Exam 16: Working Capital Policy and Short-term Financing

Exam 1: The Role and Objective of Financial Management81 Questions

Exam 2: The Domestic and International Financial Marketplace78 Questions

Exam 3: Evaluation of Financial Performance104 Questions

Exam 4: Financial Planning and Forecasting67 Questions

Exam 5: The Time Value of Money113 Questions

Exam 6: Fixed Income Securities: Characteristics and Valuation126 Questions

Exam 7: Common Stock: Characteristics, Valuation, and Issuance114 Questions

Exam 8: Analysis of Risk and Return114 Questions

Exam 9: Capital Budgeting and Cash Flow Analysis92 Questions

Exam 10: Capital Budgeting: Decision Criteria and Real Option Considerations106 Questions

Exam 11: Capital Budgeting and Risk78 Questions

Exam 12: The Cost of Capital104 Questions

Exam 13: Capital Structure Concepts75 Questions

Exam 14: Capital Structure Management in Practice85 Questions

Exam 15: Dividend Policy96 Questions

Exam 16: Working Capital Policy and Short-term Financing81 Questions

Exam 17: The Management of Cash and Marketable Securities80 Questions

Exam 18: Management of Accounts Receivable and Inventories80 Questions

Exam 19: Lease and Intermediate-term Financing52 Questions

Exam 20: Financing With Derivatives80 Questions

Exam 21: Risk Management49 Questions

Exam 22: International Financial Management51 Questions

Exam 23: Corporate Restructuring75 Questions

Exam 24: Continuous Compounding and Discounting28 Questions

Exam 25: Mutually Exclusive Investments Having Unequal Lives21 Questions

Exam 26: Breakeven Analysis23 Questions

Exam 27: Bond Refunding Analysis19 Questions

Exam 28: Taxes19 Questions

Select questions type

What is the length of the cash conversion cycle for a firm with annual sales (all cash) of $280,000, an inventory conversion period of 35 days, and a payables deferral period of 25 days.

(Multiple Choice)

4.7/5  (43)

(43)

Lenders normally feel that the relative risk associated with short-term debt is ____ the risk associated with long-term debt.

(Multiple Choice)

4.8/5  (41)

(41)

Fluctuating current assets are those assets that are affected by:

(Multiple Choice)

5.0/5  (35)

(35)

The ____ shows the time interval over which additional non-spontaneous sources of working capital financing must be obtained to carry out the firm's activities.

(Multiple Choice)

4.8/5  (43)

(43)

Under a conservative approach to working capital management, a firm tends to hold a relatively ____ proportion of its total assets in the form of current assets.

(Multiple Choice)

4.8/5  (36)

(36)

Many ____ contain provisions requiring firms to maintain a minimum net working capital provision.

(Multiple Choice)

4.9/5  (36)

(36)

The length of the operating cycle for a firm is equal to the length of the

(Multiple Choice)

4.7/5  (30)

(30)

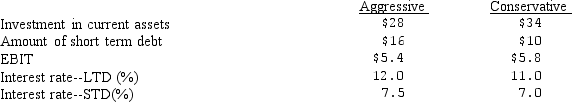

Cisco Systems wishes to analyze the joint impact of its working capital investment and financing policies on shareholder return. The company has $24 million in fixed assets. Cisco wishes to maintain a debt ratio of 40%. The company's tax rate is also 40%. The following information was developed for the two policies under consideration (dollars in millions):  For the aggressive approach, Cisco's ROE is ____ and for the conservative approach the ROE is ____.

For the aggressive approach, Cisco's ROE is ____ and for the conservative approach the ROE is ____.

(Multiple Choice)

4.8/5  (32)

(32)

Tefft Industries has an average inventory of $170,000, sells on terms of 2/10, net 30, and its cost of sales is $540,000. What is Tefft's inventory conversion period?

(Multiple Choice)

4.8/5  (42)

(42)

The ____ assets are those that are affected by the seasonal or cyclical nature of company sales.

(Multiple Choice)

4.9/5  (32)

(32)

A firm's net working capital position is a widely used measure of its ____.

(Multiple Choice)

4.8/5  (36)

(36)

Great Skot expects to have cash receipts in June of $532,160. Skot's cash disbursements in June are $581,720, including an interest payment on a bond issue of $32,000. If Skot wishes to maintain a cash balance of $40,000, how much will Skot have to borrow if it started the month with a cash balance of $52,000?

(Multiple Choice)

4.7/5  (29)

(29)

The ____ is the optimal working capital investment and financing policy.

(Multiple Choice)

4.9/5  (35)

(35)

Runners Ink, Inc. had sales last year of $700,000 and 35 percent of its sales are for cash, with the remainder buying on terms of net 30 days. If the receivables conversion period is actually 38 days, what is Runners Ink's accounts receivable?

(Multiple Choice)

4.8/5  (36)

(36)

Explain how a firm uses commercial paper as a short-term financing source and explain the disadvantage of using this form of financing.

(Essay)

4.8/5  (37)

(37)

The firm's inventory conversion period (measured in days) is equal to its average inventory divided by its ____.

(Multiple Choice)

4.9/5  (41)

(41)

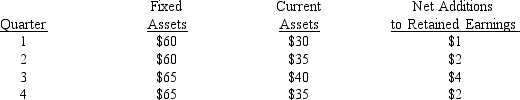

Barnes Company has highly seasonal sales and financing requirements. Barnes has made the following projections of its asset needs and net additions to retained earnings over the next year (in $ million).  Net worth (equity) at the beginning of the year is $50 million. The company does not plan to sell any new equity during the coming year. Assume that Barnes follows a matching approach to finance its assets, i.e., long-term debt and equity are used to finance fixed and permanent current assets and short-term debt is used to finance fluctuating current assets. Determine the amount of long-term and short-term debt respectively outstanding at the end of the third quarter ($ million).

Net worth (equity) at the beginning of the year is $50 million. The company does not plan to sell any new equity during the coming year. Assume that Barnes follows a matching approach to finance its assets, i.e., long-term debt and equity are used to finance fixed and permanent current assets and short-term debt is used to finance fluctuating current assets. Determine the amount of long-term and short-term debt respectively outstanding at the end of the third quarter ($ million).

(Multiple Choice)

4.8/5  (38)

(38)

All other things being equal, a policy of holding a relatively ____ proportion of the firm's total assets in the form of current assets will tend to result in a ____ risk of the firm encountering financial difficulties.

(Multiple Choice)

4.7/5  (34)

(34)

Showing 61 - 80 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)