Exam 4: Activity-Based Costing Systems

Exam 1: Cost Management and Strategic Decision Making Evaluating Opportunities and Leading Change75 Questions

Exam 2: Product Costing Systems: Concepts and Design Issues117 Questions

Exam 3: Cost Accumulation for Job-Shop and Batch Production Operations90 Questions

Exam 4: Activity-Based Costing Systems102 Questions

Exam 5: Activity-Based Management89 Questions

Exam 6: Managing Customer Profitability73 Questions

Exam 7: Managing Quality and Time to Create Value114 Questions

Exam 8: Process-Costing Systems110 Questions

Exam 9: Joint-Process Costing90 Questions

Exam 10: Managing and Allocating Support-Service Costs80 Questions

Exam 11: Cost Estimation90 Questions

Exam 12: Financial and Cost-Volume-Profit Models69 Questions

Exam 13: Cost Management and Decision Making70 Questions

Exam 14: Strategic Issues in Making Long-Term Capital Investment Decisions97 Questions

Exam 15: Budgeting and Financial Planning81 Questions

Exam 16: Standard Costing, Variance Analysis, and Kaizen Costing80 Questions

Exam 17: Flexible Budgets, Overhead Cost Management, and Activity-Based Budgeting97 Questions

Exam 18: Organizational Design, Responsibility Accounting, and Evaluation of Divisional Performance80 Questions

Exam 19: Transfer Pricing76 Questions

Exam 20: Performance Measurement Systems Glossary Photo Credits81 Questions

Select questions type

Which of the following is considered a batch-level resource in a bakery?

(Multiple Choice)

4.8/5  (32)

(32)

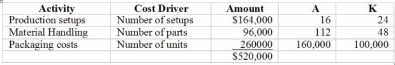

Hutchings Company manufactures and distributes two products, A and K. Overhead costs are currently allocated using the number of units produced as the allocation base. The controller has changing to an activity-based costing ABC. system. She has collected the following information:

Required

A. What is the overhead cost per unit under the current system?

B. What is the total overhead allocated to each product using the current system?

C. What would be the total overhead allocated to each product under ABC costing?

D. What would be the overhead cost per unit under ABC costing?

E. Explain how traditional cost systems can lead to inaccurate product information and poor management decisions.

Required

A. What is the overhead cost per unit under the current system?

B. What is the total overhead allocated to each product using the current system?

C. What would be the total overhead allocated to each product under ABC costing?

D. What would be the overhead cost per unit under ABC costing?

E. Explain how traditional cost systems can lead to inaccurate product information and poor management decisions.

(Essay)

4.9/5  (40)

(40)

The interview approach usually generates a more accurate activity list than the top-down approach.

(True/False)

4.9/5  (38)

(38)

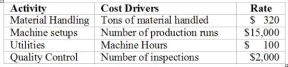

The Bridgewater Company recently switched to activity based costing ABC. The prior method allocated overhead costs at the rate of $200 per machine hour. The manager of Department J has estimated the following cost drivers and rates:

During May, Bridgewater purchased and used $400,000 of direct materials at $40 per ton. There were 32 production runs using a total of 48,000 machine hours in May. The manager of Department J needed 48 inspections

Required:

(a) Calculate the total overhead costs that would have been allocated to production using the prior method

(b) Calculate the total overhead costs that would be allocated using Activity-Based Costing

(c) Why is activity-based information useful for making business decisions?

During May, Bridgewater purchased and used $400,000 of direct materials at $40 per ton. There were 32 production runs using a total of 48,000 machine hours in May. The manager of Department J needed 48 inspections

Required:

(a) Calculate the total overhead costs that would have been allocated to production using the prior method

(b) Calculate the total overhead costs that would be allocated using Activity-Based Costing

(c) Why is activity-based information useful for making business decisions?

(Essay)

5.0/5  (37)

(37)

The first step in activity-based costing is to identify and classify the activities related to the company's products.

(True/False)

4.8/5  (36)

(36)

Salaries of the human resource staff responsible for hiring production personnel at Dell Computer would be an example of:

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following is the first step in Activity-Based Costing?

(Multiple Choice)

4.7/5  (39)

(39)

Use the following to answer questions:

Ferguson Molding Company produces custom bottle caps and jar covers for large cosmetic companies. Each customer owns the custom-made molds that are used for the caps and jar covers, so caps are produced only to customer order. Each order requires the setting of molds in molding machines. Two full time mechanics, whose combined total annual salary and benefits are $160,000 per year, are employed setting up and breaking down the molding machines. An order consists of anywhere from 50,000 to 500,000 units. 80 orders were received during the year 2008 for individual custom production runs. The total number of units produced was 8 million.

-The cost of setting up the molding machines is an example of

(Multiple Choice)

4.9/5  (38)

(38)

Customer costing identifies the costs and benefits of servicing specific customers or customer types.

(True/False)

4.9/5  (39)

(39)

Use the following to answer questions:

Ferguson Molding Company produces custom bottle caps and jar covers for large cosmetic companies. Each customer owns the custom-made molds that are used for the caps and jar covers, so caps are produced only to customer order. Each order requires the setting of molds in molding machines. Two full time mechanics, whose combined total annual salary and benefits are $160,000 per year, are employed setting up and breaking down the molding machines. An order consists of anywhere from 50,000 to 500,000 units. 80 orders were received during the year 2008 for individual custom production runs. The total number of units produced was 8 million.

-If the company allocates the cost of the setup mechanics based on the number of setups, the setup costs to be allocated to an order of 300,000 Nurturing Face Cream jar covers for Aristedes Cosmetics Company would be:

(Multiple Choice)

4.9/5  (36)

(36)

Maintenance of parts inventory for a specific toy in a toy production facility would be an example of:

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following statements is true regarding Activity-Based Costing ABC. unit-level costing?

(Multiple Choice)

5.0/5  (37)

(37)

It is always better to use activity-based costing information than to use average cost information.

(True/False)

4.9/5  (34)

(34)

Traditional cost accounting systems can be effective if the level of indirect costs is low relative to the level of direct costs and if the accuracy of the cost information is not critical to the company's success.

(True/False)

4.7/5  (36)

(36)

A cost-driver base should be based on the resource's practical capacity to support activities.

(True/False)

4.8/5  (40)

(40)

Use the following to answer questions:

Ferguson Molding Company produces custom bottle caps and jar covers for large cosmetic companies. Each customer owns the custom-made molds that are used for the caps and jar covers, so caps are produced only to customer order. Each order requires the setting of molds in molding machines. Two full time mechanics, whose combined total annual salary and benefits are $160,000 per year, are employed setting up and breaking down the molding machines. An order consists of anywhere from 50,000 to 500,000 units. 80 orders were received during the year 2008 for individual custom production runs. The total number of units produced was 8 million.

-Each production run of caps or jar covers is an example of

(Multiple Choice)

4.9/5  (34)

(34)

Many traditional cost accounting systems do not trace indirect costs to products.

(True/False)

4.9/5  (34)

(34)

Which of the following statements about activity based costing is not true?

(Multiple Choice)

4.8/5  (41)

(41)

Movement of materials for products in production is classified as:

(Multiple Choice)

4.7/5  (30)

(30)

Showing 21 - 40 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)