Exam 17: Process Costing

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

Standard costing is NOT possible in a firm that uses process costing.

(True/False)

5.0/5  (38)

(38)

Underestimating the degree of completion of ending work in process leads to increase in operating income.

(True/False)

4.9/5  (36)

(36)

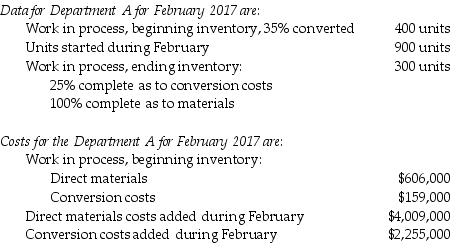

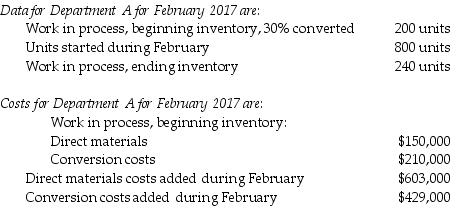

Audrey Auto Accessories manufactures plastic moldings for car seats. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

What were the equivalent units of direct materials and conversion costs, respectively, at the end of February? Assume Audrey uses the weighted-average process costing method.

What were the equivalent units of direct materials and conversion costs, respectively, at the end of February? Assume Audrey uses the weighted-average process costing method.

(Multiple Choice)

4.9/5  (29)

(29)

The cost of units completed can differ materially between the weighted average and the FIFO methods of process costing.

(True/False)

4.8/5  (38)

(38)

The Swivel Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 145,000 chairs. During the month, the firm completed 184,000 chairs and transferred them to the Finishing Department. The firm ended the month with 19,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Swivel. What were the equivalent units for materials for February?

(Multiple Choice)

4.7/5  (39)

(39)

A hybrid-costing system is a variant of process-costing that allows it to incorporate benefits of standard costing and activity-based costing.

(True/False)

4.9/5  (34)

(34)

When a company has no opening or ending inventory during the month, the cost per unit is calculated by dividing the total costs incurred in the period by the total units produced during the period.

(True/False)

4.9/5  (38)

(38)

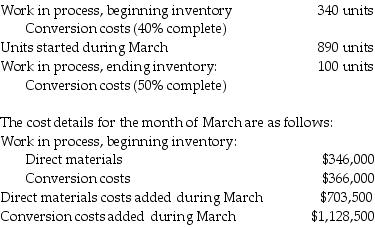

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2017 for the Assembly department.

What are the equivalent units for direct materials and conversion costs, respectively, for March?

What are the equivalent units for direct materials and conversion costs, respectively, for March?

(Multiple Choice)

4.8/5  (36)

(36)

The accounting entry to record the conversion cost of the Assembly Department is:

Work in Process-Assembly Department

Accounts Payable Control

(True/False)

4.9/5  (34)

(34)

Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

How many units were completed and transferred out of Department A during February?

How many units were completed and transferred out of Department A during February?

(Multiple Choice)

4.8/5  (42)

(42)

Bright Colors Company placed 315,000 gallons of direct materials into the mixing process. All direct materials are placed in mixing at the beginning of the process and conversion costs occur evenly during the process. Bright Colors uses weighted-average costing. The initial forecast for the end of the month was to have 75,000 gallons still in process, 15% converted as to labor and factory overhead.

Required:

a.Determine the total equivalent units (in process and transferred out) for direct materials and for conversion costs, assuming there was no beginning inventory.

b.With the installation of a new paint processing filtration device, the forecast for the end of the month was to have 50,000 gallons still in process, 70% converted as to labor and factory overhead. In this event, determine the equivalent units (in process and transferred out) for direct materials and for conversion costs, assuming there was no beginning inventory.

(Essay)

4.9/5  (35)

(35)

Under standard costing the cost per equivalent-unit calculation is more difficult than in either weighted average or FIFO.

(True/False)

4.8/5  (29)

(29)

An assumption of the FIFO process-costing method is that ________.

(Multiple Choice)

4.8/5  (38)

(38)

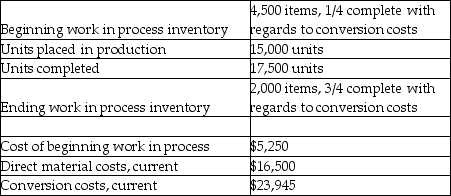

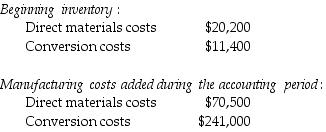

Pet Products Company uses an automated process to manufacture its pet replica products. For June, the company had the following activities:

Direct materials are placed into production at the beginning of the process and conversion costs are incurred evenly throughout the process.

Required:

Prepare a production cost worksheet using the FIFO method.

Direct materials are placed into production at the beginning of the process and conversion costs are incurred evenly throughout the process.

Required:

Prepare a production cost worksheet using the FIFO method.

(Essay)

4.8/5  (42)

(42)

Which of the following companies is most likely to use process costing?

(Multiple Choice)

4.9/5  (33)

(33)

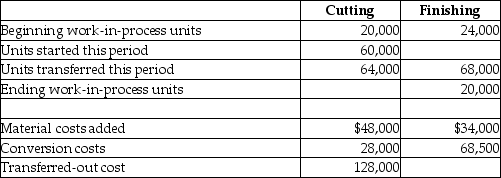

Lexington Company produces baseball bats and cricket paddles. It has two departments that process all products. During July, the beginning work in process in the cutting department was half completed as to conversion, and complete as to direct materials. The beginning inventory included $40,000 for materials and $60,000 for conversion costs. Ending work-in-process inventory in the cutting department was 40% complete. Direct materials are added at the beginning of the process.

Beginning work in process in the finishing department was 80% complete as to conversion. Direct materials for finishing the units are added near the end of the process. Beginning inventories included $24,000 for transferred-in costs and $28,000 for conversion costs. Ending inventory was 30% complete. Additional information about the two departments follows:

Required:

Prepare a production cost worksheet, using FIFO for the finishing department.

Required:

Prepare a production cost worksheet, using FIFO for the finishing department.

(Essay)

4.8/5  (37)

(37)

Jane Industries manufactures plastic toys. During October, Jane's Fabrication Department started work on 10,300 models. During the month, the company completed 11,900 models, and transferred them to the Distribution Department. The company ended the month with 1100 models in ending inventory. There were 2700 models in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is being followed. Beginning work in process was 25% complete as to conversion costs, while ending work in process was 50% complete as to conversion costs.

How many of the units that were started and completed during October?

How many of the units that were started and completed during October?

(Multiple Choice)

4.9/5  (36)

(36)

Managers find operation costing useful in cost management because it ________.

(Multiple Choice)

4.7/5  (40)

(40)

Showing 81 - 100 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)