Exam 11: Decision Making and Relevant Information

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

Altec Services Corporation has relevant costs of $46 per unit to manufacture 1,050 units of Part A. A current supplier offers to make Part A for $33 per unit. Alternatively, the company can rent out the capacity for $30,000. If capacity is constrained, the opportunity cost of buying Part A from the supplier is ________.

(Multiple Choice)

4.9/5  (35)

(35)

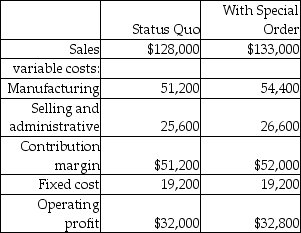

Snapper Tool Company has plenty of excess capacity to accept a special order. Shown below is an "what-if" analysis of the special order. Which of the following is the correct decision and reason?

(Multiple Choice)

4.7/5  (38)

(38)

The best way to avoid misidentification of relevant costs is to focus on ________.

(Multiple Choice)

4.8/5  (32)

(32)

Avoidable variable and fixed costs should be considered relevant when deciding whether to discontinue a product, product line, business segment, or customer.

(True/False)

4.9/5  (32)

(32)

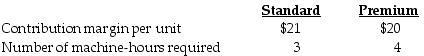

Kinnane's Fine Furniture manufactures two models, Standard and Premium. Weekly demand is estimated to be 100 units of the Standard Model and 70 units of the Premium Model. The following per unit data apply:

If there are 720 machine-hours available per week, how many rockers of each model should Kinnane produce to maximize profits?

If there are 720 machine-hours available per week, how many rockers of each model should Kinnane produce to maximize profits?

(Multiple Choice)

4.9/5  (37)

(37)

Dantley's Furniture manufactures rustic furniture. The cost accounting system estimates manufacturing costs to be $190 per table, consisting of 80% variable costs and 20% fixed costs. The company has surplus capacity available. It is Back Forrest's policy to add a 45% markup to full costs. Dantley's Furniture is invited to bid on a one-time-only special order to supply 180 rustic tables. What is the lowest price Dantley's Furniture should bid on this special order?

(Multiple Choice)

4.8/5  (37)

(37)

The rent paid for an already existing facility is an example of a sunk cost.

(True/False)

4.7/5  (34)

(34)

Which of the following minimizes the risks of outsourcing?

(Multiple Choice)

4.9/5  (37)

(37)

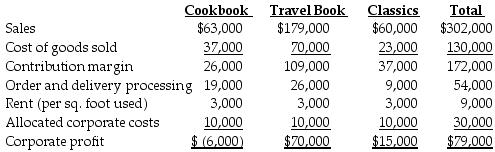

The management accountant for Giada's Book Store has prepared the following income statement for the most current year:

If the cookbook product line had been discontinued prior to this year, the company would have reported ________.

If the cookbook product line had been discontinued prior to this year, the company would have reported ________.

(Multiple Choice)

4.8/5  (32)

(32)

Computer Products produces two keyboards, Regular and Special. Regular keyboards have a unit contribution margin of $128, and Special keyboards have a unit contribution margin of $720. The demand for Regulars exceeds Computer Product's production capacity, which is limited by available machine-hours and direct manufacturing labor-hours. The maximum demand for Special keyboards is 80 per month. Management desires a product mix that will maximize the contribution toward fixed costs and profits.

Direct manufacturing labor is limited to 1,600 hours a month and machine-hours are limited to 1,200 a month. The Regular keyboards require 20 hours of labor and 8 machine-hours. Special keyboards require 34 labor-hours and 20 machine-hours.

Let R represent Regular keyboards and S represent Special keyboards. The correct set of equations for the keyboard production process is ________.

(Multiple Choice)

4.9/5  (39)

(39)

Depreciation allocated to a product line is a relevant cost when deciding to discontinue that product.

(True/False)

4.8/5  (37)

(37)

Linear programming is a tool that maximizes total contribution margin of a mix of products with multiple constraints.

(True/False)

4.8/5  (33)

(33)

For managers attempting to maximize operating income for a product offering with a great deal of variety, product-mix decisions must usually take into account:

(Multiple Choice)

4.9/5  (38)

(38)

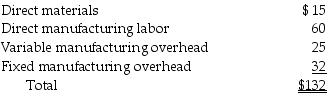

Lewis S. Gray Inc. manufactures a part for use in its production of art deco furniture. When 10,000 items are produced, the costs per unit are:

Colonial Accents Company has offered to sell to Lewis S. Gray 10,000 units of the part for $125 per unit. The plant facilities could be used to manufacture another part at a savings of $180,000 if Lewis S. Gray accepts the supplier's offer. In addition, $30 per unit of fixed manufacturing overhead on the original part would be eliminated.

Required:

a.What is the relevant per unit cost for the original part?

b.Which alternative is best for Lewis S. Gray Company? By how much?

Colonial Accents Company has offered to sell to Lewis S. Gray 10,000 units of the part for $125 per unit. The plant facilities could be used to manufacture another part at a savings of $180,000 if Lewis S. Gray accepts the supplier's offer. In addition, $30 per unit of fixed manufacturing overhead on the original part would be eliminated.

Required:

a.What is the relevant per unit cost for the original part?

b.Which alternative is best for Lewis S. Gray Company? By how much?

(Essay)

4.7/5  (41)

(41)

For make-or-buy decisions, relevant costs include ________.

(Multiple Choice)

4.8/5  (49)

(49)

Differential revenue is the additional total revenue from an activity.

(True/False)

4.8/5  (35)

(35)

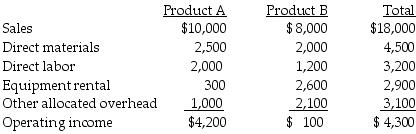

Biden Company sells two items, product A and product B. The company is considering dropping product B. It is expected that sales of product A will increase by 40% as a result. Dropping product B will allow the company to cancel its monthly equipment rental costing $200 per month. The other existing equipment will be used for additional production of product A. One employee earning $500 per month can be terminated if product B production is dropped. Biden's other fixed costs are allocated and will continue regardless of the decision made. A condensed, budgeted monthly income statement with both products follows:

Required:

Prepare an incremental analysis to determine the financial effect of dropping product B.

Required:

Prepare an incremental analysis to determine the financial effect of dropping product B.

(Essay)

4.9/5  (27)

(27)

Showing 141 - 160 of 218

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)