Exam 2: An Introduction to Cost Terms and Purposes

Exam 1: The Manager and Management Accounting9 Questions

Exam 2: An Introduction to Cost Terms and Purposes34 Questions

Exam 3: Job Costing19 Questions

Exam 4: Activity-Based Costing5 Questions

Exam 5: Process Costing19 Questions

Exam 6: Master Budgets11 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control22 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control19 Questions

Exam 9: Setermining How Cost Management13 Questions

Exam 10: Cost-Volume-Profit Analysis16 Questions

Exam 11: Decision Making10 Questions

Exam 12: Pricing Decisions and Cost Management17 Questions

Exam 13: Strategy, Balanced Scorecard, and Strategic Profitability Analysis15 Questions

Exam 14: Capital Budgeting and Cost Analysis12 Questions

Exam 15: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis11 Questions

Exam 16: Allocation of Support-Department Costs, Common Costs, and Revenues2 Questions

Exam 17: Cost Allocation: Joint Products and Byproducts12 Questions

Exam 18: Inventory Costing and Capacity Analysis19 Questions

Exam 19: Inventory Management Methods8 Questions

Exam 20: Transfer Pricing, Multinational Considerations, and Management Information System3 Questions

Exam 21: Key Performance Indicators, Compensation, and Multinational Considerations27 Questions

Exam 22: Balanced Scorecard: Quality, Time, and the Theory of Constraints6 Questions

Select questions type

Archambeau Products Company manufactures office furniture. Recently, the company decided to develop a formal cost accounting system and classify all costs into three categories. Categorize each of the following items as being appropriate for (1) cost tracing to the finished furniture, (2) cost allocation of an indirect manufacturing cost to the finished furniture, or (3) as a nonmanufacturing item.

-Factory washroom supplies

Free

(Multiple Choice)

4.7/5  (42)

(42)

Correct Answer:

B

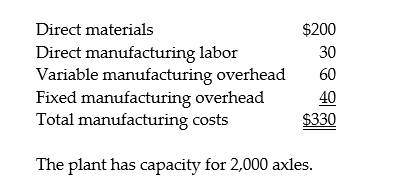

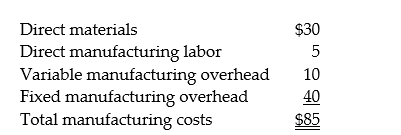

Axle and Wheel Manufacturing currently produces 1,000 axles per month. The following per unit data apply for sales to regular customers:

Required:

a. What is the total cost of producing 1,000 axles?

b. What is the total cost of producing 1,500 axles?

c. What is the per unit cost when producing 1,500 axles?

Required:

a. What is the total cost of producing 1,000 axles?

b. What is the total cost of producing 1,500 axles?

c. What is the per unit cost when producing 1,500 axles?

Free

(Essay)

4.9/5  (35)

(35)

Correct Answer:

a. [($200 + $30 + $60) × 1,000 units] + ($40 × 1,000 units) = $330,000

b. [($200 + $30 + $60) × 1,500 units] + $40,000 = $475,000

c. $475,000 / 1,500 = $316.67 per unit

Uzma Manufacturing wants to estimate costs for each product they produce at its Riyadh plant. The Riyadh plant produces three products at this plant, and runs two flexible assembly lines. Each assembly line can produce all three products.

Required:

a. Classify each of the following costs as either direct or indirect for each product.

b. Classify each of the following costs as either fixed or variable with respect to the number of units produced of each product.

-Wages of security personnel for the factory

Free

(Multiple Choice)

4.9/5  (30)

(30)

Correct Answer:

B,D

Which of the following companies is part of the service sector?

(Multiple Choice)

4.8/5  (37)

(37)

Archambeau Products Company manufactures office furniture. Recently, the company decided to develop a formal cost accounting system and classify all costs into three categories. Categorize each of the following items as being appropriate for (1) cost tracing to the finished furniture, (2) cost allocation of an indirect manufacturing cost to the finished furniture, or (3) as a nonmanufacturing item.

-Lathe depreciation

(Multiple Choice)

5.0/5  (39)

(39)

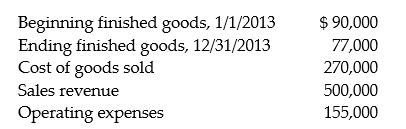

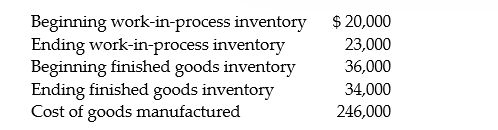

Wer the following questions using the information below:

-What is cost of goods manufactured for 2013?

-What is cost of goods manufactured for 2013?

(Multiple Choice)

4.9/5  (39)

(39)

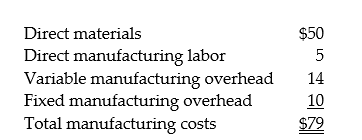

Tire and Spoke Manufacturing currently produces 1,000 bicycles per month. The following per unit data apply for sales to regular customers:

The plant has capacity for 3,000 bicycles and is considering expanding production to 2,000 bicycles. What is the per unit cost of producing 2,000 bicycles?

The plant has capacity for 3,000 bicycles and is considering expanding production to 2,000 bicycles. What is the per unit cost of producing 2,000 bicycles?

(Multiple Choice)

4.9/5  (45)

(45)

Butler Hospital wants to estimate the cost for each patient stay. It is a general health care facility offering only basic services and not specialized services such as organ transplants.

Required:

a. Classify each of the following costs as either direct or indirect with respect to each patient.

b. Classify each of the following costs as either fixed or variable with respect to hospital costs per day.

-Security

(Multiple Choice)

4.8/5  (46)

(46)

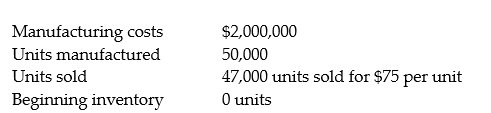

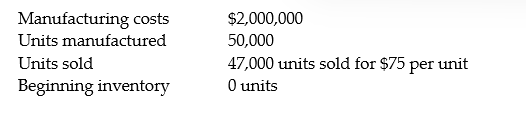

Answer the following questions using the information below:

The following information pertains to Ali's Mannequins:

-What is the amount of ending finished goods inventory?

-What is the amount of ending finished goods inventory?

(Multiple Choice)

4.9/5  (28)

(28)

During 2014, Favata Corporation incurred manufacturing expenses of $20,000,000 to produce 400,000 finished units. At year-end, it was determined that 370,000 units were sold while 30,000 units remained in ending inventory.

Required:

a. What is the cost of producing one unit?

b. What is the amount that will be reported on the income statement for cost of goods sold?

c. What is the amount that will be reported on the balance sheet for ending inventory?

(Essay)

4.8/5  (44)

(44)

Archambeau Products Company manufactures office furniture. Recently, the company decided to develop a formal cost accounting system and classify all costs into three categories. Categorize each of the following items as being appropriate for (1) cost tracing to the finished furniture, (2) cost allocation of an indirect manufacturing cost to the finished furniture, or (3) as a nonmanufacturing item.

-Depreciation - office building

(Multiple Choice)

4.8/5  (36)

(36)

Answer the following questions using the information below:

Axle and Wheel Manufacturing currently produces 1,000 axles per month. The following per unit data apply for sales to regular customers:

-What is the per unit cost when producing 3,000 axles?

-What is the per unit cost when producing 3,000 axles?

(Multiple Choice)

4.9/5  (37)

(37)

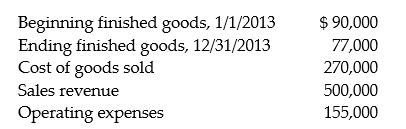

The following information pertains to the Red Sea Corporation:

What is cost of goods sold?

What is cost of goods sold?

(Multiple Choice)

4.9/5  (40)

(40)

Archambeau Products Company manufactures office furniture. Recently, the company decided to develop a formal cost accounting system and classify all costs into three categories. Categorize each of the following items as being appropriate for (1) cost tracing to the finished furniture, (2) cost allocation of an indirect manufacturing cost to the finished furniture, or (3) as a nonmanufacturing item.

-Carpenter wages

(Multiple Choice)

4.8/5  (36)

(36)

Uzma Manufacturing wants to estimate costs for each product they produce at its Riyadh plant. The Riyadh plant produces three products at this plant, and runs two flexible assembly lines. Each assembly line can produce all three products.

Required:

a. Classify each of the following costs as either direct or indirect for each product.

b. Classify each of the following costs as either fixed or variable with respect to the number of units produced of each product.

-Plant manager's wages

(Multiple Choice)

4.8/5  (32)

(32)

The distinction between direct and indirect costs is clearly set forth in international financial reporting standards (IFRS).

(True/False)

4.8/5  (36)

(36)

Butler Hospital wants to estimate the cost for each patient stay. It is a general health care facility offering only basic services and not specialized services such as organ transplants.

Required:

a. Classify each of the following costs as either direct or indirect with respect to each patient.

b. Classify each of the following costs as either fixed or variable with respect to hospital costs per day.

-Meals for patients

(Multiple Choice)

4.8/5  (35)

(35)

Answer the following questions using the information below:

Hamour Company reported the following:

-What is the amount of gross margin?

-What is the amount of gross margin?

(Multiple Choice)

4.9/5  (37)

(37)

Wer the following questions using the information below:

-What is operating income for 2013?

-What is operating income for 2013?

(Multiple Choice)

4.9/5  (35)

(35)

Uzma Manufacturing wants to estimate costs for each product they produce at its Riyadh plant. The Riyadh plant produces three products at this plant, and runs two flexible assembly lines. Each assembly line can produce all three products.

Required:

a. Classify each of the following costs as either direct or indirect for each product.

b. Classify each of the following costs as either fixed or variable with respect to the number of units produced of each product.

-Depreciation on the assembly line equipment

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 34

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)