Exam 2: Processing Accounting Information

Exam 1: Financial Accounting and Business Decisions113 Questions

Exam 2: Processing Accounting Information108 Questions

Exam 3: Accrual Basis of Accounting167 Questions

Exam 4: Understanding Financial Statements64 Questions

Exam 5: Accounting for Merchandising Operations90 Questions

Exam 6: Accounting for Inventory156 Questions

Exam 7: Internal Control and Cash43 Questions

Exam 8: Accounting for Receivables118 Questions

Exam 9: Accounting for Long-Lived and Intangible Assets129 Questions

Exam 10: Accounting for Liabilities119 Questions

Exam 11: Stockholders Equity108 Questions

Exam 12: Statement of Cash Flows43 Questions

Exam 13: Analysis and Interpretation of Financial Statements14 Questions

Exam 14: Overview of Managerial Accounting, Managerial Accounting Concepts and Cost Flows8 Questions

Exam 15: Cost Accounting Systemsjob Order Costing20 Questions

Exam 16: Cost Accounting Systemsprocess Costing31 Questions

Exam 17: Activity-Based Costing8 Questions

Exam 18: Cost-Volume-Profit Relationships13 Questions

Exam 19: Variable Costinga Tool for Decision Making5 Questions

Exam 20: Relevant Costs and Short-Term Decision Making19 Questions

Exam 21: Planning and Budgeting12 Questions

Exam 22: Standard Costing and Variance Analysis19 Questions

Exam 23: Flexible Budgets, Segment Analysis, and Performance Reporting15 Questions

Exam 24: Capital Budgeting27 Questions

Select questions type

Beginning and ending Cash account balances of Crossbow, Inc. were $14,000 and $32,000 respectively. If total cash paid out during the period was $30,000, what amount of cash was received during the period?

(Multiple Choice)

4.9/5  (42)

(42)

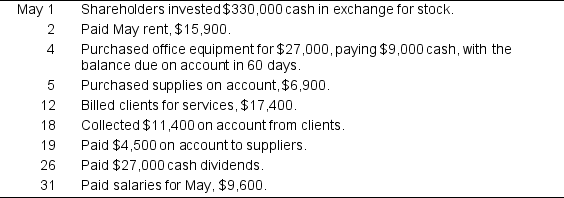

Helen H. Designs has the following accounts in its general ledger: Cash; Accounts Receivable; Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends; Service Fees Earned; Rent Expense; and Salaries Expense. Prepare general journal entries to record the following transactions:

(Essay)

4.8/5  (35)

(35)

A company received $11,000 cash in exchange for 200 shares of the company's common stock.

What would the effect of this transaction on the current year's accounting equation?

(Multiple Choice)

4.8/5  (33)

(33)

During its first month of operations, Lavender Company (1) borrowed $600,000 from a bank, and then (2) purchased an equipment costing $240,000 by paying cash of $120,000 and signing a long term note for the remaining amount. During the month, the company also (3) purchased inventory for $180,000 on credit, (4) performed services for clients for $360,000 on account, (5) paid $90,000 cash for accounts payable, and (6) paid $180,000 cash for utilities.

What is the amount of total liabilities at the end of the month?

(Multiple Choice)

4.9/5  (41)

(41)

Mouser Pet Supplies had the following transactions during December 2019:

•Paid a note of $102,000, owed since March, plus $2,550 for interest.

•Sold $219,150 of merchandise to customers on account. Cost of goods sold was $127,500. [Hint: Cost of goods sold is an expense related to the reduction of inventory (merchandise sold).]

•Paid accounts payable of $12,300.

As a result of these transactions, at year-end, liabilities and stockholders' equity would show a combined total:

(Multiple Choice)

4.8/5  (35)

(35)

If the beginning Cash account balance of Crossbow, Inc. was $36,800, the ending balance was $20,400, and total cash received during the period was $88,000, what amount of cash was paid out during the period?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is one effect of a purchase of $600 of supplies on credit?

(Multiple Choice)

4.8/5  (45)

(45)

A company received $33,000 cash in exchange for 200 shares of the company's common stock.

What would the effect of this transaction on the current year's accounting equation?

(Multiple Choice)

4.9/5  (29)

(29)

A company incurred $40,000 (to be paid next year) for the current year's insurance coverage.

What would the effect of this transaction on the current year's accounting equation?

(Multiple Choice)

4.7/5  (35)

(35)

Ringstar Company purchased a new car for $60,000 by paying $24,000 cash, and trading in an old car with a recorded net cost and market value of $20,000. They also signed a Note for $16,000.

The required journal entry will not:

(Multiple Choice)

4.9/5  (41)

(41)

Mr. Montana started a company (Montana Company) by contributing $100,000 cash, and a building valued at $800,000. The company then purchased a machine by making a $100,000 down payment (which accounted for half its purchase price), and signed a note payable to the bank.

After recording the above transactions, Montana Company's balance sheet will show:

Assets Liabilities Stockholders' Equity

(Multiple Choice)

4.8/5  (30)

(30)

Two examples of source documents are a seller's invoice and a bank deposit slip.

(True/False)

4.8/5  (40)

(40)

A company performed $8,635 of services and received $3,000 in cash with the remaining amount to be paid in 60 days with no interest.

What would the effect of this transaction on the company's current month-end accounting equation?

(Multiple Choice)

4.9/5  (22)

(22)

A customer received and then paid an $18,000 utility bill from West Haven Natural Gas Company. The journal entry by West Haven Natural Gas Company to record receipt of the payment would include:

(Multiple Choice)

4.9/5  (40)

(40)

A company paid employee wages of $24,000 for the month.

What would the effect of this transaction on the current month's accounting equation?

(Multiple Choice)

4.9/5  (34)

(34)

A company received a $72,000 payment for services to be performed over the next few months.

What would the effect of this transaction on the current year's accounting equation?

(Multiple Choice)

4.8/5  (37)

(37)

Beginning and ending Cash account balances of Firefly, Inc. were $42,000 and $96,000 respectively. If total cash paid out during the period was $90,000, what amount of cash was received during the period?

(Multiple Choice)

4.8/5  (46)

(46)

The accountant at Befuddled Company recorded the purchase of $1,800 of supplies for cash as a debit to Supplies for $1,800 and a credit to Accounts Payable for $1,800.

Determine the effect of this error on the accounting equation of Befuddled Company.

(Multiple Choice)

4.8/5  (45)

(45)

The purchase of a delivery truck for $19,000 (on credit) was posted as debit to Delivery Trucks for $19,000, and a debit to Notes Payable for $19,000.

What effect would this error have on the trial balance?

(Multiple Choice)

4.8/5  (37)

(37)

On February 1 2019 Cibula's Accounting Services had a cash balance of $10,000, and completed the following transactions during February 2019:

1) Purchased office supplies on account, $600.

2) Completed work for a client on credit, $1,000.

3) Paid cash for the office supplies purchased in (1).

4) Completed work for a client and received $1,600 cash.

5) Received $1,000 cash for the work described in (2).

6) Received $2,000 from a client for accounting services to be performed in March.

What was the balance of the company's cash account after these transactions?

(Multiple Choice)

4.8/5  (34)

(34)

Showing 61 - 80 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)