Exam 4: Activity-Based Costing, Lean Operations, and the Costs of Quality

Exam 1: Introduction to Managerial Accounting188 Questions

Exam 2: Building Blocks of Managerial Accounting279 Questions

Exam 3: Job Costing334 Questions

Exam 4: Activity-Based Costing, Lean Operations, and the Costs of Quality246 Questions

Exam 5: Process Costing254 Questions

Exam 6: Cost Behavior289 Questions

Exam 7: Cost-Volume-Profit Analysis249 Questions

Exam 8: Relevant Costs for Short-Term Decisions250 Questions

Exam 9: The Master Budget195 Questions

Exam 10: Performance Evaluation207 Questions

Exam 11: Standard Costs and Variances235 Questions

Exam 12: Capital Investment Decisions and the Time Value of Money190 Questions

Exam 13: Statement of Cash Flows178 Questions

Exam 14: Financial Statement Analysis172 Questions

Exam 15: Sustainability102 Questions

Select questions type

Which of the following is an example of a cost item that should be classified as a prevention cost?

(Multiple Choice)

5.0/5  (38)

(38)

One condition that favors using a departmental overhead rate, rather than plantwide overhead rates, is that different departments incur different amounts and types of manufacturing overhead.

(True/False)

4.8/5  (34)

(34)

Which of the following is an example of a cost item that should be classified as an internal failure cost?

(Multiple Choice)

4.9/5  (32)

(32)

Indications that a product cost system needs revision include

(Multiple Choice)

4.8/5  (44)

(44)

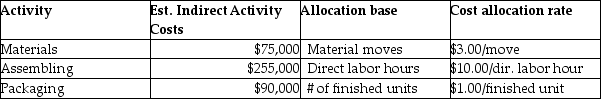

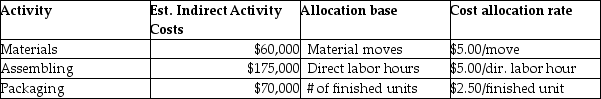

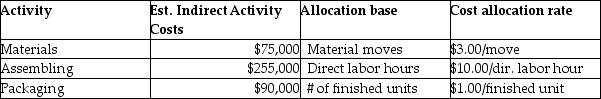

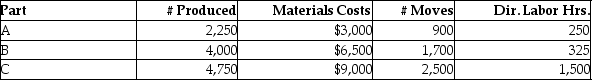

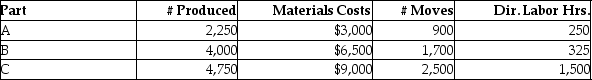

Hummingbird Manufacturing manufactures small parts and uses an activity-based costing system.  The following parts were produced in October with the following information:

The following parts were produced in October with the following information:

Total unit costs for Part A is closest to (round to two decimal points)

Total unit costs for Part A is closest to (round to two decimal points)

(Multiple Choice)

4.8/5  (39)

(39)

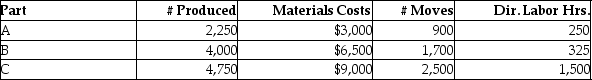

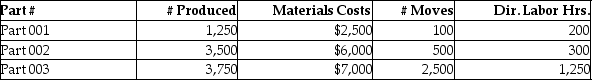

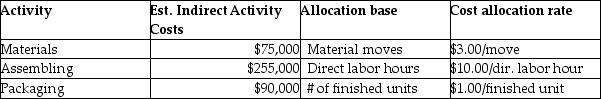

Beartowne Enterprises uses an activity-based costing system to assign costs in its auto-parts division.  The following units were produced in December with the following information:

The following units were produced in December with the following information:

Total assembly fees for Part 002 is

Total assembly fees for Part 002 is

(Multiple Choice)

5.0/5  (35)

(35)

An example of a prevention cost is the cost of redesigning the product to reduce its complexity.

(True/False)

4.8/5  (31)

(31)

ABC can be used in routine planning and control decisions as well as pricing, product mix and cost cutting decisions.

(True/False)

4.9/5  (34)

(34)

The goal of value-engineering is to eliminate all waste in the system by making the company's processes as effective and efficient as possible.

(True/False)

4.9/5  (33)

(33)

Which of the following can be used in conjunction with activity-based costing?

(Multiple Choice)

4.8/5  (34)

(34)

The cost of evaluating potential raw material suppliers is an example of what type of cost?

(Multiple Choice)

4.9/5  (37)

(37)

Hummingbird Manufacturing manufactures small parts and uses an activity-based costing system.  The following parts were produced in October with the following information:

The following parts were produced in October with the following information:

Total packaging fees for all three parts is

Total packaging fees for all three parts is

(Multiple Choice)

4.7/5  (33)

(33)

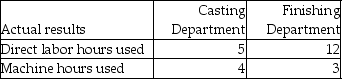

Ryan Fabrication allocates manufacturing overhead to each job using departmental overhead rates. Ryan's operations are divided into a metal casting department and a metal finishing department. The casting department uses a departmental overhead rate of $52 per machine hour, while the finishing department uses a departmental overhead rate of $28 per direct labor hour. Job A216 used the following direct labor hours and machine hours in the two departments:  The cost for direct labor is $32 per direct labor hour and the cost of the direct materials used by Job A216 is $1,800.

How much manufacturing overhead would be allocated to Job A216 using the departmental overhead rates?

The cost for direct labor is $32 per direct labor hour and the cost of the direct materials used by Job A216 is $1,800.

How much manufacturing overhead would be allocated to Job A216 using the departmental overhead rates?

(Multiple Choice)

4.8/5  (38)

(38)

Hummingbird Manufacturing manufactures small parts and uses an activity-based costing system.  The following parts were produced in October with the following information:

The following parts were produced in October with the following information:

Total assembly fees for part B is

Total assembly fees for part B is

(Multiple Choice)

4.7/5  (41)

(41)

If a company uses departmental overhead allocation rates, then the amount of manufacturing overhead allocated to the job is equal to the plantwide overhead rate multiplied by the actual use of the cost allocation base.

(True/False)

4.8/5  (37)

(37)

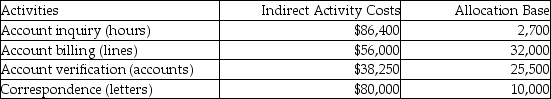

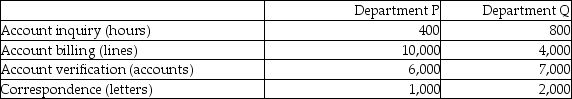

Potter & Weasley Company had the following activities, estimated indirect activity costs, and allocation bases:  Potter & Weasley uses activity based costing.

The above activities are used by Departments P and Q as follows:

Potter & Weasley uses activity based costing.

The above activities are used by Departments P and Q as follows:

How much of the correspondence cost will be assigned to Department P?

How much of the correspondence cost will be assigned to Department P?

(Multiple Choice)

4.8/5  (42)

(42)

Molding and sanding each unit of product would most likely be classified as a ________ cost.

(Multiple Choice)

4.8/5  (32)

(32)

Inspection of incoming raw materials and production loss caused by downtime are examples of prevention costs.

(True/False)

4.8/5  (35)

(35)

Showing 181 - 200 of 246

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)