Exam 5: Understanding Interest Rates, Savings, and the Wealth Effect

Exam 1: Understanding the Financial System and Its Impact on the Economy and Markets137 Questions

Exam 2: Financial Systems, Monetary Units, and the Role of Money in the Economy133 Questions

Exam 3: Financial Indices, Market Information, and Economic Data141 Questions

Exam 4: The Financial Crisis and Its Impact on the Mortgage Market and Economy128 Questions

Exam 5: Understanding Interest Rates, Savings, and the Wealth Effect133 Questions

Exam 6: Financial Concepts and Interest Rates137 Questions

Exam 7: Effects of Inflation and Yield Curves on Stock Prices and Investments122 Questions

Exam 8: Understanding Risk and Market Factors in Financial Securities128 Questions

Exam 9: Exploring Financial Markets and Hedging Strategies138 Questions

Exam 10: Factors Affecting the Volume of CDs117 Questions

Exam 11: Exploring the Reserve Accounting System, Money Markets, and Financial Instruments124 Questions

Exam 12: Exploring Central Banks and Their Impact on the Economy and Financial System122 Questions

Exam 13: Central Banking and Monetary Policy: Exploring Tools and Strategies146 Questions

Exam 14: Banking and Financial Services: Regulations, Operations, and Trends138 Questions

Exam 15: Comparative Analysis of Financial Institutions and Their Operations104 Questions

Exam 16: Exploring Various Aspects of Pension Funds, Finance Companies, and Insurance Industry135 Questions

Exam 17: The Impact of Deregulation and Regulation on Financial Institutions and Banking Industry in the United States116 Questions

Exam 18: Treasury Auctions, Public Debt, and Government Borrowing: Exploring the Us Treasury System135 Questions

Exam 19: Corporate Bond Pricing, Market Development, and Financing Strategies98 Questions

Exam 20: The Truth About Regulation Fd and Stock Holdings: Debunking Common Myths in the Financial Market131 Questions

Exam 21: Flexible Savings Account Options104 Questions

Exam 22: Mortgage Market and Mortgage Instruments109 Questions

Exam 23: International Financial Transactions and Balance of Payments120 Questions

Exam 24: International Banking and Financial Regulations76 Questions

Exam 25: Exploring the Complexities of Financial Services and Regulation118 Questions

Select questions type

If domestic savings rise, less foreign savings will be needed to support domestic living standards according to the textbook.

(True/False)

4.8/5  (41)

(41)

For households current saving is defined as equal to the difference between current income and current consumption expenditures.

(True/False)

4.9/5  (41)

(41)

According to the Rational Expectations Theory, interest rates follow predictable patterns that can be used to earn excess profits.

(True/False)

4.8/5  (38)

(38)

In the real world there are thousands of interest rates, but there is no such thing as "the interest rate."

(True/False)

4.9/5  (36)

(36)

Suppose a $1,000 par-value bond was issued last year with a promised annual rate of return (yield) of 6 percent when market interest rates on comparable securities were also 6 percent. Thus, the bond pays its holder $60 annually in interest. Today, one year later, market interest rates on comparable securities are 10 percent. The price of the 6 percent bond will approach what dollar figure?

(Multiple Choice)

4.8/5  (32)

(32)

The equilibrium rate of interest in the Liquidity Preference Theory is determined by:

(Multiple Choice)

4.9/5  (42)

(42)

The rational expectations view suggests that new information made available to market investors will tend to cause interest rates to fall temporarily below their equilibrium values, but rates will rapidly move back toward equilibrium.

(True/False)

4.8/5  (45)

(45)

Which of the following statements concerning the "pure" rate of interest is true?

(Multiple Choice)

4.8/5  (41)

(41)

The equilibrium rate of interest as determined in the loanable funds theory of interest will rise if:

(Multiple Choice)

5.0/5  (31)

(31)

For an individual or family heavily in debt a rise in interest rates will stimulate a greater amount of savings because of the wealth effect.

(True/False)

4.8/5  (47)

(47)

The majority of business expenditures for investment are to carry out net investment.

(True/False)

4.9/5  (37)

(37)

The wealth effect was very strong during the stock market and housing booms of the late 1990s when the personal savings rate went negative as households consumed more than their income. This effect has sense reversed itself due to the recent credit crisis.

(True/False)

4.7/5  (41)

(41)

Money demanded for transactions and precautionary purposes is dependent upon the level of and changes in interest rates.

(True/False)

4.8/5  (32)

(32)

Dishoarding of money leads to higher interest rates, ceteris paribus.

(True/False)

4.7/5  (36)

(36)

Suppose the total demand for money is described by the following equation: MD = 30 - 2i, where i is the prevailing market interest rate. The total supply of money is described by the equation: MS = 3 + 7i. According to the liquidity preference theory of interest rates, what is the prevailing equilibrium rate of interest?

(Short Answer)

4.8/5  (40)

(40)

According to the Liquidity Preference theory of interest, at a point above the equilibrium rate of interest, the supply of money exceeds the quantity demanded and some households, businesses and units of government will try to dispose of unwanted money balances by purchasing bonds.

(True/False)

4.7/5  (34)

(34)

As long as projects are mutually exclusive, NPV and IRR yield the same results.

(True/False)

4.8/5  (38)

(38)

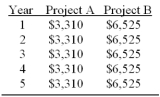

Each project will last an estimated 5 years with no remaining significant scrap value. Determine the IRR and the NPV for each of these two projects. What should INLAC decide about each proposed project, assuming the above figures are truly accurate?

INLAC Company, Ltd. is examining two investment projects as a part of its expansion plan for the coming year. These two projects are not mutually exclusive. The cost of Project A is $9,870 while the second project (B) is expected to cost $17,850. INLAC's cost of capital (required rate of return) is 12 %. Expected annual cash flows are projected to be as follows:

(Short Answer)

4.8/5  (35)

(35)

A new drill press is considered a possible new investment for EXRON Corporation if it generates an expected return of $2,000 per year for 10 years. Its expected purchase price (including installation) is $9,400. What is the drill press project's expected internal rate of return?

(Short Answer)

4.8/5  (29)

(29)

Factors influencing the investment decision-making process of business firms include all of the following except:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 41 - 60 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)