Exam 16: Uncertainty

Exam 1: Introduction43 Questions

Exam 2: Supply and Demand226 Questions

Exam 3: A Consumers Constrained Choice129 Questions

Exam 4: Demand123 Questions

Exam 5: Consumer Welfare and Policy Analysis73 Questions

Exam 6: Firms and Production111 Questions

Exam 7: Costs132 Questions

Exam 8: Competitive Firms and Markets112 Questions

Exam 9: Properties and Applications of the Competitive Model101 Questions

Exam 10: General Equilibrium and Economic Welfare108 Questions

Exam 11: Monopoly and Monopsony141 Questions

Exam 12: Pricing and Advertising91 Questions

Exam 13: Game Theory84 Questions

Exam 14: Oligopoly and Monopolistic Competition114 Questions

Exam 15: Factor Markets115 Questions

Exam 16: Uncertainty103 Questions

Exam 17: Property Rights, externalities, rivalry, and Exclusion105 Questions

Exam 18: Asymmetric Information85 Questions

Exam 19: Contracts and Moral Hazards79 Questions

Select questions type

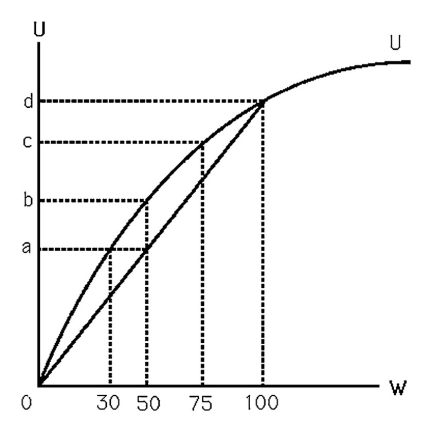

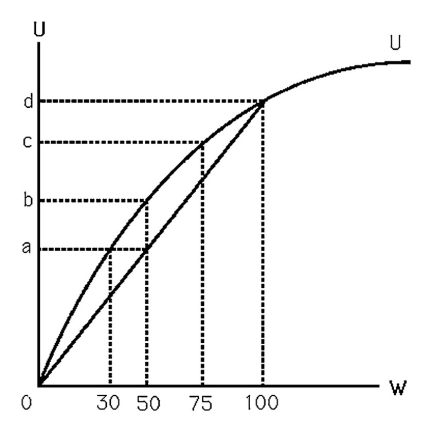

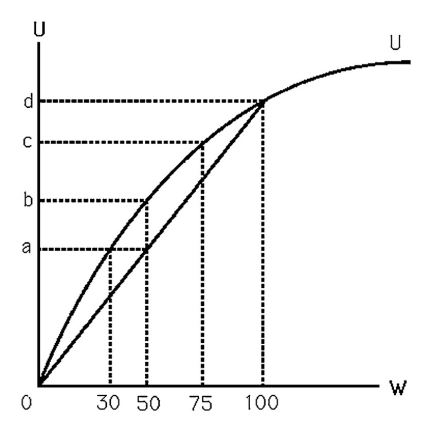

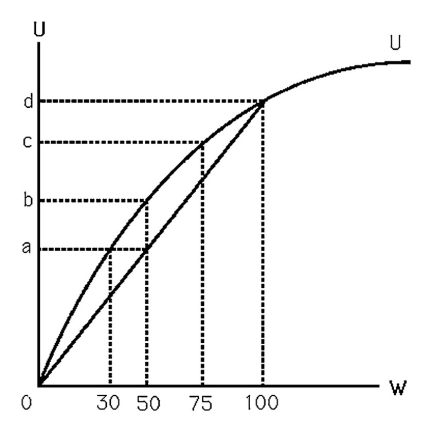

16.2 Attitudes Toward Risk

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob's expected wealth is

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob's expected wealth is

(Multiple Choice)

4.8/5  (32)

(32)

Assume the following.In location A yearly temperatures range from -30°F to 100°F and in location B yearly temperatures range from 55°F to 75°F.In both locations the average yearly temperature equals 65°F.We can conclude that

(Multiple Choice)

4.8/5  (34)

(34)

Sarah has the utility function U(x)= 1 - 1/x,where x is the present value of her lifetime income.Sarah is trying to select a career.If she goes into teaching,she will make x=5 with certainty.If she pursues acting,she will make x=400 if successful or x=2 if unsuccessful (and therefore ends up waiting tables).The chance of succeeding in acting is 1% if she pursues acting.

a.Determine which career Sarah will choose.Is she choosing the career with the higher expected value? Explain.

b.An acting career expert charges 0.01 to determine if a person will succeed at acting.By going to an expert,Sarah can choose the best career according to her skills.Assuming that the expert is able to correctly determine if Sarah will be a successful actor,will she pay for this service?

(Essay)

4.9/5  (40)

(40)

Why would a usury law result in banks making less credit available to low-income households?

(Essay)

4.8/5  (42)

(42)

Your friend Dimitre tells you that he thinks that his favorite basketball team has a 70% chance of winning the next game.This is an example of

(Multiple Choice)

5.0/5  (35)

(35)

What type of risk behavior does the person exhibit who is willing to pay $5 for the chance to bet $60 on a game where 20% of the time the bet returns $100,and 80% of the time returns $50? Explain.

(Essay)

4.8/5  (37)

(37)

16.2 Attitudes Toward Risk

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

(Multiple Choice)

4.8/5  (29)

(29)

-Bob's utility function is shown in the above Figure.He currently has $100 worth of property,but there is a 50% chance that all of it will be stolen.An insurance company offers to reimburse Bob for his loss if the money is stolen.What is the most that Bob would pay for such a policy? Explain.

-Bob's utility function is shown in the above Figure.He currently has $100 worth of property,but there is a 50% chance that all of it will be stolen.An insurance company offers to reimburse Bob for his loss if the money is stolen.What is the most that Bob would pay for such a policy? Explain.

(Essay)

4.8/5  (39)

(39)

Explain why insurance companies usually do not offer earthquake insurance.

(Essay)

4.8/5  (36)

(36)

16.2 Attitudes Toward Risk

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob's expected utility is

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob's expected utility is

(Multiple Choice)

4.9/5  (36)

(36)

Alvin's utility function is U = W.Barry's utility function is U = W².Carl's utility function is U = W⁰.⁵.Each has wealth of only $100.An investment of that $100 has a 10% chance of netting $1,000 and a 90% chance of netting a loss of that $100.Who among the three will make the investment?

(Essay)

4.8/5  (34)

(34)

Bob invests $75 in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.From this information we can conclude that Bob is

(Multiple Choice)

4.8/5  (37)

(37)

Catherine is risk-averse.When faced with a choice between a gamble and a certain level of wealth,she will

(Multiple Choice)

4.9/5  (39)

(39)

Why does diversification fail to reduce risk when the returns of the two investments purchased are perfectly positively correlated?

(Essay)

4.7/5  (32)

(32)

For the following, please answer "True" or "False" and explain why.

-If insurance is fairly priced,a risk-averse individual will purchase enough insurance to cover the full amount of the possible loss.

(True/False)

4.8/5  (28)

(28)

Showing 21 - 40 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)