Exam 12: Inventory and Supply Chain Models

Exam 1: Introduction to Modeling30 Questions

Exam 2: Introduction to Spreadsheet Modeling30 Questions

Exam 3: Introduction to Optimization Modeling30 Questions

Exam 4: Linear Programming Models31 Questions

Exam 5: Network Models30 Questions

Exam 6: Optimization Models With Integer Variables30 Questions

Exam 7: Nonlinear Optimization Models30 Questions

Exam 8: Evolutionary Solver: An Alternative Optimization Procedure30 Questions

Exam 9: Decision Making Under Uncertainty30 Questions

Exam 10: Introduction to Simulation Modeling30 Questions

Exam 11: Simulation Models30 Questions

Exam 12: Inventory and Supply Chain Models30 Questions

Exam 13: Queuing Models30 Questions

Exam 14: Regression and Forecasting Models30 Questions

Select questions type

Which of the following is not one of the important issues in inventory models?

Free

(Multiple Choice)

4.7/5  (35)

(35)

Correct Answer:

C

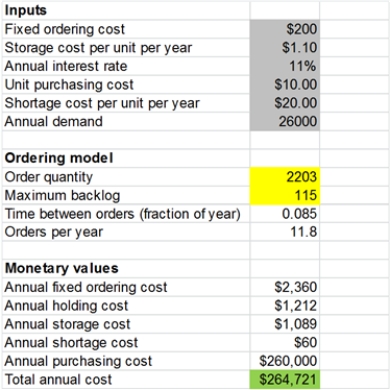

Exhibit 12-3The North Slope clothing store chain sells approximately 26,000 units of its most popular cotton sweater each year. North Slope buys these sweaters from a manufacturer located in Canada. The fixed cost of placing an order for this particular product is $200. North Slope pays $10 for each cotton sweater. The company's cost of capital is 11%, and the cost of storing a sweater for one year is $1.10. While North Slope prefers not to backlog customer demand, management of the company believes that it can afford to run out of sweaters on an occasional basis. The company estimates that the shortage cost per sweater per year is about $20.

-Refer to Exhibit 12-3. Formulate a Solver model and find the optimal order quantity for the cotton sweaters. What is the optimal order? How much, if any, is the maximum backlog?

Free

(Essay)

4.9/5  (45)

(45)

Correct Answer:

The optimized model below shows an optimal order quantity is about 2,200. The maximum backlog in that case is just over 115 sweaters.

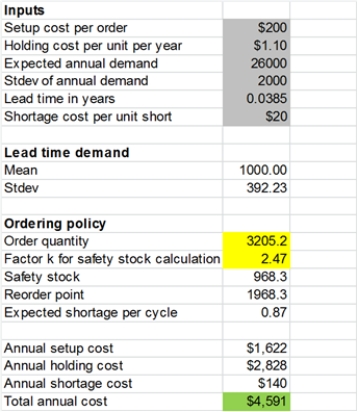

Exhibit 12-3The North Slope clothing store chain sells approximately 26,000 units of its most popular cotton sweater each year. North Slope buys these sweaters from a manufacturer located in Canada. The fixed cost of placing an order for this particular product is $200. North Slope pays $10 for each cotton sweater. The company's cost of capital is 11%, and the cost of storing a sweater for one year is $1.10. While North Slope prefers not to backlog customer demand, management of the company believes that it can afford to run out of sweaters on an occasional basis. The company estimates that the shortage cost per sweater per year is about $20.

-Refer to Exhibit 12-3. Suppose the annual demand for the sweaters is not known with certainty, but rather is estimated to be normally distributed with mean 26,000 and standard deviation 2,000. Formulate a Solver model to find the optimal (R,Q) policy by minimizing the North Slope's expected annual cost. What is the policy, and what is the total annual cost?

Free

(Essay)

4.8/5  (27)

(27)

Correct Answer:

North Slope should reorder 3205 sweaters whenever the inventory drops to about 1968 units, which produces a minimized annual cost of $4,591.

Uncertainty about lead time in a probabilistic inventory model adds to the uncertainty about the demand during lead time.

(True/False)

4.8/5  (37)

(37)

In an economic order quantity (EOQ) model with shortages allowed, the decision variables are:

(Multiple Choice)

4.9/5  (25)

(25)

Exhibit 12-2A moving company purchases large cardboard shipping boxes from a supplier. The company uses approximately 10,000 of these boxes for packing customers' belongings each year, and demand for the boxes is essentially constant throughout the year. The box supplier offers the following pricing schedule, based on the quantity of boxes ordered:The fixed cost of placing an order is $50, and the company's cost of capital is 7% per year.

Unit purchase cost \ 5.00 \ 4.50 \ 4.00 \ 3.50 Order is more than 0 251 501 751 Order is less than 250 500 750 1000

-Refer to Exhibit 12-2. Suppose there is a storage cost of $1 per unit. Make the appropriate change to your Solver model and find the optimal order quantity in that case. Does the unit purchasing price change?

(Essay)

4.9/5  (38)

(38)

Exhibit 12-1An appliance store sells 500 units of a particular type of dishwasher each year. The demand for this product is essentially constant throughout the year. The store orders its products from a regional supplier, and it typically takes two weeks for the dishwashers to arrive after an order has been placed. Each time an order is placed, an ordering cost of $1000 is incurred. Each dishwasher costs the hardware store $300 and retails for $550. The store's annual cost of capital is estimated to be 7% per year.

-Refer to Exhibit 12-1. Suppose there is a storage cost of $10 per unit. Make the appropriate change to your Solver model or EOQ formula, and find the optimal order quantity in that case.

(Essay)

4.9/5  (30)

(30)

Exhibit 12-2A moving company purchases large cardboard shipping boxes from a supplier. The company uses approximately 10,000 of these boxes for packing customers' belongings each year, and demand for the boxes is essentially constant throughout the year. The box supplier offers the following pricing schedule, based on the quantity of boxes ordered:The fixed cost of placing an order is $50, and the company's cost of capital is 7% per year.

Unit purchase cost \ 5.00 \ 4.50 \ 4.00 \ 3.50 Order is more than 0 251 501 751 Order is less than 250 500 750 1000

-Refer to Exhibit 12-2. Assuming there are no storage costs, formulate a Solver model and find the optimal order quantity.

(Essay)

4.8/5  (39)

(39)

The basic economic order quantity (EOQ) model can be formulated as a linear model in Solver.

(True/False)

4.9/5  (39)

(39)

In a probabilistic inventory model, there is no guarantee that the planned safety stock will exist.

(True/False)

4.7/5  (36)

(36)

Which of the following is one of the two ways to "cost" shortages in inventory modeling?

(Multiple Choice)

4.8/5  (30)

(30)

The opportunity cost of having money tied up in inventory is a type of ____ cost:

(Multiple Choice)

4.8/5  (31)

(31)

The annual ordering cost in the economic order quantity (EOQ) model is:

(Multiple Choice)

4.9/5  (31)

(31)

In specifying an (R,Q) ordering policy, the choice of R depends largely on:

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following is not one of the assumptions in an economic order quantity (EOQ) model?

(Multiple Choice)

4.8/5  (34)

(34)

Exhibit 12-2A moving company purchases large cardboard shipping boxes from a supplier. The company uses approximately 10,000 of these boxes for packing customers' belongings each year, and demand for the boxes is essentially constant throughout the year. The box supplier offers the following pricing schedule, based on the quantity of boxes ordered:The fixed cost of placing an order is $50, and the company's cost of capital is 7% per year.

Unit purchase cost \ 5.00 \ 4.50 \ 4.00 \ 3.50 Order is more than 0 251 501 751 Order is less than 250 500 750 1000

-Promoters of the Mulligan Golf tournament order sets of special edition clubs for $300 each that are sold during the tournament for $800 per set. Once the tournament is over, unsold sets are donated to the local Boys and Girls Clubs to be used by underprivileged youth. Based on past experience, they believe that demand for the sets will follow the Gamma distribution with alpha equal to 50 and beta equal to 20. How many sets of clubs should they order to maximize expected profit?

(Essay)

4.9/5  (34)

(34)

The time it takes for an order to arrive at facility is called the stockout time.

(True/False)

4.9/5  (33)

(33)

Which of the following is not one of the factors which influence the decision about how much safety stock a company should hold?

(Multiple Choice)

4.9/5  (26)

(26)

When customer demand is known, the resulting inventory model is called:

(Multiple Choice)

4.8/5  (34)

(34)

A bookstore chain often has to place orders for a wide variety of books. The setup cost for placing an order for copies of a particular hardcover book is $100, regardless of the size of the order. The unit cost per copy is $40. The head of the purchasing department of the bookstore estimates that the cost of holding a copy of this book in inventory for one week is $6. The text's inventory position at the beginning of any week is the number of copies in inventory plus any copies that have already been ordered but have not yet arrived. The reorder policy specifies that if the inventory (x) at the beginning of the week is less than or equal to R, exactly enough copies will be ordered to bring the inventory up to a set amount Q. Thus, the bookstore will order Q − x copies. Otherwise, if the inventory is greater than R, no order will be placed that week. If an order is placed, it will arrive after a lead time of 1, 2, or 3 weeks with probabilities 0.65, 0.25, and 0.10, respectively. The weekly demand for this book is uncertain, but it can be described by a normal distribution with mean 600 and standard deviation 150. The bookstore's policy is to satisfy all demand in the week it occurs. If weekly demand cannot be satisfied completely from on-hand inventory, then an emergency order will be placed at the end of the week for the shortage. This order will arrive virtually instantaneously (via express mail delivery), but at a much higher cost of $70. It is currently the beginning of week 1, and the current inventory of this hardcover book, including any copies that might have just arrived, is 1200. There are no other orders on the way. Simulate a range of (R,Q) ordering policies, from 400<R<1400 and 1000<Q<2500, and determine which one minimizes total cost over the next 52 weeks.

(Essay)

4.8/5  (22)

(22)

Showing 1 - 20 of 30

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)