Exam 21: Risk Management

Exam 1: Corporate Finance and the Financial Manager91 Questions

Exam 2: Introduction to Financial Statement Analysis122 Questions

Exam 3: The Valuation Principle: the Foundation of Financial Decision Making120 Questions

Exam 4: The Time Value of Money101 Questions

Exam 5: Interest Rates118 Questions

Exam 6: Bonds122 Questions

Exam 7: Valuing Stocks122 Questions

Exam 8: Investment Decision Rules137 Questions

Exam 9: Fundamentals of Capital Budgeting107 Questions

Exam 10: Risk and Return in Capital Markets101 Questions

Exam 11: Systematic Risk and the Equity Risk Premium102 Questions

Exam 12: Determining the Cost of Capital106 Questions

Exam 13: Risk and the Pricing of Options112 Questions

Exam 14: Raising Equity Capital104 Questions

Exam 15: Debt Financing109 Questions

Exam 16: Capital Structure113 Questions

Exam 17: Payout Policy101 Questions

Exam 18: Financial Modelling and Pro Forma Analysis124 Questions

Exam 19: Working Capital Management122 Questions

Exam 20: Short Term Financial Planning105 Questions

Exam 21: Risk Management108 Questions

Exam 22: International Corporate Finance108 Questions

Exam 23: Leasing86 Questions

Exam 24: Mergers and Acquisitions81 Questions

Exam 25: Corporate Governance52 Questions

Select questions type

What is the percentage change in a 10-year zero-coupon bond with a duration of 10 years,when interest rates increase from 3% to 4%?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

________ is the sensitivity of a firm's assets and liabilities to interest rate changes.

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

C

How does insurance allow firms to increase their use of debt financing?

Free

(Essay)

4.9/5  (35)

(35)

Correct Answer:

Firms limit their leverage to avoid financial distress costs.Because insurance reduces the risk of financial distress,it can relax this trade-off and allow the firm to increase its use of debt financing.

Use the information for the question(s) below.

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

-If your firm is fully insured,the net present value (NPV)of implementing the new safety policies is closest to:

(Multiple Choice)

4.9/5  (38)

(38)

A firm wishes to buy fire insurance at its plant.The loss in case of fire is estimated to be $30 million and the probability of occurrence is 0.5% over the next year.If claims are paid at the end of the year and the annual risk-free rate is 10%,compute the insurance premium.

(Multiple Choice)

4.8/5  (37)

(37)

________ is one of the most common methods to reduce the risks related to business liability,business interruption,or loss of key personnel.

(Multiple Choice)

4.9/5  (39)

(39)

Adverse selection is a market friction that raises the cost of insurance.

(True/False)

4.7/5  (28)

(28)

Luther Industries needs to borrow $50 million in cash.Currently long-term AAA rates are 9%.Luther can borrow at 9.75% given its current credit rating.Luther is expecting interest rates to fall over the next few years,so it would prefer to borrow at the short-term rates and refinance after rates have dropped.Luther management is afraid,however,that its credit rating may fall which could greatly increase the spread the firm must pay on new borrowings.How can Luther benefit from the expected decline in future interest rates without exposure to the risk of the potential future changes to its credit rating?

(Essay)

4.7/5  (33)

(33)

A steel maker needs 5,000,000 tons of coal next year.The current market price for coal is $70.00 per ton.At this price,the firm expects its EBIT to be $500 million.What will the firm's EBIT if the firm enters into a supply contract for coal for a fixed price of $72.00 per ton?

(Multiple Choice)

4.7/5  (41)

(41)

The ________ is the annual fee a firm pays the insurance company in exchange for compensation in the event of a random future loss.

(Multiple Choice)

4.8/5  (30)

(30)

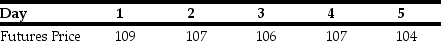

Use the table for the question(s) below.

-Suppose oil futures prices are as given in the above table (price per barrel).Suppose you sell 100 crude oil futures contracts,each for 1000 barrels of crude oil,at the current futures price of $108 per barrel on day 0.What is your cumulative profit/loss in your margin account by the end of day 5?

-Suppose oil futures prices are as given in the above table (price per barrel).Suppose you sell 100 crude oil futures contracts,each for 1000 barrels of crude oil,at the current futures price of $108 per barrel on day 0.What is your cumulative profit/loss in your margin account by the end of day 5?

(Multiple Choice)

4.9/5  (36)

(36)

The ability of a firm to pass on cost increases to its customers or revenue decreases to its suppliers is known as

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following is a customized agreement between two parties who are known to each other to trade an asset on some future date,at a price that is fixed today?

(Multiple Choice)

4.7/5  (36)

(36)

An interest rate that adjusts to current market conditions is called a(n)

(Multiple Choice)

4.8/5  (43)

(43)

A firm can borrow at a floating rate of LIBOR + 2.5% on short-term loans.If it swaps its short-term payments so that it receives LIBOR + 1.25% and pays a fixed rate of 3.75%,what is the rate of interest on its borrowing?

(Multiple Choice)

4.8/5  (41)

(41)

Heinz uses 2000 tons of corn syrup each year as an ingredient in its tomato ketchup products.Heinz is concerned about the increase in prices of corn-based products and purchases a fixed-price contract to buy corn syrup at $10,000 per ton.What is the impact on earnings before taxes as opposed to no hedging if the price of corn is $10,000 per ton over the next year?

(Multiple Choice)

4.8/5  (27)

(27)

To cover the costs that result if some aspect of the business causes harm to a third party or someone else's property,a firm would purchase

(Multiple Choice)

4.8/5  (38)

(38)

________ is method of hedging because a firm can lock in the cost of a commodity at today's prices plus any carrying costs.

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)