Exam 7: Net Present Value and Other Investment Rules

Exam 1: Introduction to Corporate Finance61 Questions

Exam 2: Financial Statements Cash Flow95 Questions

Exam 3: Financial Statements Analysis and Long-Term Planning116 Questions

Exam 4: Discounted Cash Flow Valuation133 Questions

Exam 5: Interest Rate and Bond Valuation132 Questions

Exam 6: Stock Valuation119 Questions

Exam 7: Net Present Value and Other Investment Rules116 Questions

Exam 8: Making Capital Investment Decisions89 Questions

Exam 9: Risk Analysis, Real Options, and Capital Budgeting92 Questions

Exam 10: Risk and Return Lessons From Market History76 Questions

Exam 11: Return and Risk: The Capital Asset Pricing Model Capm118 Questions

Exam 12: Risk, Cost of Capital, and Capital Budgeting57 Questions

Exam 13: Efficient Capital Markets and Behavioral Challenges61 Questions

Exam 14: Capital Structure: Basic Concepts84 Questions

Exam 15: Capital Structure: Limits to the Use of Debt69 Questions

Exam 16: Dividend and Other Payouts85 Questions

Exam 17: Options and Corporate Finance91 Questions

Exam 18: Short-Term Finance and Planning121 Questions

Exam 19: Raising Capital68 Questions

Exam 20: International Corporate Finance96 Questions

Select questions type

Based on the net present value method of analysis and given the information in the problem,you should:

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

C

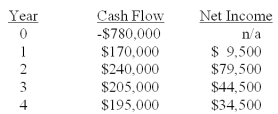

Martin is analyzing a project and has gathered the following data.Based on this data,what is the average accounting rate of return? The firm depreciates it assets using straight-line depreciation to a zero book value over the life of the asset.Assume there are no additional costs after Year 0.

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

B

When two projects both require the total use of the same limited economic resource,the projects are generally considered to be:

(Multiple Choice)

4.8/5  (35)

(35)

The Liberty Co.is considering two projects.Project A consists of building a wholesale book outlet on lot #169 of the Englewood Retail Center.Project B consists of building a sit-down restaurant on lot #169 of the Englewood Retail Center.When trying to decide whether to build the book outlet or the restaurant,management should rely most heavily on the analysis results from the _____ method of analysis.

(Multiple Choice)

4.8/5  (38)

(38)

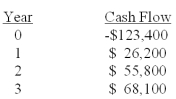

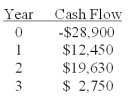

What is the internal rate of return on an investment with the following cash flows?

(Multiple Choice)

5.0/5  (36)

(36)

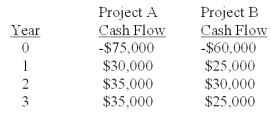

The Winston Co.is considering two mutually exclusive projects with the following cash flows.The incremental IRR is _____ and if the required rate is higher than the crossover rate then project _____ should be accepted.

(Multiple Choice)

4.8/5  (27)

(27)

Based on the payback period of ____ for this project,you should _____ the project.

(Multiple Choice)

5.0/5  (44)

(44)

In actual practice,managers frequently use the:

I.AAR because the necessary accounting numbers are readily available.

II.IRR because the results are easy to communicate and understand.

III.payback because of its simplicity.

IV.net present value because it is considered by many to be the best method of analysis.

(Multiple Choice)

4.8/5  (26)

(26)

Based on the net present value of ____ for this project,you should _____ the project.

(Multiple Choice)

4.9/5  (45)

(45)

The discounted payback period of a project will decrease whenever the:

(Multiple Choice)

4.9/5  (42)

(42)

The primary reason that a company's projects with positive net present values are considered acceptable is that:

(Multiple Choice)

4.8/5  (37)

(37)

Based upon the payback period and the information provided in the problem,you should:

(Multiple Choice)

4.9/5  (37)

(37)

You are considering an investment with the following cash flows.If the required rate of return for this investment is 13.5%,should you accept it based solely on the internal rate of return rule? Why or why not?

(Multiple Choice)

4.9/5  (40)

(40)

The internal rate of return (IRR):

I.rule states that a typical investment project with an IRR that is less than the required rate should be accepted.

II.is the rate generated solely by the cash flows of an investment.

III.is the rate that causes the net present value of a project to exactly equal zero.

IV.can effectively be used to analyze all investment scenarios.

(Multiple Choice)

4.8/5  (33)

(33)

The internal rate of return for a project will increase if:

(Multiple Choice)

4.7/5  (37)

(37)

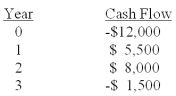

What is the net present value of a project with the following cash flows and a required return of 12%?

(Multiple Choice)

4.8/5  (28)

(28)

Showing 1 - 20 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)