Exam 14: Macroeconomics in an Open Economy

Exam 1: Economics: Foundations and Models160 Questions

Exam 2: Choices and Trade Offs in the Market192 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply201 Questions

Exam 4: Gdp: Measuring Total Production, Income and Economic Growth123 Questions

Exam 5: Economic Growth, the Financial System and Business Cycles132 Questions

Exam 6: Long-Run Economic Growth: Sources and Policies118 Questions

Exam 7: Unemployment120 Questions

Exam 8: Inflation110 Questions

Exam 9: Aggregate Expenditure and Output in the Short Run138 Questions

Exam 10: Aggregate Demand and Aggregate Supply Analysis134 Questions

Exam 11: Money, Banks and the Reserve Bank of Australia123 Questions

Exam 12: Monetary Policy116 Questions

Exam 13: Fiscal Policy163 Questions

Exam 14: Macroeconomics in an Open Economy141 Questions

Exam 15: The International Financial System145 Questions

Select questions type

Graph the demand for and supply of Australian dollars for euros. Suppose the Reserve Bank of Australia decides to follow a contractionary monetary policy. Show graphically and explain the effect of this policy on the demand and supply of dollars and the resulting change in the exchange rate of euros for dollars.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.9/5  (33)

(33)

Assume the exchange rate between the dollar and yen is ¥80= $1. Suppose that the exchange rate changes to ¥75 = $1. As a result of the change, there will be:

(Multiple Choice)

4.8/5  (39)

(39)

If the dollar appreciates against the yen, ceteris paribus, this will cause:

(Multiple Choice)

4.8/5  (29)

(29)

A large federal budget deficit will not lead to a current account deficit if private saving ________ or domestic investment ________.

(Multiple Choice)

4.8/5  (37)

(37)

In international exchange markets, a rise in interest rates in Australia, ceteris paribus, will cause the demand for dollars to ________ and the supply of dollars to ________.

(Multiple Choice)

4.7/5  (36)

(36)

Outline the three main components of the current account.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

5.0/5  (25)

(25)

The real exchange rate of British pounds to Australian dollars will increase if the British price level ________ and the nominal exchange rate of pounds to the dollar ________.

(Multiple Choice)

4.8/5  (43)

(43)

Experiences of other countries show support for the twin deficits hypothesis.

(True/False)

4.6/5  (28)

(28)

Which of the following would decrease the size of the deficit in the current account of Australia?

(Multiple Choice)

4.8/5  (34)

(34)

Suppose that interest rates decrease in Japan and at the same time the Japanese economy is experiencing a recession. What will happen to the value of the dollar relative to the yen?

(Multiple Choice)

4.9/5  (28)

(28)

If foreign holdings of Australian dollars decrease, holding all else constant, the:

(Multiple Choice)

4.9/5  (41)

(41)

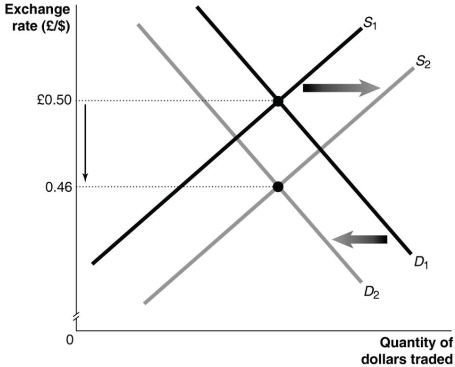

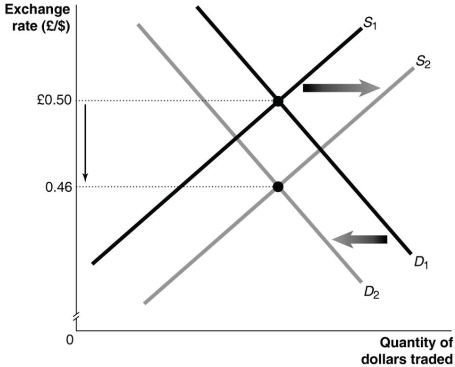

Refer to Figure 14.1 for the following questions.

Figure 14.1

-Consider the market for dollars against the British pound shown in Figure 14.1. From this graph, we can conclude that the dollar price of a British pound has ________ to ________ dollars per pound.

-Consider the market for dollars against the British pound shown in Figure 14.1. From this graph, we can conclude that the dollar price of a British pound has ________ to ________ dollars per pound.

(Multiple Choice)

4.9/5  (33)

(33)

Assume that the exchange rate between the dollar and the euro is €0.6 = $1. Suppose the exchange rate changes to €0.50 = $1. Because of the change:

(Multiple Choice)

4.9/5  (40)

(40)

Suppose that the world is currently experiencing a period of strong economic growth. Both the European Union and Australia experience robust increases in income. Illustrate how this will affect the exchange rate using a graph of the demand and supply of dollars for euros. Will the dollar appreciate or depreciate against the euro? Explain why.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.9/5  (44)

(44)

Which of the following is a 'capital outflow' from Australia?

(Multiple Choice)

4.7/5  (41)

(41)

Refer to Figure 14.1 for the following questions.

Figure 14.1

-Refer to Figure 14.1. Which of the following events cause the shifts in the supply and demand curves in the market for dollars against the British pound shown in the graph above?

-Refer to Figure 14.1. Which of the following events cause the shifts in the supply and demand curves in the market for dollars against the British pound shown in the graph above?

(Multiple Choice)

4.8/5  (38)

(38)

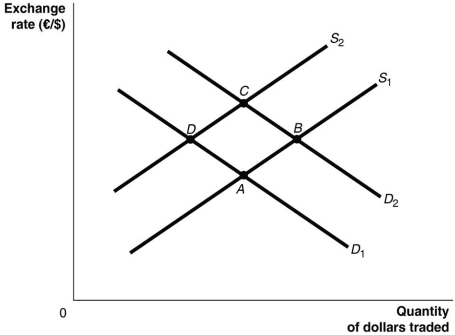

Refer to Figure 14.2 for the following questions.

Figure 14.2

-Refer to Figure 14.2. Suppose that Italians reduce their demand for Australian steel by half. Assuming all else remains constant, this would be represented as a movement from:

-Refer to Figure 14.2. Suppose that Italians reduce their demand for Australian steel by half. Assuming all else remains constant, this would be represented as a movement from:

(Multiple Choice)

4.8/5  (36)

(36)

A federal budget deficit may ________ exchange rates (foreign currency per domestic currency)and ________ the balance of trade for goods and services.

(Multiple Choice)

4.9/5  (38)

(38)

Since the 1970s, Australia's imports and exports have both grown from less than ________ of GDP, to approximately ________ of GDP by 2016.

(Multiple Choice)

4.8/5  (46)

(46)

Showing 21 - 40 of 141

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)