Exam 8: Investment Decision Rules

Exam 1: Corporate Finance and the Financial Manager91 Questions

Exam 2: Introduction to Financial Statement Analysis122 Questions

Exam 3: The Valuation Principle: the Foundation of Financial Decision Making120 Questions

Exam 4: The Time Value of Money101 Questions

Exam 5: Interest Rates118 Questions

Exam 6: Bonds122 Questions

Exam 7: Valuing Stocks122 Questions

Exam 8: Investment Decision Rules137 Questions

Exam 9: Fundamentals of Capital Budgeting107 Questions

Exam 10: Risk and Return in Capital Markets101 Questions

Exam 11: Systematic Risk and the Equity Risk Premium102 Questions

Exam 12: Determining the Cost of Capital106 Questions

Exam 13: Risk and the Pricing of Options112 Questions

Exam 14: Raising Equity Capital104 Questions

Exam 15: Debt Financing109 Questions

Exam 16: Capital Structure113 Questions

Exam 17: Payout Policy101 Questions

Exam 18: Financial Modelling and Pro Forma Analysis124 Questions

Exam 19: Working Capital Management122 Questions

Exam 20: Short Term Financial Planning105 Questions

Exam 21: Risk Management108 Questions

Exam 22: International Corporate Finance108 Questions

Exam 23: Leasing86 Questions

Exam 24: Mergers and Acquisitions81 Questions

Exam 25: Corporate Governance52 Questions

Select questions type

A brewery is considering adding a new line of craft beers to its product mix.The new beer will require additional brewing and bottling capacity at a cost of $15 million,but is expected to generate new sales of $5 million per year for the next 5 years.If the brewery has a cost of capital of 6%,what is the NPV of this investment?

Free

(Multiple Choice)

4.7/5  (29)

(29)

Correct Answer:

A

According to Graham and Harvey's 2001 survey (Figure 7.2 in the text),the most popular decision rules for capital budgeting used by CFOs are

Free

(Multiple Choice)

4.7/5  (39)

(39)

Correct Answer:

C

Mary is in contract negotiations with a publishing house for her new novel.She has two options.She may be paid $100,000 up front,and receive royalties that are expected to total $26,000 at the end of each of the next five years.Alternatively,she can receive $200,000 up front and no royalties.Which of the following investment rules would indicate that she should take the former deal,given a discount rate of 8%? Rule I: The Net Present Value rule

Rule II: The Payback Rule with a payback period of two years

Rule III: The internal rate of return (IRR)Rule

Free

(Multiple Choice)

4.7/5  (39)

(39)

Correct Answer:

A

Martin is offered an investment where for $5000 today,he will receive $5250 in one year.He decides to borrow $5000 from the bank to make this investment.What is the maximum interest rate the bank needs to offer on the loan if Martin is at least to break even on this investment?

(Multiple Choice)

4.8/5  (31)

(31)

How do you apply the Net Present Value rule when multiple projects are available and you have the added constraint of accepting only one project?

(Essay)

4.9/5  (32)

(32)

A security firm is offered $80,000 in one year for providing CCTV coverage of a property.The cost of providing this coverage to the security firm is $74,000,payable now,and the interest rate is 8.5%.Should the firm take the contract?

(Multiple Choice)

4.7/5  (41)

(41)

What can you comment about the shape of the net present value (NPV)profile of a multiple IRR project?

(Essay)

4.9/5  (34)

(34)

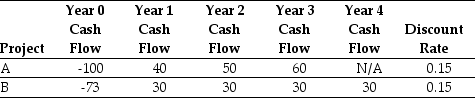

Use the information for the question(s) below.

-If WiseGuy Inc.uses the IRR rule to choose projects,which of the projects will rank highest?

-If WiseGuy Inc.uses the IRR rule to choose projects,which of the projects will rank highest?

(Multiple Choice)

4.8/5  (36)

(36)

You are trying to decide between three mutually exclusive investment opportunities.The most appropriate tool for identifying the correct decision is

(Multiple Choice)

4.8/5  (39)

(39)

You have an investment opportunity that will cost $10,000 today and will return $10,500 in one year.If interest rates are 8%,what is the NPV of this investment?

(Multiple Choice)

4.9/5  (32)

(32)

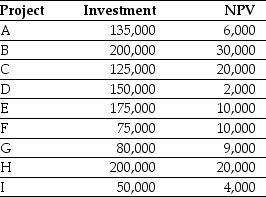

Use the table for the question(s) below.

Consider the following list of projects:

-Assume that your capital is constrained,so that you only have $500,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total net present value (NPV)for all the projects you invest in will be closest to:

-Assume that your capital is constrained,so that you only have $500,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total net present value (NPV)for all the projects you invest in will be closest to:

(Multiple Choice)

4.8/5  (30)

(30)

The profitability index can break down completely when dealing with multiple resource restraints.

(True/False)

4.7/5  (42)

(42)

Use the table for the question(s) below.

Consider the following list of projects:

-Assuming that your capital is constrained,which investment tool should you use to determine the correct investment decisions?

-Assuming that your capital is constrained,which investment tool should you use to determine the correct investment decisions?

(Multiple Choice)

4.8/5  (21)

(21)

A firm is considering several mutually exclusive investment opportunities.The best way to choose between them is which of the following?

(Multiple Choice)

4.9/5  (46)

(46)

A firm decides to purchase a 3D printer at a cost of $25,000,with an estimated useful life of 10 years.The printer will require servicing at a cost of $1,500 per year.What is the equivalent annual annuity of this deal,given a cost of capital of 8%?

(Multiple Choice)

4.8/5  (35)

(35)

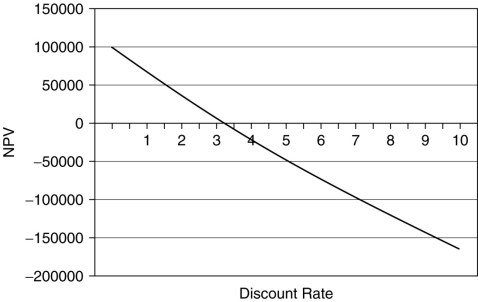

Use the information for the question(s) below.

-The owner of a hair salon spends $1,000,000 to renovate its premises,estimating that this will increase her cash flow by $220,000 per year.She constructs the above graph,which shows the net present value (NPV)as a function of the discount rate.If her discount rate is 6%,should she accept the project?

-The owner of a hair salon spends $1,000,000 to renovate its premises,estimating that this will increase her cash flow by $220,000 per year.She constructs the above graph,which shows the net present value (NPV)as a function of the discount rate.If her discount rate is 6%,should she accept the project?

(Multiple Choice)

4.8/5  (35)

(35)

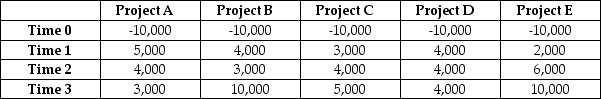

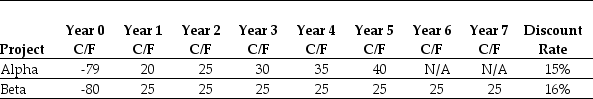

Use the table for the question(s) below.

Consider the following two projects:

-Why is the internal rate of return (IRR)inadequate when comparing mutually exclusive investments with different timing of the cash flows?

-Why is the internal rate of return (IRR)inadequate when comparing mutually exclusive investments with different timing of the cash flows?

(Essay)

4.8/5  (36)

(36)

An investor is considering the two investments shown above.Which of the following statements about these investments is true?

(Multiple Choice)

4.8/5  (37)

(37)

Use the table for the question(s) below.

Consider the following two projects:

-The net present value (NPV)for project alpha is closest to:

-The net present value (NPV)for project alpha is closest to:

(Multiple Choice)

4.9/5  (38)

(38)

Use the table for the question(s) below.

Consider the following two projects:

-The profitability index for project B is closest to:

-The profitability index for project B is closest to:

(Multiple Choice)

4.7/5  (36)

(36)

Showing 1 - 20 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)