Exam 5: Income Statement and Related Information

Exam 1: Financial Accounting and Accounting Standards20 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting35 Questions

Exam 3: The Accounting Information System34 Questions

Exam 4: Balance Sheet32 Questions

Exam 5: Income Statement and Related Information50 Questions

Exam 6: Statement of Cash Flows49 Questions

Exam 7: Revenue Recognition52 Questions

Exam 8: Cash and Receivables58 Questions

Exam 9: Accounting for Inventories51 Questions

Exam 10: Accounting for Property, Plant, and Equipment64 Questions

Exam 11: Intangible Assets48 Questions

Exam 12: Accounting for Liabilities63 Questions

Exam 13: Stockholders Equity74 Questions

Exam 14: Investments48 Questions

Exam 15: Accounting for Income Taxes69 Questions

Exam 16: Accounting for Compensation42 Questions

Exam 17: Accounting for Leases59 Questions

Exam 18: Additional Reporting Issues70 Questions

Exam 19: Appendix A: Accounting and the Time Value of Money31 Questions

Exam 20: Appendix B: Reporting Cash Flows18 Questions

Exam 21: Appendix D: Retail Inventory Method6 Questions

Exam 22: Appendix E: Accounting for Natural Resources6 Questions

Exam 23: Appendix G: Accounting for Troubled Debt3 Questions

Exam 24: Appendix H: Accounting for Derivative Instruments1 Questions

Exam 25: Appendix I: Error Analysis6 Questions

Select questions type

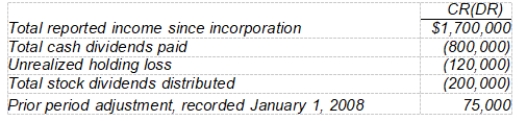

The following information was extracted from the accounts of Boone Corporation at December 31, 2008:

What should be the balance of retained earnings at December 31, 2008?

What should be the balance of retained earnings at December 31, 2008?

(Multiple Choice)

4.8/5  (37)

(37)

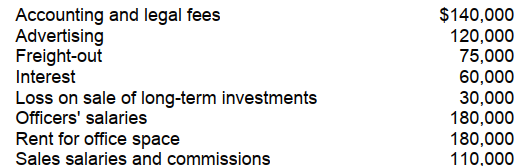

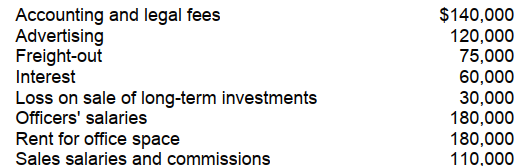

Meyer Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 2008, included the following expense accounts:

One-half of the rented premises is occupied by the sales department

-How much of the expenses listed above should be included in Meyer's general and administrative expenses for 2008?

One-half of the rented premises is occupied by the sales department

-How much of the expenses listed above should be included in Meyer's general and administrative expenses for 2008?

(Multiple Choice)

4.7/5  (32)

(32)

The concept that reports extraordinary items in the income statement is called the

(Multiple Choice)

4.8/5  (37)

(37)

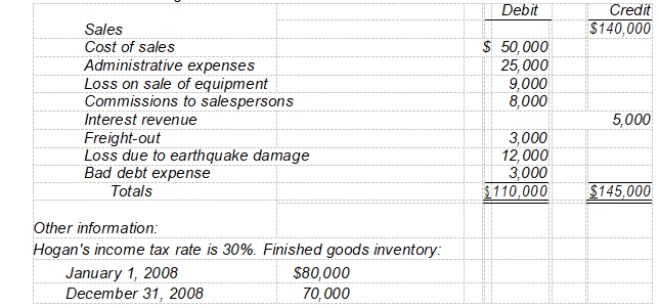

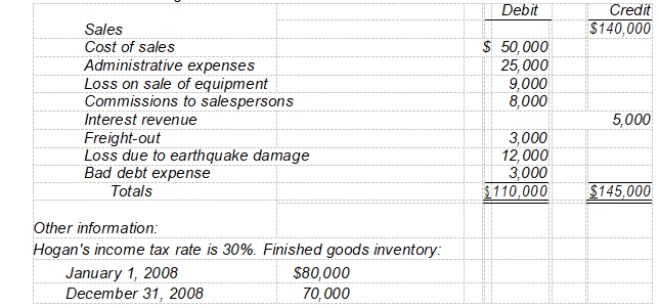

Hogan Corp.'s trial balance of income statement accounts for the year ended December 31, 2008 included the following:

On Hogan's multiple-step income statement for 2008,

-Inventory purchases are

On Hogan's multiple-step income statement for 2008,

-Inventory purchases are

(Multiple Choice)

4.9/5  (41)

(41)

A review of the December 31, 2008, financial statements of Baden Corporation revealed that under the caption "extraordinary losses," Baden reported a total of $515,000. Further analysis revealed that the $515,000 in losses was comprised of the following items:

(1) Baden recorded a loss of $150,000 incurred in the abandonment of equipment formerly used in the business.

(2) In an unusual and infrequent occurrence, a loss of $250,000 was sustained as a result of hurricane damage to a warehouse.

(3) During 2008, several factories were shut down during a major strike by employees, resulting in a loss of $85,000.

(4) Uncollectible accounts receivable of $30,000 were written off as uncollectible.

Ignoring income taxes, what amount of loss should Baden report as extraordinary on its 2008 income statement?

(Multiple Choice)

4.7/5  (40)

(40)

Meyer Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 2008, included the following expense accounts:

One-half of the rented premises is occupied by the sales department

-How much of the expenses listed above should be included in Meyer's selling expenses for 2008?

One-half of the rented premises is occupied by the sales department

-How much of the expenses listed above should be included in Meyer's selling expenses for 2008?

(Multiple Choice)

4.8/5  (38)

(38)

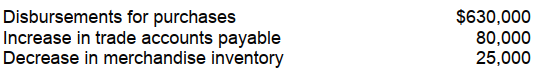

During the year 2008, Siska Corporation had the following information available related to its income statement:

Cost of goods sold for 2008 amounted to

Cost of goods sold for 2008 amounted to

(Multiple Choice)

4.7/5  (35)

(35)

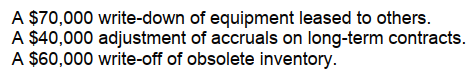

Snead, Inc. incurred the following infrequent losses during 2008:

In its 2008 income statement, what amount should Snead report as total infrequent losses that are not considered extraordinary?

In its 2008 income statement, what amount should Snead report as total infrequent losses that are not considered extraordinary?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following should not be reported on the income statement as an extra-ordinary item?

(Multiple Choice)

4.7/5  (38)

(38)

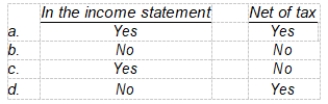

Which of the following is true about intraperiod tax allocation?

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following is a required disclosure in the income statement when reporting the disposal of a component of the business?

(Multiple Choice)

4.9/5  (37)

(37)

The primary reason the income statement is so important to investors and creditors relates to its ability to provide information helpful in

(Multiple Choice)

4.8/5  (31)

(31)

A change in accounting principle is considered appropriate only when it is demonstrated that the newly adopted principle is preferable to the old one.

(True/False)

4.9/5  (39)

(39)

Shank Corporation made a very large arithmetical error in the preparation of its year-end financial statements by improper placement of a decimal point in the calculation of depreciation. The error caused the net income to be reported at almost double the proper amount. Correction of the error when discovered in the next year should be treated as

(Multiple Choice)

4.9/5  (37)

(37)

A correction of an error in prior periods' income will be reported

(Short Answer)

4.9/5  (47)

(47)

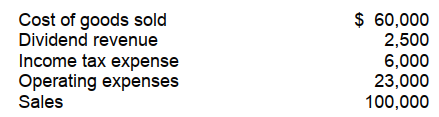

For Garret Wolfe Company, the following information is available:

-In Garret Wolfe's single-step income statement, gross profit

-In Garret Wolfe's single-step income statement, gross profit

(Multiple Choice)

4.8/5  (42)

(42)

According to the FASB, displaying comprehensive income as a part of the statement of stockholders' equity is one of the acceptable ways of presenting comprehensive income items.

(True/False)

4.9/5  (38)

(38)

Which of the following should be reported on the income statement as an extraordinary item?

(Multiple Choice)

4.9/5  (39)

(39)

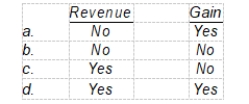

When a manufacturing company sells one of its plant assets at a price in excess of its book value, it should recognize

(Short Answer)

4.9/5  (33)

(33)

Hogan Corp.'s trial balance of income statement accounts for the year ended December 31, 2008 included the following:

On Hogan's multiple-step income statement for 2008,

-Income before extraordinary item is

On Hogan's multiple-step income statement for 2008,

-Income before extraordinary item is

(Multiple Choice)

4.9/5  (34)

(34)

Showing 21 - 40 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)