Exam 11: Decision Making and Relevant Information

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

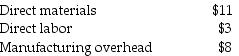

A product cost is composed of the following:

The product sells for $40 and a 15% commission is paid to a salesperson for every unit sold. Management accountants also estimate that storage cost per unit averages $0.75 per unit. What is the full cost of the product?

The product sells for $40 and a 15% commission is paid to a salesperson for every unit sold. Management accountants also estimate that storage cost per unit averages $0.75 per unit. What is the full cost of the product?

(Multiple Choice)

4.7/5  (31)

(31)

One-time-only special orders should only be accepted if ________.

(Multiple Choice)

4.9/5  (35)

(35)

Sarasota Bicycles has been manufacturing its own wheels for its bikes. The company is currently operating at 100% capacity, and variable manufacturing overhead is charged to production at the rate of 30% of direct labor cost. The direct materials and direct labor cost per unit to make the wheels are $3.00 and $3.60 respectively. Normal production is 200,000 wheels per year.

A supplier offers to make the wheels at a price of $8 each. If the bicycle company accepts this offer, all variable manufacturing costs will be eliminated, but the $84,000 of fixed manufacturing overhead currently being charged to the wheels will have to be absorbed by other products.

Required:

a.Prepare an incremental analysis for the decision to make or buy the wheels.

b.Should Sarasota Bicycles buy the wheels from the outside supplier? Justify your answer.

(Essay)

4.8/5  (39)

(39)

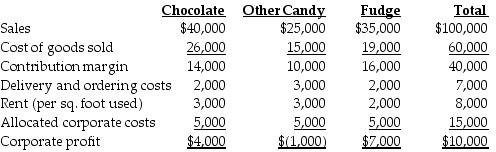

The management accountant for the Chocolate S'more Company has prepared the following income statement for the most current year:

a.Do you recommend discontinuing the Other Candy product line? Why or why not?

b.If the Chocolate product line had been discontinued, corporate profits for the current year would have decreased by what amount?

a.Do you recommend discontinuing the Other Candy product line? Why or why not?

b.If the Chocolate product line had been discontinued, corporate profits for the current year would have decreased by what amount?

(Essay)

4.9/5  (31)

(31)

When deciding to accept a one-time-only special order from a wholesaler, management should ________.

(Multiple Choice)

4.8/5  (38)

(38)

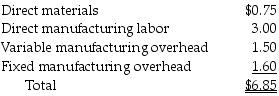

Rockford Company manufactures a part for use in its production of hats. When 10,000 items are produced, the costs per unit are:

Angel Company has offered to sell to Rockford Company 10,000 units of the part for $6.00 per unit. The plant facilities could be used to manufacture another item at a savings of $9,000 if Rockford accepts the offer. In addition, $1.00 per unit of fixed manufacturing overhead on the original item would be eliminated.

Required:

a.What is the relevant per unit cost for the original part?

b.Which alternative is best for Rockford Company? By how much?

Angel Company has offered to sell to Rockford Company 10,000 units of the part for $6.00 per unit. The plant facilities could be used to manufacture another item at a savings of $9,000 if Rockford accepts the offer. In addition, $1.00 per unit of fixed manufacturing overhead on the original item would be eliminated.

Required:

a.What is the relevant per unit cost for the original part?

b.Which alternative is best for Rockford Company? By how much?

(Essay)

4.9/5  (25)

(25)

Loft Lake Cabinets is approached by Ms. Jenny Zhang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Loft Lake Cabinets has excess capacity. Ms. Zhang wants the cabinets in cherry rather than oak, so direct material costs will increase by $15 per unit.

Required:

a.For Loft Lake Cabinets, what is the minimum acceptable price of this one-time-only special order?

b.Other than price, what other items should Loft Lake Cabinets consider before accepting this one-time-only special order?

c.How would the analysis differ if there was limited capacity?

Loft Lake Cabinets has excess capacity. Ms. Zhang wants the cabinets in cherry rather than oak, so direct material costs will increase by $15 per unit.

Required:

a.For Loft Lake Cabinets, what is the minimum acceptable price of this one-time-only special order?

b.Other than price, what other items should Loft Lake Cabinets consider before accepting this one-time-only special order?

c.How would the analysis differ if there was limited capacity?

(Essay)

4.9/5  (34)

(34)

Top management faces a persistent challenge to make sure that the performance evaluation model of lower level managers is ________.

(Multiple Choice)

4.9/5  (43)

(43)

Direct materials are $600, direct labor is $450, variable overhead costs are $650, and fixed overhead costs are $400. The cost of one unit is ________.

(Multiple Choice)

4.8/5  (34)

(34)

Determining which products should be produced when the plant is operating at full capacity is referred to as a(n) ________.

(Multiple Choice)

4.9/5  (29)

(29)

When deciding whether to discontinue a segment of a business, relevant costs include ________.

(Multiple Choice)

4.9/5  (31)

(31)

Incremental revenue is the sum of differential revenues of two alternatives.

(True/False)

4.9/5  (30)

(30)

Planet Furniture, Inc. is currently producing well below its full capacity. The Swansea Company has approached Plant with an offer to buy 5,000 tools at $17.50 each. Planet sells its end table for $18.50 each; the average cost per unit is $18.30, of which $2.70 is fixed costs. If Planet accepts the order, the increase in operating income will be $7,500.

(True/False)

4.9/5  (43)

(43)

Which of the following costs always differ among future alternatives?

(Multiple Choice)

4.9/5  (30)

(30)

Relevant data in a make-or-buy decision of a part include which of the following?

(Multiple Choice)

4.8/5  (40)

(40)

Under what conditions might a manufacturing firm sell a product for less than its long-term price? Why?

(Essay)

4.9/5  (38)

(38)

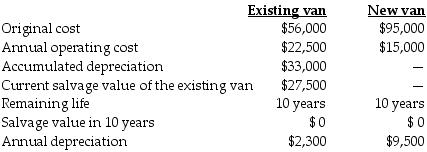

Hartley's Meat Pies is considering replacing its existing delivery van with a new one. The new van can offer considerable savings in operating costs. Information about the existing van and the new van follow:

If Hartley's Meat Pies replaces the existing delivery van with the new one, over the next 10 years operating income will ________.

If Hartley's Meat Pies replaces the existing delivery van with the new one, over the next 10 years operating income will ________.

(Multiple Choice)

4.8/5  (40)

(40)

Showing 101 - 120 of 218

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)