Exam 13: Return, Risk, and the Security Market Line

Exam 1: Introduction to Corporate Finance71 Questions

Exam 2: Financial Statements, Taxes, and Cash Flow81 Questions

Exam 3: Working With Financial Statements96 Questions

Exam 4: Long-Term Financial Planning and Growth80 Questions

Exam 5: Introduction to Valuation: The Time Value of Money68 Questions

Exam 6: Discounted Cash Flow Valuation132 Questions

Exam 7: Interest Rates and Bond Valuation129 Questions

Exam 8: Stock Valuation119 Questions

Exam 9: Net Present Value and Other Investment Criteria115 Questions

Exam 10: Making Capital Investment Decisions108 Questions

Exam 11: Project Analysis and Evaluation106 Questions

Exam 12: Some Lessons From Capital Market History98 Questions

Exam 13: Return, Risk, and the Security Market Line109 Questions

Exam 14: Cost of Capital100 Questions

Exam 15: Raising Capital93 Questions

Exam 16: Financial Leverage and Capital Structure Policy98 Questions

Exam 17: Dividends and Payout Policy103 Questions

Exam 18: Short-Term Finance and Planning109 Questions

Exam 19: Cash and Liquidity Management101 Questions

Exam 20: Credit and Inventory Management97 Questions

Exam 21: International Corporate Finance99 Questions

Exam 22: Behavioral Finance: Implications for Financial Management45 Questions

Exam 23: Enterprise Risk Management68 Questions

Exam 24: Options and Corporate Finance106 Questions

Exam 25: Option Valuation79 Questions

Exam 26: Mergers and Acquisitions89 Questions

Exam 27: Leasing72 Questions

Select questions type

Which of the following statements concerning risk are correct?

I.Nondiversifiable risk is measured by beta.

II.The risk premium increases as diversifiable risk increases.

III.Systematic risk is another name for nondiversifiable risk.

IV.Diversifiable risks are market risks you cannot avoid.

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

A

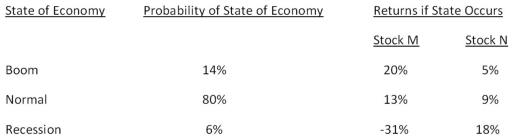

What is the expected return on a portfolio comprised of $6,200 of stock M and $4,500 of stock N if the economy enjoys a boom period?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

E

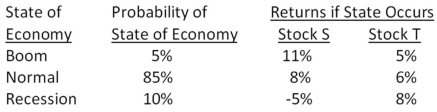

What is the standard deviation of the returns on a $30,000 portfolio which consists of stocks S and T? Stock S is valued at $21,000.

Free

(Multiple Choice)

4.9/5  (46)

(46)

Correct Answer:

B

Suzie owns five different bonds valued at $36,000 and twelve different stocks valued at $82,500 total.Which one of the following terms most applies to Suzie's investments?

(Multiple Choice)

4.8/5  (35)

(35)

The rate of return on the common stock of Lancaster Woolens is expected to be 21 percent in a boom economy,11 percent in a normal economy,and only 3 percent in a recessionary economy.The probabilities of these economic states are 10 percent for a boom,70 percent for a normal economy,and 20 percent for a recession.What is the variance of the returns on this common stock?

(Multiple Choice)

4.8/5  (36)

(36)

Steve has invested in twelve different stocks that have a combined value today of $121,300.Fifteen percent of that total is invested in Wise Man Foods.The 15 percent is a measure of which one of the following?

(Multiple Choice)

4.9/5  (32)

(32)

Which one of the following is most directly affected by the level of systematic risk in a security?

(Multiple Choice)

4.8/5  (32)

(32)

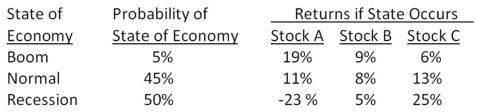

What is the expected return on a portfolio which is invested 25 percent in stock A,55 percent in stock B,and the remainder in stock C?

(Multiple Choice)

4.9/5  (36)

(36)

The _____ tells us that the expected return on a risky asset depends only on that asset's nondiversifiable risk.

(Multiple Choice)

4.8/5  (39)

(39)

You own a portfolio that has $2,000 invested in Stock A and $3,500 invested in Stock B.The expected returns on these stocks are 14 percent and 9 percent,respectively.What is the expected return on the portfolio?

(Multiple Choice)

4.8/5  (36)

(36)

You want your portfolio beta to be 0.90.Currently,your portfolio consists of $4,000 invested in stock A with a beta of 1.47 and $3,000 in stock B with a beta of 0.54.You have another $9,000 to invest and want to divide it between an asset with a beta of 1.74 and a risk-free asset.How much should you invest in the risk-free asset?

(Multiple Choice)

4.9/5  (31)

(31)

The expected return on a stock computed using economic probabilities is:

(Multiple Choice)

4.9/5  (38)

(38)

The expected risk premium on a stock is equal to the expected return on the stock minus the:

(Multiple Choice)

4.8/5  (31)

(31)

The common stock of Alpha Manufacturers has a beta of 1.14 and an actual expected return of 15.26 percent.The risk-free rate of return is 4.3 percent and the market rate of return is 12.01 percent.Which one of the following statements is true given this information?

(Multiple Choice)

4.9/5  (32)

(32)

The excess return earned by an asset that has a beta of 1.34 over that earned by a risk-free asset is referred to as the:

(Multiple Choice)

4.8/5  (38)

(38)

The capital asset pricing model (CAPM)assumes which of the following?

I.a risk-free asset has no systematic risk.

II.beta is a reliable estimate of total risk.

III.the reward-to-risk ratio is constant.

IV.the market rate of return can be approximated.

(Multiple Choice)

4.8/5  (29)

(29)

According to CAPM,the expected return on a risky asset depends on three components.Describe each component and explain its role in determining expected return.

(Essay)

4.8/5  (42)

(42)

Which one of the following should earn the most risk premium based on CAPM?

(Multiple Choice)

4.9/5  (42)

(42)

Which one of the following is the formula that explains the relationship between the expected return on a security and the level of that security's systematic risk?

(Multiple Choice)

4.7/5  (39)

(39)

If a stock portfolio is well diversified,then the portfolio variance:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 1 - 20 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)