

a. FIFO

b. Weighted-average cost

c. LIFO

(Essay)

4.9/5  (40)

(40)

Use the following inventory related information for Questions below

-Assuming a periodic inventory system is used, what is ending inventory under the Weighted-Average Cost method?

-Assuming a periodic inventory system is used, what is ending inventory under the Weighted-Average Cost method?

(Multiple Choice)

4.9/5  (41)

(41)

Assuming rising prices, which method will give the highest dollar value for cost of goods sold on the income statement?

(Multiple Choice)

4.8/5  (35)

(35)

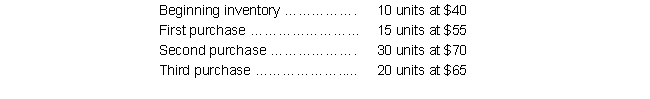

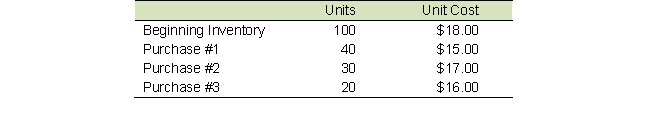

The following inventory was available for sale during the year for Mega Tools:

Mega has 25 units on hand at the end of the year. What is the dollar amount of inventory at the end of the year according to the first-in, first-out method?

Mega has 25 units on hand at the end of the year. What is the dollar amount of inventory at the end of the year according to the first-in, first-out method?

(Multiple Choice)

4.8/5  (38)

(38)

Use the following information to answer Questions below

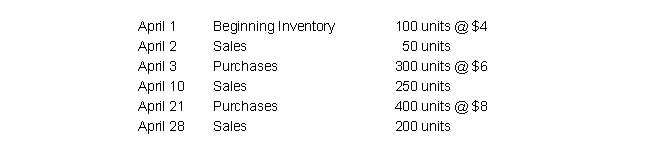

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Blunt, Inc., for an operating period.

-Assuming Blunt, Inc., uses LIFO perpetual inventory procedures, sale no. 2 is recorded as an entry to Cost of Goods Sold for:

-Assuming Blunt, Inc., uses LIFO perpetual inventory procedures, sale no. 2 is recorded as an entry to Cost of Goods Sold for:

(Multiple Choice)

5.0/5  (30)

(30)

Use the following inventory related information for Questions below

-Assuming a periodic inventory system is used, what is cost of goods sold under FIFO?

-Assuming a periodic inventory system is used, what is cost of goods sold under FIFO?

(Multiple Choice)

4.9/5  (31)

(31)

The lower-of-cost-or-net realizable value rule for inventory may be applied to:

(Multiple Choice)

4.8/5  (39)

(39)

Blue Danube Tires has the following inventory records for the month ending July 31:

Blue Danube sold 140 tires during July. Compute the ending inventory and the cost of goods sold for the period using FIFO, LIFO, and weighted-average cost inventory methods.

Blue Danube sold 140 tires during July. Compute the ending inventory and the cost of goods sold for the period using FIFO, LIFO, and weighted-average cost inventory methods.

(Essay)

4.7/5  (34)

(34)

Use the following information to answer Questions below

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of McKensie Company for an operating period.

-Assuming McKensie Company uses FIFO perpetual inventory procedures, sale no. 1 is recorded as an entry to Cost of Goods Sold for:

-Assuming McKensie Company uses FIFO perpetual inventory procedures, sale no. 1 is recorded as an entry to Cost of Goods Sold for:

(Multiple Choice)

4.9/5  (38)

(38)

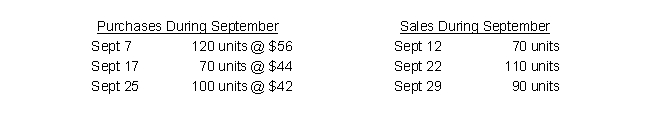

Use the following inventory related information for Questions below

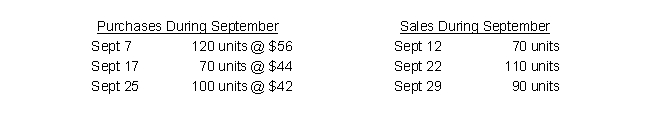

On September 1, the beginning inventory was 110 units at $50 each. Purchases and sales during September were:

-What is the cost of inventory on September 30 if the periodic LIFO costing alternative is used?

-What is the cost of inventory on September 30 if the periodic LIFO costing alternative is used?

(Multiple Choice)

5.0/5  (32)

(32)

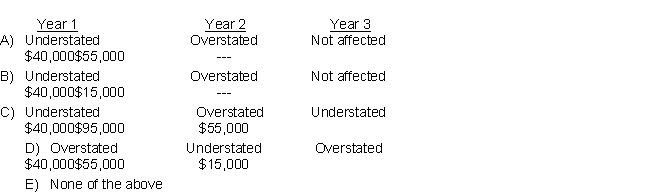

During its first and second years of operations, Forrester Company, a corporation using a periodic inventory system, made undiscovered errors in taking its year-end inventories that understated Year 1 ending inventory by $40,000 and overstated Year 2 ending inventory by $55,000.

The combined effect of these errors on reported income is:

(Short Answer)

4.8/5  (42)

(42)

Use the following inventory related information for Questions below

On September 1, the beginning inventory was 110 units at $50 each. Purchases and sales during September were:

-What is the cost of goods sold for September if the periodic FIFO costing alternative is used?

-What is the cost of goods sold for September if the periodic FIFO costing alternative is used?

(Multiple Choice)

4.9/5  (39)

(39)

The lower-of-cost-or-net realizable value rule for inventory:

(Multiple Choice)

4.8/5  (32)

(32)

Showing 41 - 60 of 124

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)