Exam 7: Cost Allocation: Departments, Joint Products, and By-Products

Exam 1: Cost Management and Strategy79 Questions

Exam 2: Implementing Strategy: The Value Chain, the Balanced Scorecard, and the Strategy Map70 Questions

Exam 3: Basic Cost Management Concepts98 Questions

Exam 4: Job Costing118 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis149 Questions

Exam 6: Process Costing106 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products96 Questions

Exam 8: Cost Estimation120 Questions

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit CVP Analysis105 Questions

Exam 10: Strategy and the Master Budget146 Questions

Exam 11: Decision Making With a Strategic Emphasis137 Questions

Exam 12: Strategy and the Analysis of Capital Investments167 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing, Theory of Constraints, and Strategic Pricing94 Questions

Exam 14: Operational Performance Measurement: Sales, Direct-Cost Variances, and the Role of Nonfinancial Performance Measures178 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource-Capacity Management167 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales134 Questions

Exam 17: The Management and Control of Quality146 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard130 Questions

Exam 19: Strategic Performance Measurement: Investment Centers and Transfer Pricing151 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation108 Questions

Select questions type

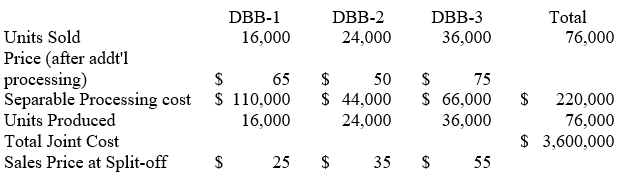

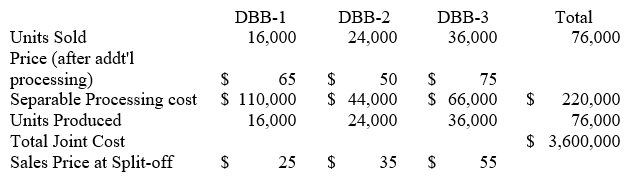

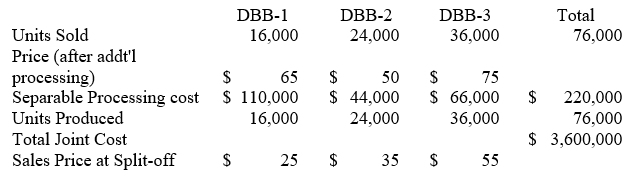

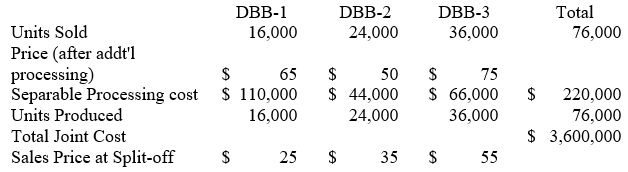

Marin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. The amount of joint costs allocated to product DBB-2 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

The amount of joint costs allocated to product DBB-2 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

Free

(Multiple Choice)

5.0/5  (41)

(41)

Correct Answer:

E

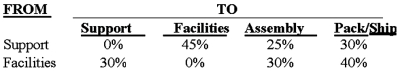

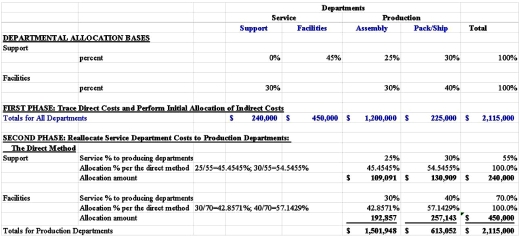

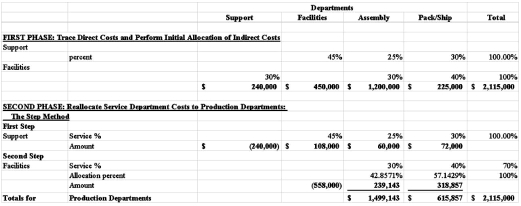

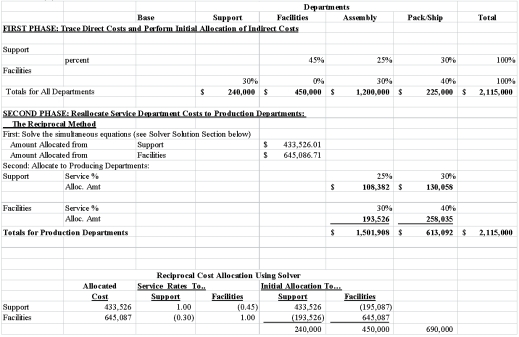

The Chapman Manufacturing Company has two service departments - manufacturing support and facilities management, and two production departments - assembly and packing/shipping.The distribution of each service department's efforts to the other departments is shown below:  The direct operating costs of the departments (including both variable and fixed costs) were as follows: Manufacturing Support \ 240,000 Facilities Management 450,000 Assembly 1,200,000 Pack/Ship 225,000 Required:

(calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

(1) Allocate the service department costs to the production departments using the direct method.

(2) Allocate the service department costs to the production departments using the step method with the support department going first.

(3) Allocate the service department costs to the production departments using the reciprocal method.

The direct operating costs of the departments (including both variable and fixed costs) were as follows: Manufacturing Support \ 240,000 Facilities Management 450,000 Assembly 1,200,000 Pack/Ship 225,000 Required:

(calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

(1) Allocate the service department costs to the production departments using the direct method.

(2) Allocate the service department costs to the production departments using the step method with the support department going first.

(3) Allocate the service department costs to the production departments using the reciprocal method.

Free

(Essay)

4.8/5  (33)

(33)

Correct Answer:

(1)  (2)

(2)  (3)

(3)

Marin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. The amount of joint costs allocated to product DBB-1 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

The amount of joint costs allocated to product DBB-1 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

Free

(Multiple Choice)

4.7/5  (36)

(36)

Correct Answer:

C

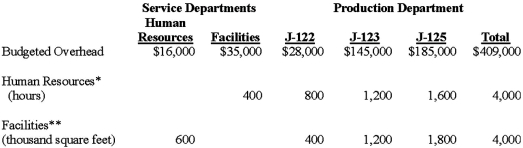

The following data on overhead apply to the Acme Manufacturing Company that manufactures frames for large trucks in three production departments (J-122, J-123, and J-125).There are two service departments, the Human Resources Department and the Facilities Department.  *Allocated on the basis of hours of usage in the HR department.

**Allocated on the basis of floor space.

Required:

Using hours as the application base for the Human Resources Department and square feet of floor space for the Facilities Department, apply overhead from these service departments to the production departments, using the following two methods.Calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar.

(1) Direct method.

(2) Step method (assume the human resources department is allocated first).

*Allocated on the basis of hours of usage in the HR department.

**Allocated on the basis of floor space.

Required:

Using hours as the application base for the Human Resources Department and square feet of floor space for the Facilities Department, apply overhead from these service departments to the production departments, using the following two methods.Calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar.

(1) Direct method.

(2) Step method (assume the human resources department is allocated first).

(Essay)

4.9/5  (38)

(38)

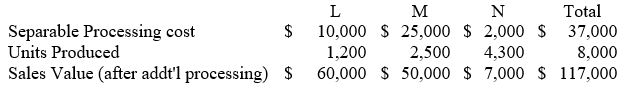

Harmon Inc. produces joint products L, M, and N from a joint process. Information concerning a batch produced in May at a joint cost of $75,000 was as follows: The amount of joint costs allocated to product L using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

The amount of joint costs allocated to product L using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.9/5  (32)

(32)

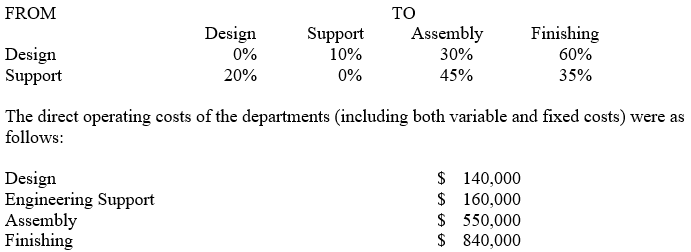

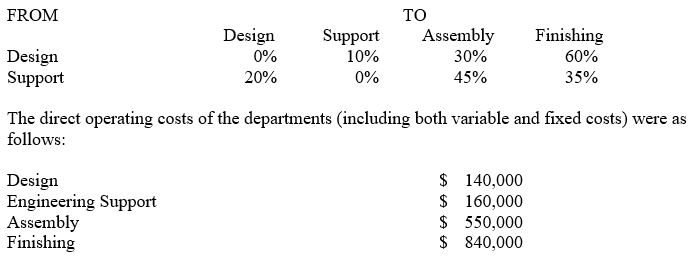

Barstow Manufacturing Company has two service departments — product design and engineering support, and two production departments — assembly and finishing. The distribution of each service department's efforts to the other departments is shown below: The total cost accumulated in the finishing department using the direct method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

The total cost accumulated in the finishing department using the direct method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.9/5  (42)

(42)

Marin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. The amount of joint costs allocated to product DBB-1 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

The amount of joint costs allocated to product DBB-1 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.7/5  (47)

(47)

Marin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. The amount of joint costs allocated to product DBB-1 using the net realizable value method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

The amount of joint costs allocated to product DBB-1 using the net realizable value method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.7/5  (33)

(33)

The point in a joint production process at which individual products can be identified for the first time is called the:

(Multiple Choice)

5.0/5  (37)

(37)

Revenue methods of by-product cost allocation are justified on financial accounting concepts of:

(Multiple Choice)

4.9/5  (38)

(38)

Barstow Manufacturing Company has two service departments — product design and engineering support, and two production departments — assembly and finishing. The distribution of each service department's efforts to the other departments is shown below: The total cost accumulated in the assembly department using the direct method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

The total cost accumulated in the assembly department using the direct method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.9/5  (37)

(37)

The direct method of departmental cost allocation is the simplest of the three methods because it:

(Multiple Choice)

4.9/5  (30)

(30)

The reciprocal method of departmental cost allocation is preferred over the step method because it takes into account all the reciprocal flows between:

(Multiple Choice)

4.9/5  (37)

(37)

A concept which is commonly employed with allocation bases related to size is:

(Multiple Choice)

4.8/5  (33)

(33)

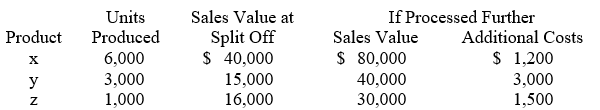

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow.  The amount of joint costs allocated to product X using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

The amount of joint costs allocated to product X using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.8/5  (29)

(29)

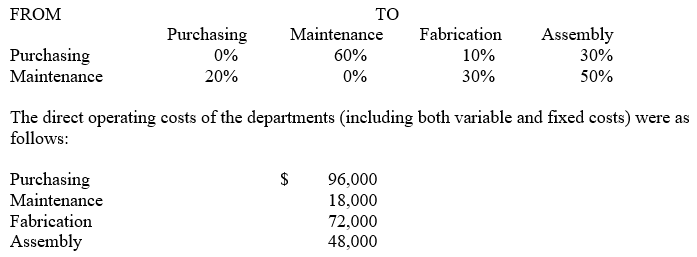

The Merchant Manufacturing Company has two service departments — purchasing and maintenance, and two production departments — fabrication and assembly. The distribution of each service department's efforts to the other departments is shown below: The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.8/5  (35)

(35)

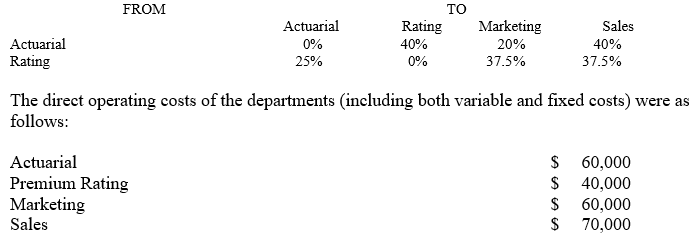

The Long Term Care Plus Company has two service departments — actuarial and premium rating, and two operations departments — marketing and sales. The distribution of each service department's efforts to the other departments is shown below: The total cost accumulated in the marketing department using the direct method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

The total cost accumulated in the marketing department using the direct method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar):

(Multiple Choice)

4.8/5  (43)

(43)

Which one of the following methods uses units of output to allocate joint costs to joint products?

(Multiple Choice)

4.8/5  (46)

(46)

The concepts of cost allocation that are used in manufacturing can also apply in:

(Multiple Choice)

4.7/5  (36)

(36)

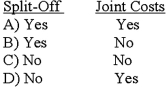

Relative sales value at split-off is used to allocate: Cost Beyond

(Multiple Choice)

4.8/5  (39)

(39)

Showing 1 - 20 of 96

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)