Exam 9: Accounting for Long-Lived and Intangible Assets

Exam 1: Financial Accounting and Business Decisions113 Questions

Exam 2: Processing Accounting Information108 Questions

Exam 3: Accrual Basis of Accounting167 Questions

Exam 4: Understanding Financial Statements64 Questions

Exam 5: Accounting for Merchandising Operations90 Questions

Exam 6: Accounting for Inventory156 Questions

Exam 7: Internal Control and Cash43 Questions

Exam 8: Accounting for Receivables118 Questions

Exam 9: Accounting for Long-Lived and Intangible Assets129 Questions

Exam 10: Accounting for Liabilities119 Questions

Exam 11: Stockholders Equity108 Questions

Exam 12: Statement of Cash Flows43 Questions

Exam 13: Analysis and Interpretation of Financial Statements14 Questions

Exam 14: Overview of Managerial Accounting, Managerial Accounting Concepts and Cost Flows8 Questions

Exam 15: Cost Accounting Systemsjob Order Costing20 Questions

Exam 16: Cost Accounting Systemsprocess Costing31 Questions

Exam 17: Activity-Based Costing8 Questions

Exam 18: Cost-Volume-Profit Relationships13 Questions

Exam 19: Variable Costinga Tool for Decision Making5 Questions

Exam 20: Relevant Costs and Short-Term Decision Making19 Questions

Exam 21: Planning and Budgeting12 Questions

Exam 22: Standard Costing and Variance Analysis19 Questions

Exam 23: Flexible Budgets, Segment Analysis, and Performance Reporting15 Questions

Exam 24: Capital Budgeting27 Questions

Select questions type

Fashion Company sells a plant asset that originally cost $360,000 for $120,000 on December 31, 2019. The accumulated depreciation account had a balance of $180,000 after the current year's depreciation had been recorded.

The company should recognize a:

(Multiple Choice)

4.8/5  (43)

(43)

Tiffany Company's 2019 asset turnover was 3.0. The firm's total assets were $10,000,000 at January 1, 2019 and $12,400,000 at December 31, 2019. Net sales for 2019 were:

(Multiple Choice)

4.9/5  (39)

(39)

Steve Company purchased a tractor at a cost of $180,000. The tractor has an estimated salvage value of $20,000 and an estimated life of 8 years, or 10,000 hours of operation. The tractor was purchased on January 1, 2019 and was used 2,400 hours in 2019 and 2,100 hours in 2020. On January 1, 2021, the company decided to sell the tractor for $70,000. Steve uses the units-of-production method to account for the depreciation on the tractor.

Based on this information, the entry to record the sale of the tractor will show:

(Multiple Choice)

4.8/5  (45)

(45)

On April 1, 2019, Leon Company purchased a copper mine at a cost of $84,000,000. The mine was estimated to contain 4,000,000 tons of ore and to have a residual value of $24,000,000 after mining operations are completed. During the year, 750,000 tons of ore were removed from the mine.

On December 31, 2019, the book value of the mine is:

(Multiple Choice)

4.9/5  (33)

(33)

On January 1, 2019, Sabrina Company acquired equipment for $480,000. The estimated life of the equipment is 5 years or 20,000 hours. The estimated residual value is $80,000.

What is the amount of depreciation expense for 2020, if the company uses the double-declining-balance method of depreciation?

(Multiple Choice)

4.9/5  (33)

(33)

On January 1, 2019, Thomas Peter Company purchased a bottle-capping machine for $480,000. During its useful life, the company expects that the machine will cap 1,500,000 bottles. The machine's expected salvage value is $30,000. During 2019, the machine capped 250,000 bottles and during 2020, the machine capped 300,000 bottles.

Assuming units-of-production depreciation, 2020 depreciation expense is:

(Multiple Choice)

4.9/5  (37)

(37)

On June 1, 2019, Martin Products purchased a silver mine for $3,000,000. Costs to further explore and develop the mine totaled $1,500,000. The value of the mine once mining operations are completed is expected to total $1,000,000. Martin Products expects to extract 1,250,000 tons of ore from the mine. During 2019, 150,000 tons of ore were extracted. 80,000 tons were sold to another company for further processing.

What is the balance in the Inventory - Silver Ore account at December 31, 2019?

(Multiple Choice)

4.9/5  (39)

(39)

On January 1, 2019, Fullerton, Inc. purchased a new machine for $180,000. Its estimated useful life is eight years with an expected salvage value of $18,000.

Assuming double-declining balance depreciation, 2020 depreciation expense is:

(Multiple Choice)

4.8/5  (38)

(38)

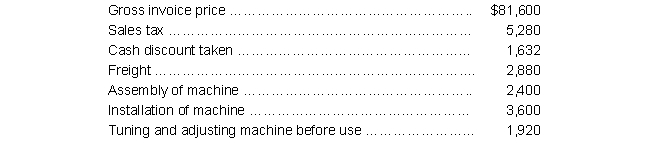

Summit, Inc. acquired a machine that involved the following expenditures and related factors:

The initial accounting cost of the machine should be:

The initial accounting cost of the machine should be:

(Multiple Choice)

4.8/5  (46)

(46)

Showing 121 - 129 of 129

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)