Exam 21: Key Performance Indicators, Compensation, and Multinational Considerations

Exam 1: The Manager and Management Accounting9 Questions

Exam 2: An Introduction to Cost Terms and Purposes34 Questions

Exam 3: Job Costing19 Questions

Exam 4: Activity-Based Costing5 Questions

Exam 5: Process Costing19 Questions

Exam 6: Master Budgets11 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control22 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control19 Questions

Exam 9: Setermining How Cost Management13 Questions

Exam 10: Cost-Volume-Profit Analysis16 Questions

Exam 11: Decision Making10 Questions

Exam 12: Pricing Decisions and Cost Management17 Questions

Exam 13: Strategy, Balanced Scorecard, and Strategic Profitability Analysis15 Questions

Exam 14: Capital Budgeting and Cost Analysis12 Questions

Exam 15: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis11 Questions

Exam 16: Allocation of Support-Department Costs, Common Costs, and Revenues2 Questions

Exam 17: Cost Allocation: Joint Products and Byproducts12 Questions

Exam 18: Inventory Costing and Capacity Analysis19 Questions

Exam 19: Inventory Management Methods8 Questions

Exam 20: Transfer Pricing, Multinational Considerations, and Management Information System3 Questions

Exam 21: Key Performance Indicators, Compensation, and Multinational Considerations27 Questions

Exam 22: Balanced Scorecard: Quality, Time, and the Theory of Constraints6 Questions

Select questions type

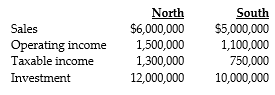

Answer the following questions using the information below:

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2014 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

-What are the respective residual incomes for the North and South Divisions?

The company's desired rate of return is 10%. Income is defined as operating income.

-What are the respective residual incomes for the North and South Divisions?

Free

(Multiple Choice)

4.7/5  (35)

(35)

Correct Answer:

B

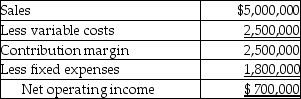

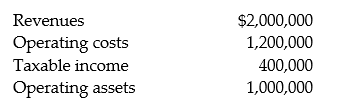

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions. The division managers are evaluated, in part, on the basis of the change in their return on invested assets. Operating results for the Packer Division for 2015 are budgeted as follows:

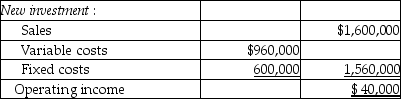

Operating assets for the division are currently $3,600,000. For 2015, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Required:

a. What is the effect on ROI of accepting the new product line?

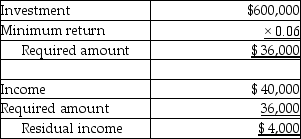

b. If the company's required rate of return is 6% and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Operating assets for the division are currently $3,600,000. For 2015, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Required:

a. What is the effect on ROI of accepting the new product line?

b. If the company's required rate of return is 6% and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Free

(Essay)

4.9/5  (38)

(38)

Correct Answer:

a.

Current ROI = $700,000 / $3,600,000 = 0.194

Current ROI = $700,000 / $3,600,000 = 0.194

New investment ROI = $40,000 / $600,000 = 0.067

Combined ROI = $740,000 / $4,200,000 = 0.176

Accepting the new product line will reduce the division's ROI. This would make the manager reluctant to make the investment.

b.

The manager would accept the investment because income is increased by $4,000.

The manager would accept the investment because income is increased by $4,000.

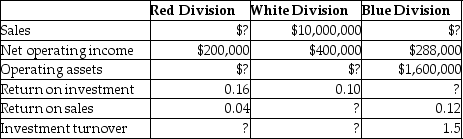

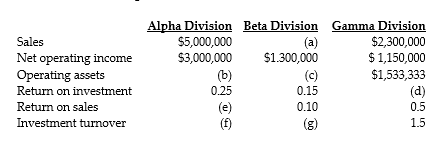

Provide the missing data for the following situations:

Free

(Essay)

4.7/5  (41)

(41)

Correct Answer:

Red Division:

ROI = ROS × IT

0.16 = 0.04 × IT

IT = 4.0

ROS = Income/Sales

0.04 = $200,000/Sales

Sales = $5,000,000

IT = Sales/OA

4 = $5,000,000/OA

OA = $1,250,000

White Division:

ROS = $400,000/$10,000,000 = 0.04

IT = ROI/ROS = 0.10 / 0.04 = 2.5

OA = S/IT = $10,000,000 / 2.5 = $4,000,000

Blue Division:

Sales = IT × OA = 1.5 × $1,600,000 = $2,400,000

ROI = 0.12 × 1.5 = 0.18

Answer the following questions using the information below:

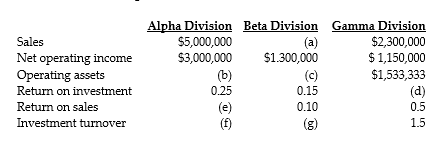

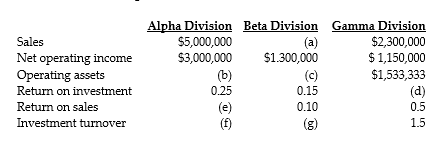

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the value of the operating assets belonging to the Beta Division?

-What is the value of the operating assets belonging to the Beta Division?

(Multiple Choice)

4.7/5  (36)

(36)

Answer the following questions using the information below:

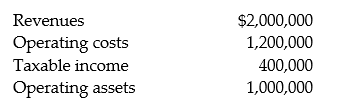

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

-What is the Cyclotron Division's investment turnover ratio?

Income is defined as operating income.

-What is the Cyclotron Division's investment turnover ratio?

(Multiple Choice)

4.8/5  (35)

(35)

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Alpha Division's return on sales?

-What is the Alpha Division's return on sales?

(Multiple Choice)

4.9/5  (34)

(34)

Answer the following questions using the information below:

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

-What is the Cyclotron Division's return on investment?

Income is defined as operating income.

-What is the Cyclotron Division's return on investment?

(Multiple Choice)

4.9/5  (39)

(39)

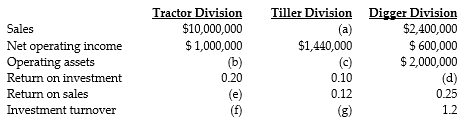

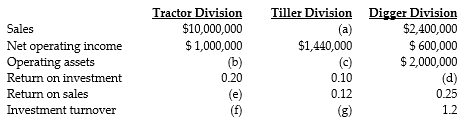

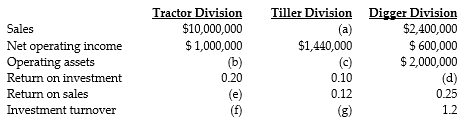

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's investment turnover?

-What is the Tractor Division's investment turnover?

(Multiple Choice)

4.9/5  (37)

(37)

Answer the following questions using the information below:

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's residual incomes based on book values, respectively?

-What are Bleach's and Cleanser's residual incomes based on book values, respectively?

(Multiple Choice)

4.8/5  (37)

(37)

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What were the sales for the Tiller Division?

-What were the sales for the Tiller Division?

(Multiple Choice)

4.7/5  (40)

(40)

Answer the following questions using the information below:

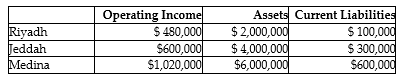

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Medina?

-What is the EVA for Medina?

(Multiple Choice)

4.9/5  (39)

(39)

The Coffee Division of Arabian Coffee Products is planning the 2015 operating budget. Average operating assets of $1,500,000 will be used during the year and unit selling prices are expected to average $100 each. Variable costs of the division are budgeted at $400,000, while fixed costs are set at $250,000. The company's required rate of return is 18%.

Required:

a. Compute the sales volume necessary to achieve a 20% ROI.

b. The division manager receives a bonus of 50% of residual income. What is his anticipated bonus for 2015, assuming he achieves the 20% ROI from part (a)?

(Essay)

4.7/5  (35)

(35)

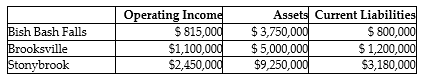

Answer the following questions using the information below:

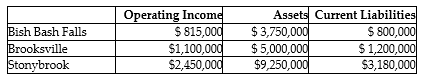

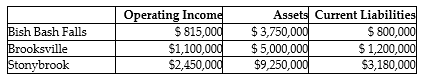

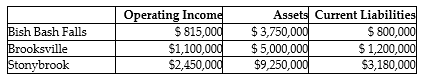

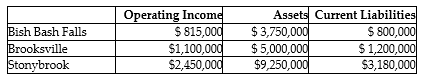

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Stonybrook?

-What is the EVA for Stonybrook?

(Multiple Choice)

4.7/5  (30)

(30)

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's return on sales?

-What is the Tractor Division's return on sales?

(Multiple Choice)

4.9/5  (41)

(41)

Answer the following questions using the information below:

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's return on investment based on current values, respectively?

-What are Bleach's and Cleanser's return on investment based on current values, respectively?

(Multiple Choice)

4.9/5  (32)

(32)

Answer the following questions using the information below:

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's return on investment based on book values, respectively?

-What are Bleach's and Cleanser's return on investment based on book values, respectively?

(Multiple Choice)

4.7/5  (30)

(30)

Answer the following questions using the information below:

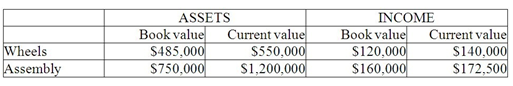

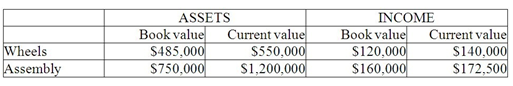

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's return on investment based on book values, respectively?

-What are Wheels's and Assembly's return on investment based on book values, respectively?

(Multiple Choice)

4.9/5  (36)

(36)

Answer the following questions using the information below:

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's return on investment based on current values, respectively?

-What are Wheels's and Assembly's return on investment based on current values, respectively?

(Multiple Choice)

4.9/5  (38)

(38)

Answer the following questions using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Brooksville?

-What is the EVA for Brooksville?

(Multiple Choice)

4.8/5  (33)

(33)

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Gamma Division's return on investment?

-What is the Gamma Division's return on investment?

(Multiple Choice)

4.9/5  (29)

(29)

Showing 1 - 20 of 27

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)