Exam 6: Portfolio Performance Evaluation

Exam 1: Securities Markets, Efficient Diversification, Risk and Return: Past and Prologue11 Questions

Exam 2: Capital Pricing, Arbitrage Pricing Theory, Bond Prices, Yields, Efficient Market Hypothesis and Behavioral Finance11 Questions

Exam 3: Equity Valuation, Managing Bond Portfolios, Macroeconomic and Industry Analysis9 Questions

Exam 4: Financial Statement Analysis, Options and Risk Management15 Questions

Exam 5: Hedge Funds, Futures, Risk Management, Investors and the Investment Process7 Questions

Exam 6: Portfolio Performance Evaluation9 Questions

Select questions type

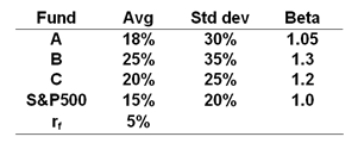

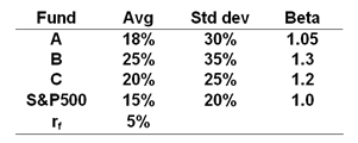

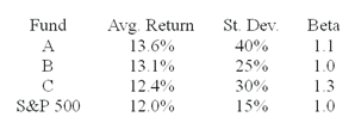

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

What is the T2 measure for Portfolio A?

What is the T2 measure for Portfolio A?

Free

(Multiple Choice)

4.8/5  (44)

(44)

Correct Answer:

B

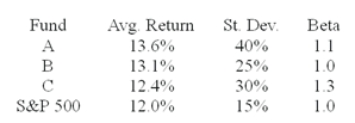

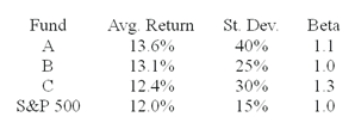

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

B

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?

Free

(Multiple Choice)

4.8/5  (44)

(44)

Correct Answer:

D

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

(Multiple Choice)

4.7/5  (35)

(35)

What is the contribution of security selection to relative performance?

(Multiple Choice)

4.9/5  (33)

(33)

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

(Multiple Choice)

4.9/5  (38)

(38)

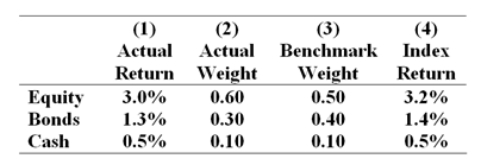

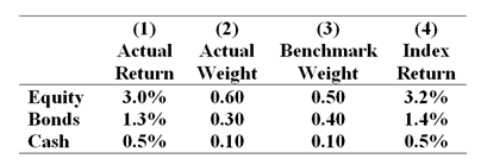

The table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3) and the returns of sector indexes in column (4).  What was the manager's return in the month?

What was the manager's return in the month?

(Multiple Choice)

4.9/5  (38)

(38)

What is the contribution of asset allocation to relative performance?

(Multiple Choice)

4.8/5  (39)

(39)

The table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3) and the returns of sector indexes in column (4).  What was the bogey's return in the month?

What was the bogey's return in the month?

(Multiple Choice)

4.9/5  (38)

(38)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)